By no means simply look the headline quantity. The “why’s” matter. GDPNow down from 3.3% q/q AR to 2.8%, whereas GS monitoring at 3.0%

.

Supply: Rindels, Walker, “US Day by day: Q3 GDP Preview,” Goldman Sachs World Investor Analysis, October 29, 2024, Exhibit 2.

2.8% or 3% is lower than earlier nowcasts, however nonetheless method above recession ranges (suppose EJ Antoni, who thought the recession may’ve began in July or August).

If one seems to be on the GDPNow forecast evolution (as of 29 October 2024), one sees {that a} huge purpose for the decline in nowcast is greater imports. How does one interpret this?

Interpretation highlights the distinction between accounting and economics. The next progress fee of imports (not resulting from trade fee appreciation) presumably means quicker progress is anticipated now and sooner or later (extra imports for consumption and funding the place each are ahead trying variables). Nevertheless, a push up within the nowcasted degree of imports holding fixed nowcasts of the opposite elements of GDP (GDP ≡ C+I+G+X-IM) implies that the nowcast of GDP is lowered (h/t my outdated colleague at CEA Steve Braun for educating me this).

Right here, imports stunned on the upside. From the advance financial indicators launch immediately:

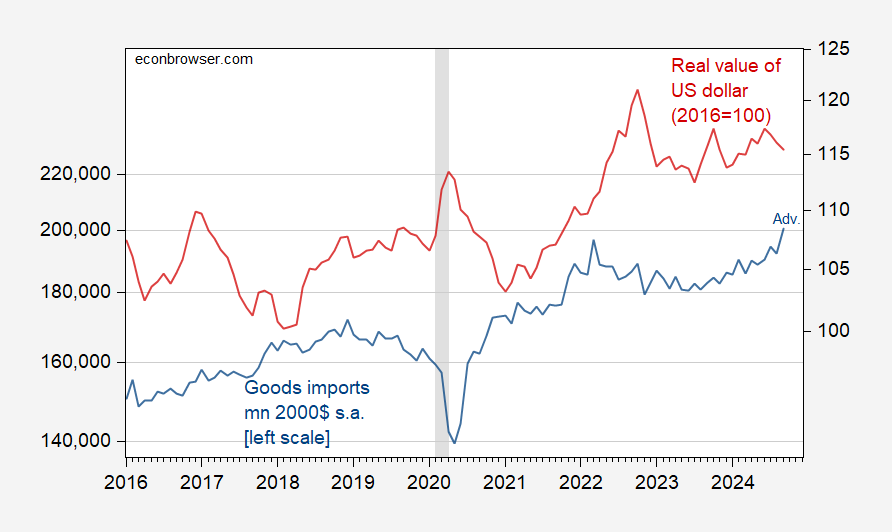

Determine 1: Actual items imports, in mn. 2020$ (blue, left log scale), and actual worth of the US greenback (pink, proper log scale). Deflation of imports utilizing BLS worth of imports of commodities. NBER outlined peak-to-trough recession dates shaded grey. Supply: Census and Federal Reserve by way of FRED, NBER, and creator’s calculations.

So, this quarter’s numbers are down, whereas the implied progress fee (ceteris paribus) is up for subsequent quarter.