Right now, we current a visitor put up written by David Papell and Ruxandra Prodan-Boul, Professor of Economics on the College of Houston and Economics Lecturer at Stanford College.

The Federal Open Market Committee (FOMC) lowered the goal vary for the federal funds charge (FFR) by ½ proportion level from 5.25 – 5.5 p.c to 4.75 – 5.0 p.c at its September 2024 assembly and, within the Abstract of Financial Projections (SEP), projected additional decreases with a variety for the FFR between 4.25 and 4.5 p.c by the tip of 2024 and between 3.25 and three.5 p.c by the tip of 2025. Futures markets summarized by the CME FedWatch Instrument after the assembly predicted a quicker path of charge cuts with a variety for the FFR between 4.00 – 4.25 p.c by the tip of 2024 and between 2.75 – 3.00 p.c by the tip of 2025.

We evaluate the FOMC projections and CME predictions to prescriptions of non-inertial coverage guidelines the place the FOMC achieves the specified charge instantly and inertial coverage guidelines the place the FOMC smooths charge modifications. The put up relies on two of our papers. “Coverage Guidelines and Ahead Steerage Following the Covid-19 Recession,” printed on-line within the Journal of Monetary Stability, and “Different Coverage Guidelines and Fed Insurance policies,” which use information from the SEP’s for September 2020 to June 2024 to check all kinds of coverage rule prescriptions with precise and FOMC projections of the FFR. On this put up, we analyze 4 coverage guidelines which might be related for the long run path of the FFR, replace the coverage rule prescriptions by way of December 2027 from the September 2024 SEP, and embrace futures market predictions.

The Taylor (1993) rule with an unemployment hole is as follows,

the place is the extent of the short-term federal funds rate of interest prescribed by the rule, is the inflation charge, is the two p.c goal stage of inflation, is the 4 p.c charge of unemployment within the longer run, and is the present unemployment charge. is the impartial actual rate of interest from the SEP which equals 0.5 p.c between September 2020 and December 2023, 0.6 p.c in March 2024, 0.8 p.c in June 2024, and 0.9 p.c in September 2024.

Yellen (2012) analyzed the balanced strategy rule the place the coefficient on the inflation hole is 0.5 however the coefficient on the unemployment hole is raised to 2.0.

The balanced strategy rule acquired appreciable consideration following the Nice Recession and have become the usual coverage rule utilized by the Fed.

These guidelines are non-inertial as a result of the FFR absolutely adjusts at any time when the goal FFR modifications. This isn’t in accord with FOMC observe to easy charge will increase when inflation rises. We specify inertial variations of the principles based mostly on Clarida, Gali, and Gertler (1999),

the place is the diploma of inertia and is the goal stage of the federal funds charge prescribed by Equations (1) and (2). We set as in Bernanke, Kiley, and Roberts (2019). equals the speed prescribed by the rule whether it is constructive and nil if the prescribed charge is damaging.

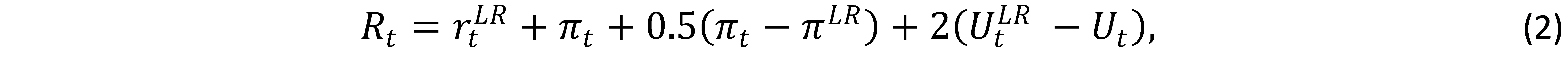

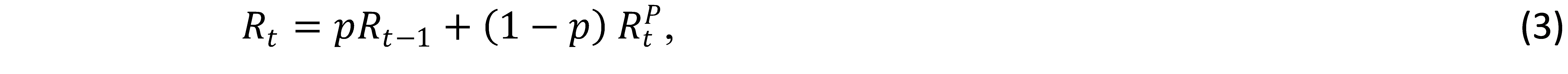

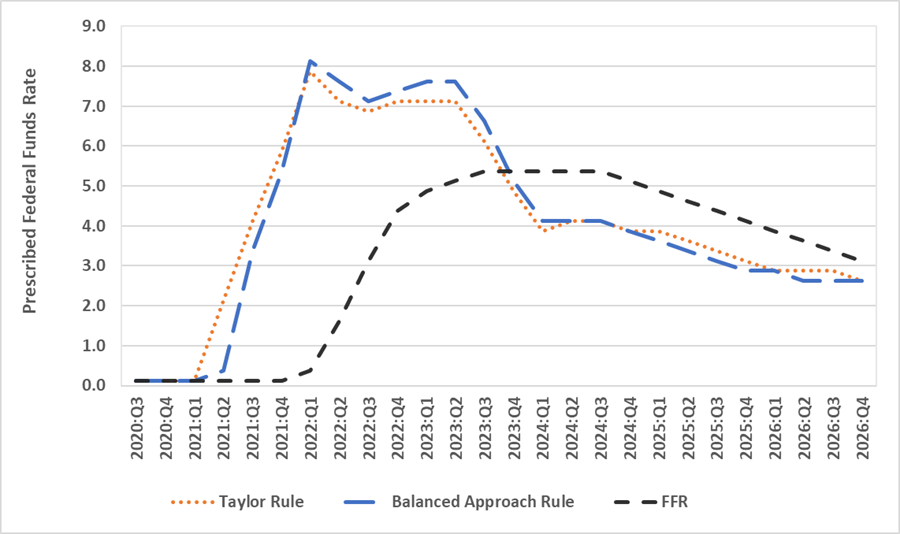

Determine 1 depicts the midpoint for the goal vary of the FFR for September 2020 to September 2024 and the projected FFR for December 2024 to December 2027 from the September 2024 SEP. Determine 1 additionally depicts coverage rule prescriptions. Between September 2020 and September 2024, we use real-time inflation and unemployment information that was out there on the time of the FOMC conferences. Between December 2024 and December 2027, we use inflation and unemployment projections from the September 2024 SEP. The variations within the prescribed FFR’s between the inertial and non-inertial guidelines are a lot bigger than these between the Taylor and balanced strategy guidelines.

Coverage rule prescriptions are reported in Panel A for the non-inertial Taylor and balanced strategy guidelines. They’re much increased than the FFR in 2022 and 2023 and aren’t in accord with the FOMC’s observe of smoothing charge will increase when inflation rises. In distinction, whereas the coverage rule prescriptions for 2024 by way of 2027 from the September 2024 SEP are constantly decrease than the FFR projections, the hole narrows significantly in 2026 and 2027. The inertial guidelines in Panel B prescribe a a lot smoother path of charge will increase in 2021 and 2022 than that adopted by the FOMC. Between December 2022 and September 2024, the coverage rule prescriptions are near the FOMC projections and, wanting ahead, the prescriptions proceed to be near the projections.

Determine 1. The Federal Funds Fee and Coverage Rule Prescriptions for September 2024

Panel A. Non-Inertial Guidelines

Panel B. Inertial Guidelines

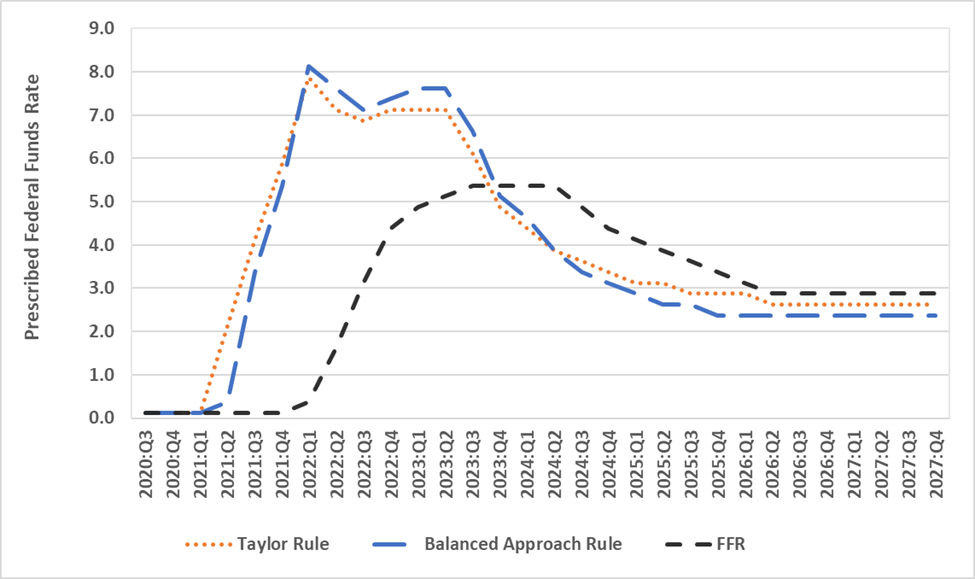

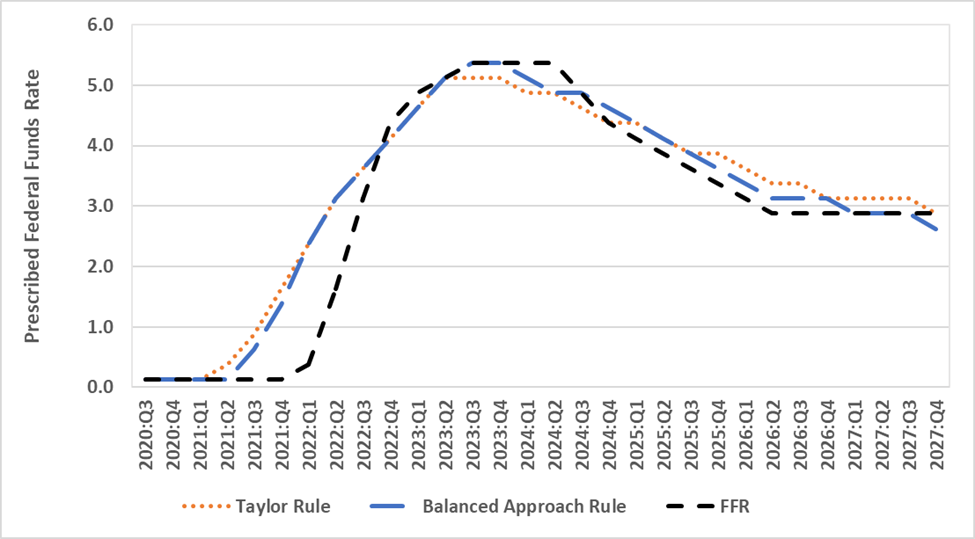

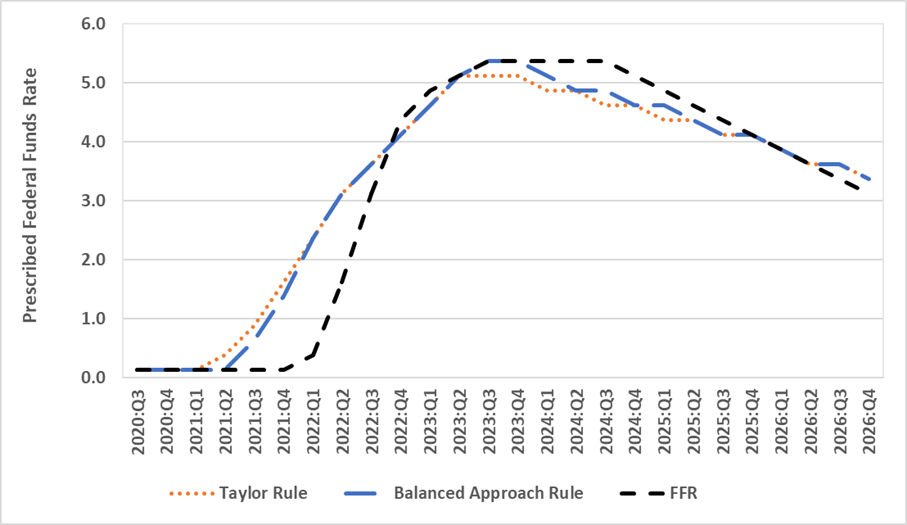

Determine 2 illustrates the federal funds charge projections and coverage rule prescriptions from the June 2024 SEP to see how a lot has modified up to now three months. Panel A depicts prescriptions from the non-inertial guidelines. For the Taylor rule, the hole between the projections and the predictions is about the identical in 2024 and 2025 with the June and September SEP’s as a result of the speed decreases are roughly equal. For the balanced strategy rule, the hole is smaller as a result of forecasted unemployment elevated between the June and September SEP’s and the FFR responds extra to will increase within the unemployment hole with the stability strategy rule than with the Taylor rule. The hole between the projections and the predictions narrows in 2026 for each guidelines. Panel B depicts prescriptions from the inertial guidelines. Whereas the dimensions of the gaps is slim and comparable between the June and September SEP’s, the FFR projections are usually above each coverage rule prescriptions in June and beneath each prescriptions in September.

Determine 2. The Federal Funds Fee and Coverage Rule Prescriptions for June 2024

Panel A. Non-Inertial Guidelines

Panel B. Inertial Guidelines

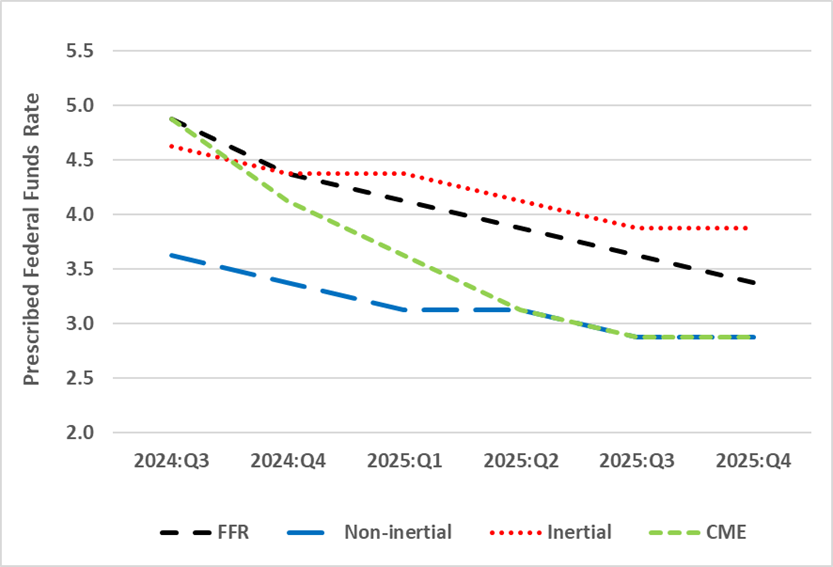

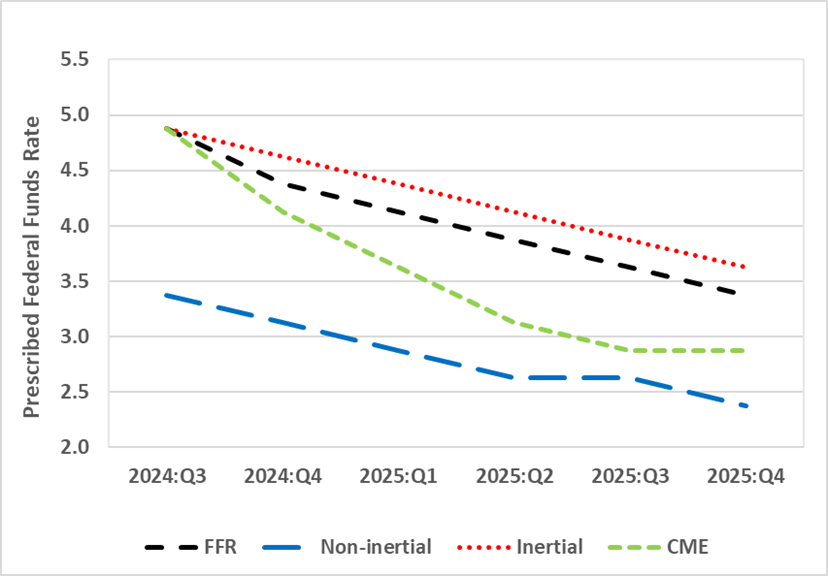

Determine 3 reveals the median predictions from futures markets within the CME FedWatch Instrument the day following the September 2024 FOMC assembly by way of the tip of the CME prediction horizon in September 2025. The futures markets predict sharper decreases within the FFR than the FOMC projections. We add to this dialogue by together with prescriptions from coverage guidelines. Determine 3 reveals that, for each Taylor and balanced strategy guidelines, the prescriptions from the inertial coverage guidelines for December 2024 by way of December 2025 are above the futures market forecasts. For the non-inertial Taylor rule, the prescriptions are beneath the futures market predictions by way of June 2025 and equal thereafter. For the non-inertial balanced strategy rule, the prescriptions are at all times beneath the futures market predictions. Comparability between futures market predictions and coverage rule prescriptions relies upon extra on the selection between inertial and non-inertial guidelines than on the selection between Taylor and balanced strategy guidelines.

Determine 3: The Federal Funds Fee, CME FedWatch Instrument and Coverage Rule Prescriptions

Panel A. Taylor Guidelines

Panel B. Balanced Method Guidelines

This put up written by David Papell and Ruxandra Prodan-Boul.