Launched yesterday:

Primarily based upon the S&P World nationwide forecast, DoR concludes:

- Wisconsin employment is anticipated to develop by 0.8% in 2024. Wisconsin’s unemployment price was 3.0% within the second quarter of 2024, a full share level under the US price of 4.0%. The forecast expects Wisconsin’s unemployment price to peak at 3.6% in 2027, in comparison with 4.6% nationwide.

- Wisconsin’s private earnings elevated 4.4% in 2023 and simply 0.6% after adjusting by inflation. Nominal wages grew a powerful 5.7%, offsetting a decline of two.4% in proprietors’

earnings. The forecast anticipates nominal private earnings to develop 4.3% in 2024. Actual private earnings is anticipated to extend 1.7% in 2024 as inflation slows.

For employment:

Determine 1: Wisconsin nonfarm payroll employment (daring black), forecast primarily based on US NFP (crimson), and Division of Income Could 2024 forecast (gentle tan traces), August 2024 forecast (blue traces), all in 000’s, s.a. Forecast primarily based on first log differenced Wisconsin and US employment, 2021M07-2024M06, dynamically forecasted. Vertical axis is on log scale. Supply: BLS, DoR, and writer’s calculations.

The downward motion in July employment is preliminary. Exploiting the correlation between nationwide and state employment, the July quantity is more likely to be revise dupward.

As for GDP:

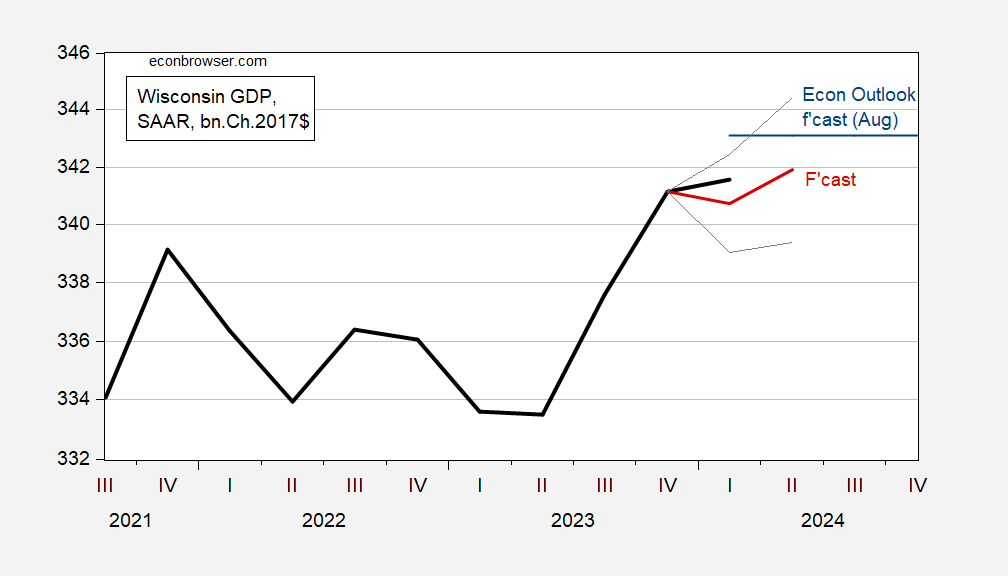

Determine 2: Wisconsin GDP (daring black), and Division of Income August 2024 forecast (blue line), nowcast primarily based on 2021Q3-2023Q4 in first log variations (crimson), +/- 1 commonplace errors (grey traces), all in bn.Ch2017$ SAAR. Vertical axis is on log scale. Supply: BEA, DoR, and writer’s calculations.

One thriller is why BEA’s estimates of Wisconsin GDP is seemingly indifferent from earnings measures (complete salaries and wages, employment, Philadelphia Fed’s coincident index). It’d come about as a result of nationwide degree — versus state degree — business particular value deflators are used, however that’s mere hypothesis on my half. The adjusted R2 between quarterly development charges over the 2021Q3-2023Q4 is 0.70. The forecasted degree is proven in crimson. Given sampling uncertainty, it’s potential to hit the DoR forecast.

As of mid-August, Eric Hovde believed the nation was on the verge of a downturn:

“I believe we’re on the verge” of a recession, he asserted, suggesting as effectively that it may need already began, however that economists sometimes don’t determine a recession’s begin till months later. “I believe we’re both in it or very shut.”

The information thus far should not in line with a recession having began in Q2.

Extra on the Wisconsin economic system from Michael Collins (LaFollette) on WPR, Affiliate Director Laura Dresser on WIsconsin PBS (8/30).