NBER BCDC indicators, various indicators, weekly indicators, nowcasts. As one who famous the excessive probability of recession by August 2024, I can’t see a downturn within the present vintages of (preliminary) knowledge.

Determine 1: Nonfarm Payroll (NFP) employment from CES (blue), implied NFP from preliminary benchmark (daring blue), civilian employment (orange), industrial manufacturing (crimson), private revenue excluding present transfers in Ch.2017$ (daring mild inexperienced), manufacturing and commerce gross sales in Ch.2017$ (black), consumption in Ch.2017$ (mild blue), and month-to-month GDP in Ch.2017$ (pink), GDP (blue bars), all log normalized to 2021M11=0. Supply: BLS by way of FRED, Federal Reserve, BEA 2024Q2 third launch/annual replace, S&P World Market Insights (nee Macroeconomic Advisers, IHS Markit) (10/1/2024 launch), and writer’s calculations.

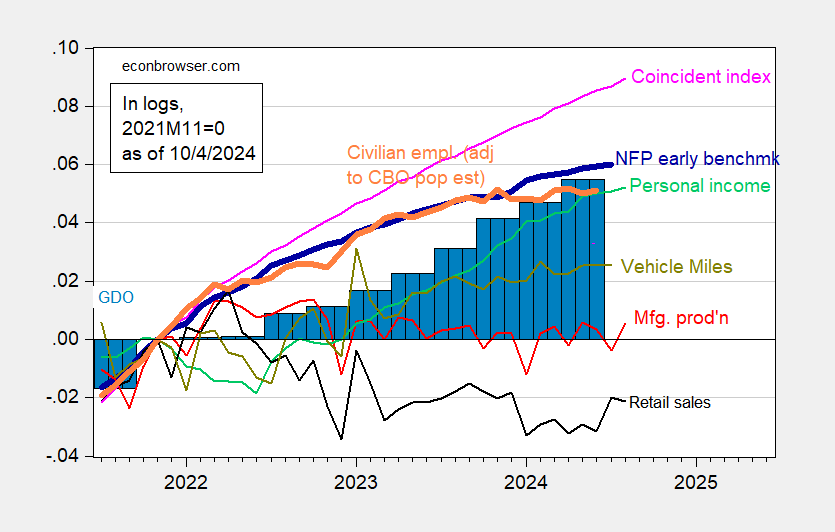

Determine 2: Nonfarm Payroll early benchmark (NFP) (daring blue), civilian employment adjusted utilizing CBO immigration estimates by way of mid-2024 (orange), manufacturing manufacturing (crimson), private revenue excluding present transfers in Ch.2017$ (mild inexperienced), retail gross sales in 1999M12$ (black), car miles travelled (chartreuse), and coincident index (pink), GDO (blue bars), all log normalized to 2021M11=0. Early benchmark is official NFP adjusted by ratio of early benchmark sum-of-states to CES sum of states. Supply: Philadelphia Fed, Federal Reserve, NHTSA by way of FRED, BEA 2024Q2 third launch/annual replace, and writer’s calculations.

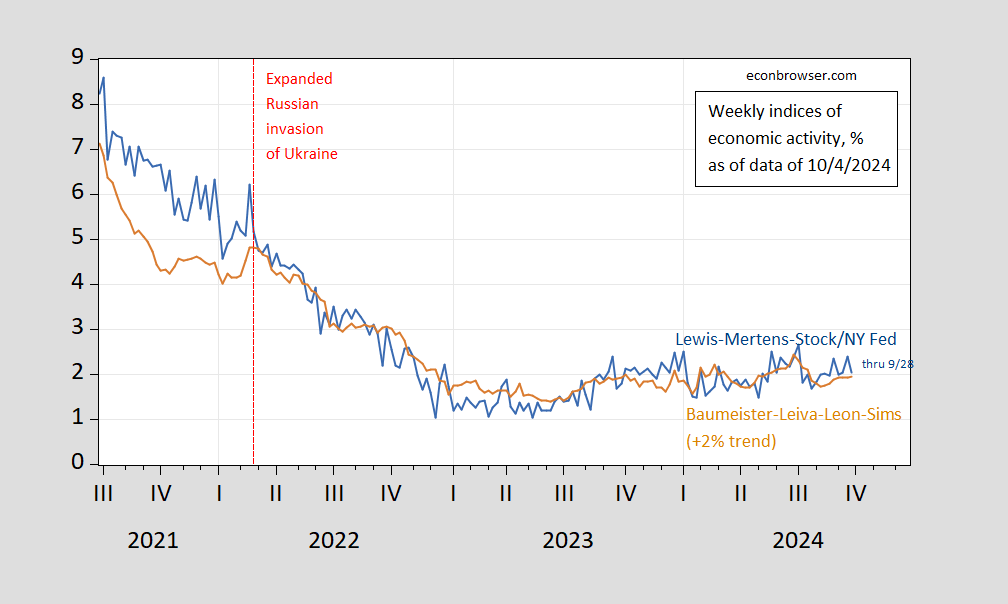

Determine 3: Lewis-Mertens-Inventory Weekly Financial Index (blue), and Baumeister-Leiva-Leon-Sims Weekly Financial Situations Index for US plus 2% pattern (tan), all y/y progress charge in %. Supply: NY Fed by way of FRED, WECI, accessed 10/6, and writer’s calculations.

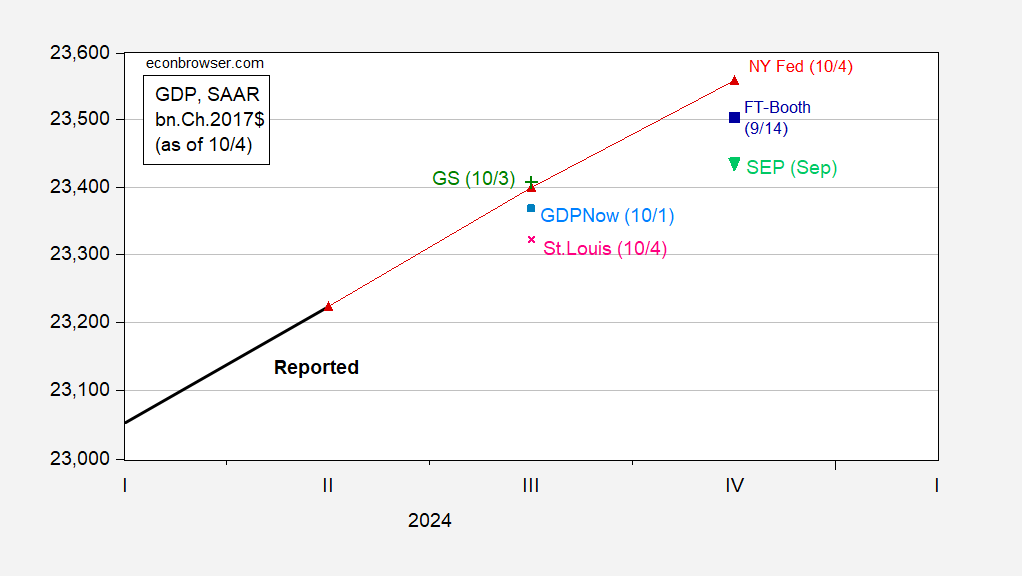

Determine 4: GDP (daring black), Abstract of Financial Projections median iterated off of third launch (inverted mild inexperienced triangle), GDPNow as of 10/1 (mild blue sq.), NY Fed nowcast as of 9/20 (crimson triangles), St Louis Fed information nowcast as of 10/4 (pink x), Goldman Sachs monitoring as of 10/3 (inexperienced +), FT-Sales space as of 9/14 iterated off of third launch (blue sq.), all in bn.Ch.2017$ SAAR. Ranges calculated by iterating progress charge on ranges of GDP, aside from Survey of Skilled Forecasters. Supply: BEA 2024Q2 2nd launch, Atlanta Fed, NY Fed, Philadelphia Fed, Federal Reserve September 2024 SEP and writer’s calculations.

Even taking NFP preliminary benchmark at face worth, most indicators are rising — even options (besides maybe retail gross sales). Excessive frequency indicators (weekly) are close to pattern by way of knowledge accessible as of 9/28. Lastly, nowcasts, other than St. Louis Fed’s, are indicating above pattern (2%) progress in Q3.

Addendum (12:25 PT):

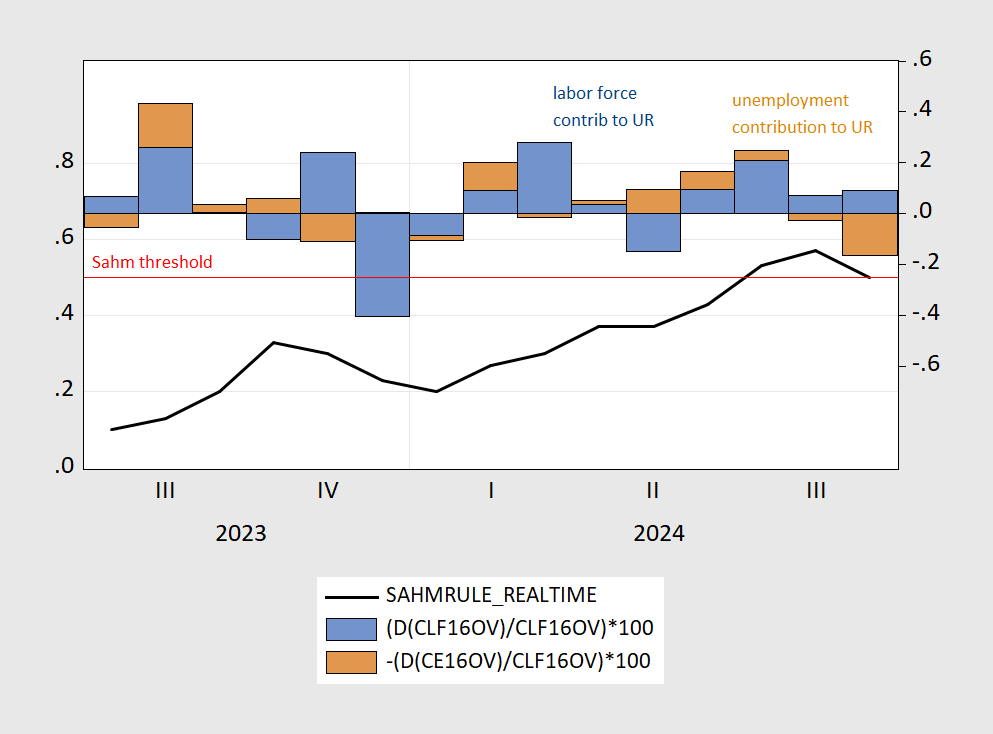

Bonus Indicator: Sahm Rule (actual time) declines to threshold. Be aware that peak index due largely to extend in labor pressure dimension, relatively than unemployed (as was the case in earlier episodes, see dialogue right here).

Determine 5: Actual time Sahm rule indicator (black, left scale), and contributions to vary in unemployment charge, from elevated labor pressure (blue bar, proper scale), from better variety of unemployed (brown bar, proper scale), all in proportion factors. Supply: FRED, BLS by way of FRED, and writer’s calculations.