Excessive frequency indicators (PMI, and many others.) counsel — and have prompt — a slowdown in manufacturing. Nonetheless, different indicators point out sideways trending. Right here’s an image, incorporating the just-available manufacturing worth added for Q2, as nicely employment incorporating the preliminary benchmark revision.

Determine 1: Manufacturing manufacturing (blue, left scale), implied employment from preliminary benchmark (tan, left scale), combination hours (inexperienced, left scale), and actual valued added (purple), all in logs, 2021M07=0, and capability utilization in manufacturing, in % (black, proper scale). Supply: BLS by way of FRED, Federal Reserve, BLS, BEA by way of FRED, NBER.

I do surprise a bit about extrapolations from manufacturing to the remainder of the economic system. Whereas manufacturing may be a number one indicator (that’s doubtful), it’s been declining share of total financial exercise for a long time.

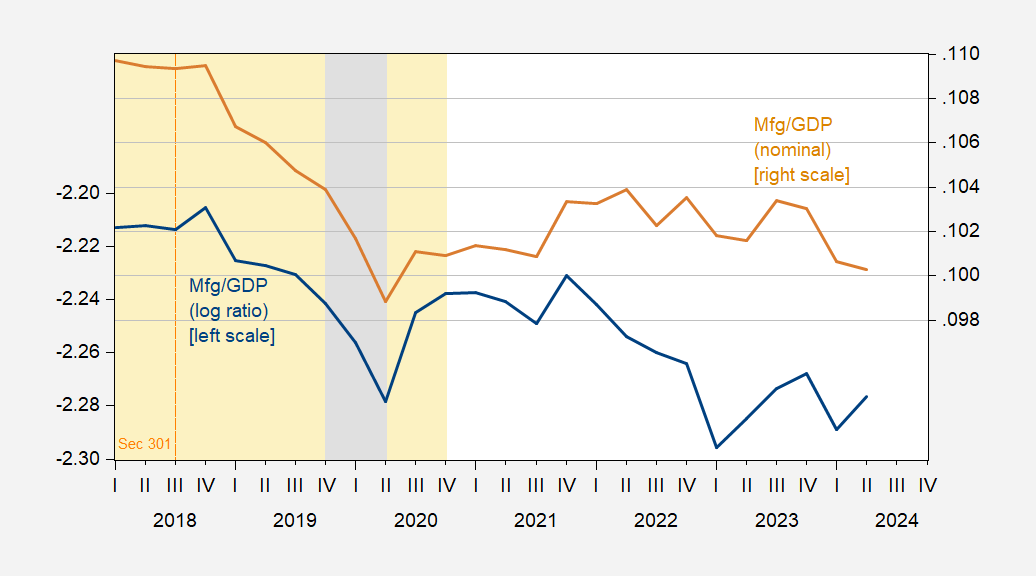

Determine 2: Log ratio of actual manufacturing worth added to GDP (blue, left scale), and manufacturing to GDP share (tan, proper scale). NBER outlined peak-to-trough recession dates shaded grey. Orange shading denotes Trump administration. Supply: BEA 2024Q2 launch/annual replace, NBER, and writer’s calculations.

The truth is, manufacturing sector worth added declined considerably within the wake Trump commerce struggle (even earlier than the pandemic). So, we must be eager about manufacturing to the extent that it’s a big share of the economic system (about 10% in worth added phrases). Nonetheless, the manufacturing sector may very well be in recession (nevertheless a sectoral recession is outlined) with out the remainder of the economic system struggling one (as outlined by NBER).