With two quarters of GDP decline within the UK in keeping with the present classic of information, it’s cheap to ask if the UK is in recession. ONS discusses the restrictions of utilizing the two-quarter rule of thumb right here. Determine 2 of this examine illustrates the risks of relying upon the two-quarter rule when the GDP knowledge are topic to revision. See further dialogue utilizing the “technical” definition, AP, CNN, Bloomberg. It’s additionally of curiosity to contemplate whether or not statistical strategies counting on monetary indicators would have predicted a recession, variously outlined.

Right here’s an image of GDP, month-to-month GDP, and industrial manufacturing ex-construction:

Determine 1: Actual GDP (blue bar, left log scale), month-to-month actual GDP (black line, proper log scale), industrial manufacturing ex-construction (pink, proper log scale). Supply: ONS. A hypothesized peak-to-trough 2023M06-2023M12 recession shaded gentle blue.

I mark the tip of the recession at 2023M12 since I’ve no further knowledge previous that point, and BoE Governor Bailey argues the recession may already be over.

As a counterpoint, NIESR observes:

…the state of the UK financial system is best described by the truth that GDP fell between the primary quarter of 2022 and the ultimate quarter of 2023.

So maybe the recession is 2022Q2 to 2023Q4, peak-to-trough.

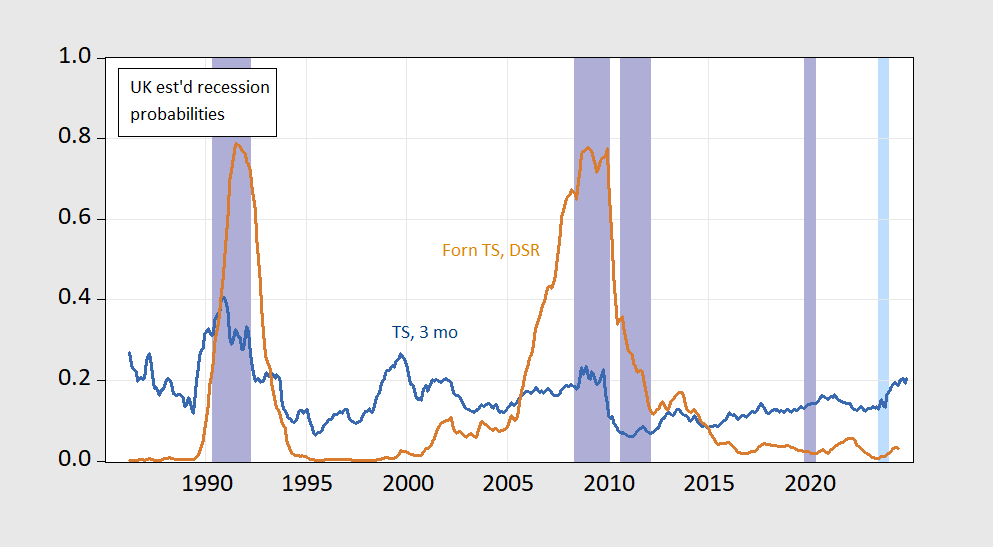

Would we’ve predicted both of those recessions (if certainly one or the opposite is a recession)? I evaluate an estimate from a easy 10yr-3mo unfold plus quick price (blue line), towards a overseas time period unfold plus debt service ratio (tan line), the latter advised by Chinn-Ferrara (2024).

The reply is probably going no (for a 1985-2022 pattern), until a really low threshold was used.

FIgure 2: Estimated chances from probit mannequin on unfold and quick price (blue line), and on overseas unfold, debt service ratio (tan line). ECRI outlined peak-to-trough recession dates shaded lilac. Hypothesized 2023M06-M12 recession shaded gentle blue. Supply: writer’s calculations and ECRI.

Whereas a debt-service mannequin primarily based regression specification has a a lot larger pseudo-R2 (0.38), the implied recession chances are fairly low for 2023. Curiously, the unfold plus quick price has a really low pseudo-R2 (0.08), however accords a a lot larger likelihood of recession — though effectively in need of 50%. That is in distinction with analysis which signifies the unfold is an efficient predictor of recessions (Mills, Capehart and Goodhart, 2019), though their pattern was for much longer than the one I used.