Be ready. It doesn’t look good for Wisconsin (similar to Trump 1.0 didn’t however this time there isn’t $18 billion on faucet to bail out the soybean farmers).

Supply: McClelland et al. (2024).

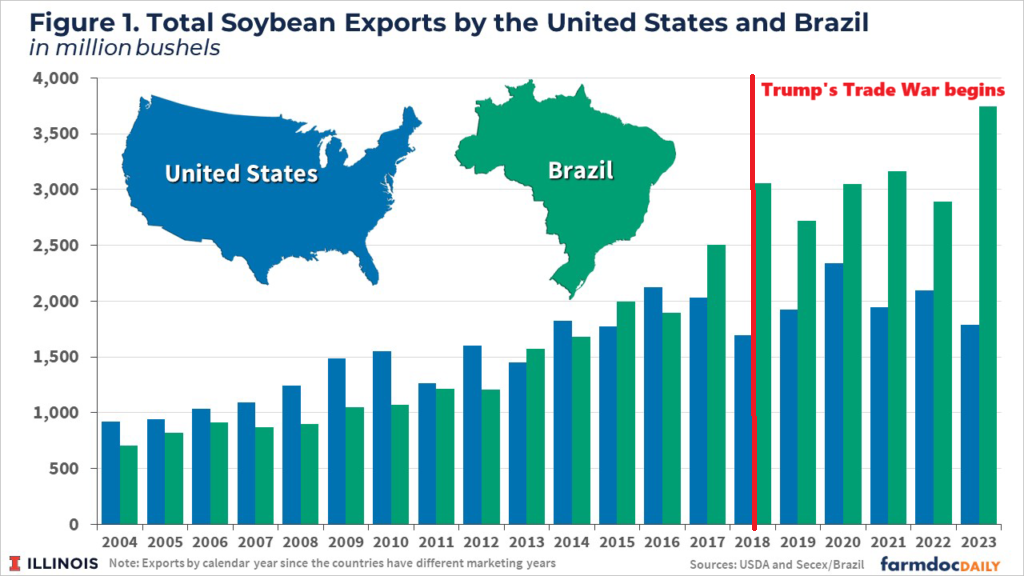

These estimated impacts are for imports and may end in industry-specific employment will increase, however nearly definitely will trigger manufacturing-wide employment decreases as enter prices rise (recall, estimates are that the 2018 tariffs price on internet 175,000 manufacturing jobs). For nationwide macro impacts see this put up. What occurred final time Trump raised tariffs is that China (and different nations) retaliated. China retaliated by imposing tariffs on soybeans, and an entire vary of different manufactured and commodity items.

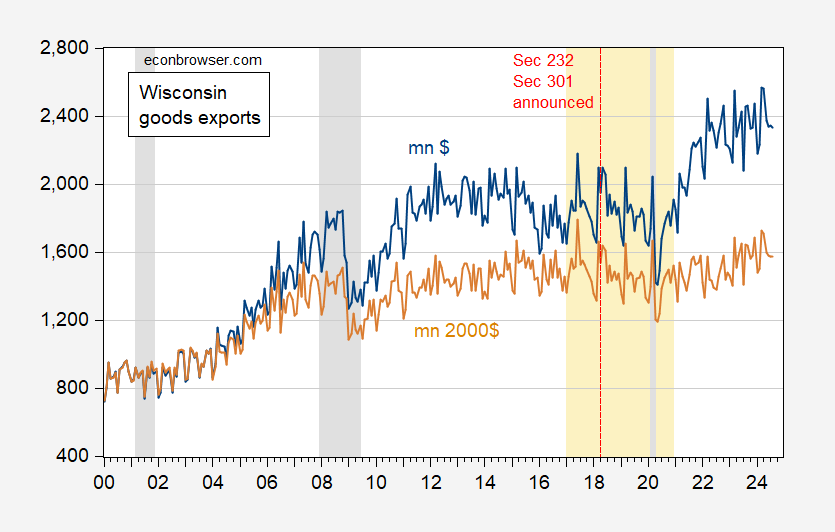

Determine 1: Wisconsin exports of products in tens of millions $ (blue), in tens of millions of 2000$ (tan), n.s.a. Wisconsin exports deflated by US export worth index, 2000=100. NBER outlined peak-to-trough recession dates shaded grey. Trump administration shaded orange. Crimson dashed line at announcement of Part 232, 301 actions. Supply: Census, BLS through FRED, NBER, and creator’s calculations.

Actual exports from Wisconsin declined (manufactured and commodities) as retaliation took maintain.

As for soybeans, right here’s an image of the quantity of US soybean exports — primarily Brazil stepped in.

Supply: Colusi, et al. (2024). Marking for commerce struggle in 2018 by creator.

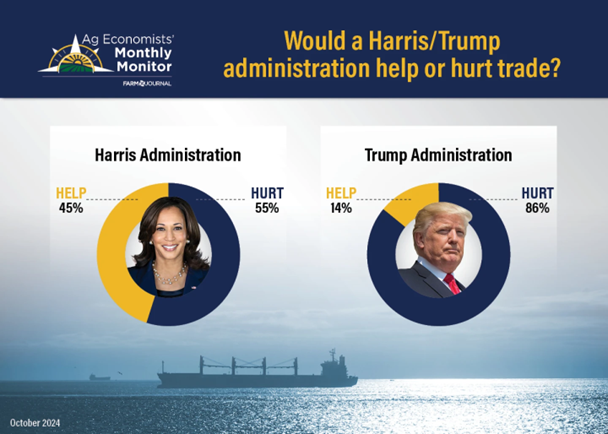

Curiously, agricultural economists imagine that Trump insurance policies will damage the agricultural sector greater than Harris insurance policies (AgWeb farm journal), at a time when greater than half of agricultural economists imagine the ag economic system is in recession.

Supply: Agweb (Oct. 10, 2024).