By Menzie Chinn and Mark Copelovitch

A Harris administration is way much less more likely to disrupt the continuing and unprecedented American financial restoration of the final three years with stark coverage reversals. That is an expanded model of an op-ed printed within the Milwaukee Journal Sentinel.

For the 2024 presidential election, American voters face two starkly completely different paths for the economic system.

The primary one is a path towards additional financial isolationism, deregulation, and tax cuts for top earnings households financed by huge authorities deficits. The opposite is a street that helps the center class by way of tax insurance policies, retains engagement within the worldwide economic system, and invests sooner or later with spending on infrastructure and new factories. This second selection builds upon the trail that has led to speedy and extensively shared development over the past 3½ years.

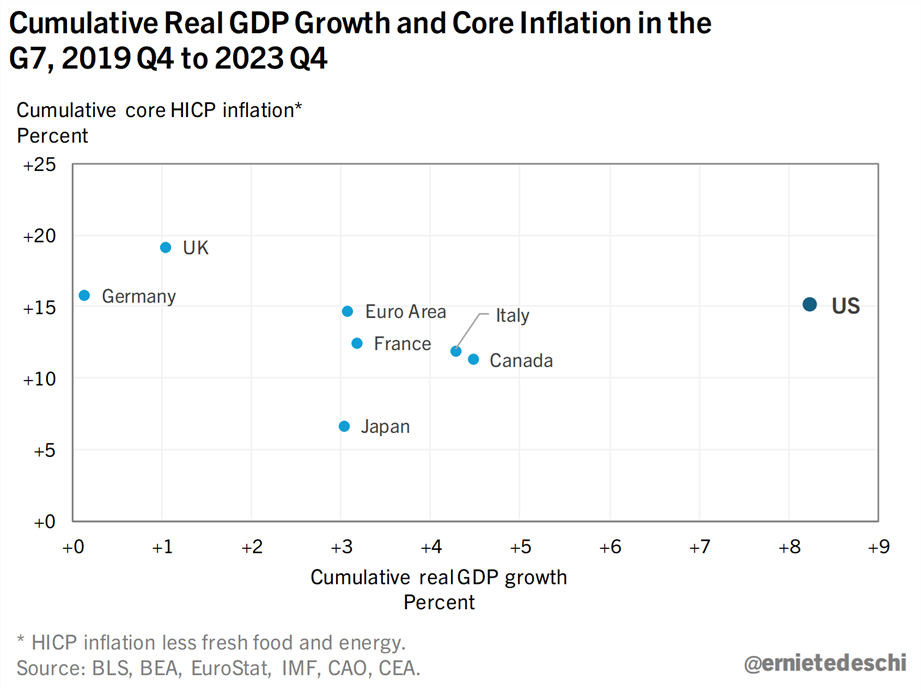

Regardless of the financial turmoil and inflation attributable to the worldwide pandemic and the conflict in Ukraine, the U.S. economic system has skilled an unprecedented speedy and profitable restoration within the final three years. Within the 12 months ending final quarter, GDP grew at 3%, whereas unemployment was at a close to file low of three.4% (January 2023). Among the many massive industrial nations, the U.S. restoration has far outstripped that of our G7 counterparts because the pandemic’s onset.

What’s most spectacular in regards to the U.S. development is that it has come with none further inflation over and above that of our G7 friends. That is additional proof that the first drivers of inflation, within the U.S. and elsewhere, have been world shocks (the pandemic, the conflict in Ukraine), slightly than the results of the Biden administration’s fiscal coverage. It seems that the traditional knowledge within the U.S. in 2022-23, which entailed numerous pessimistic headlines in regards to the economic system and blamed Joe Biden’s fiscal coverage for being the first reason for inflation, was not fairly proper.

Financial restoration in U.S. outstrips different G7 international locations

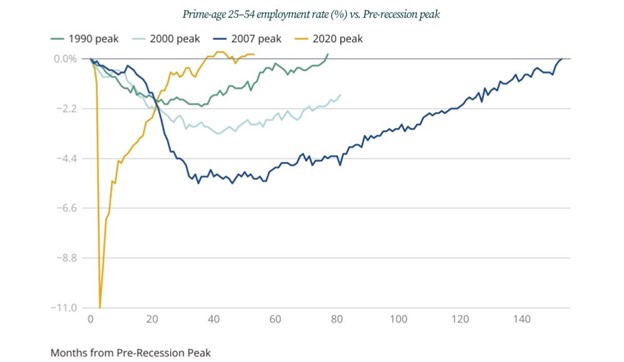

The US restoration has not solely been spectacular relative to different international locations. It has additionally been traditionally unprecedented in American historical past. After the beginning of the International Monetary Disaster in 2008, it took greater than a decade to return to pre-crisis ranges of unemployment. America really skilled a “Misplaced Decade,” which some estimates have calculated price the typical family tens of 1000’s of {dollars} in lifetime earnings loss. In distinction, the U.S. restoration from COVID-19 has been terribly quick and full. Employment is larger now than in 2020, and the restoration took solely three years.

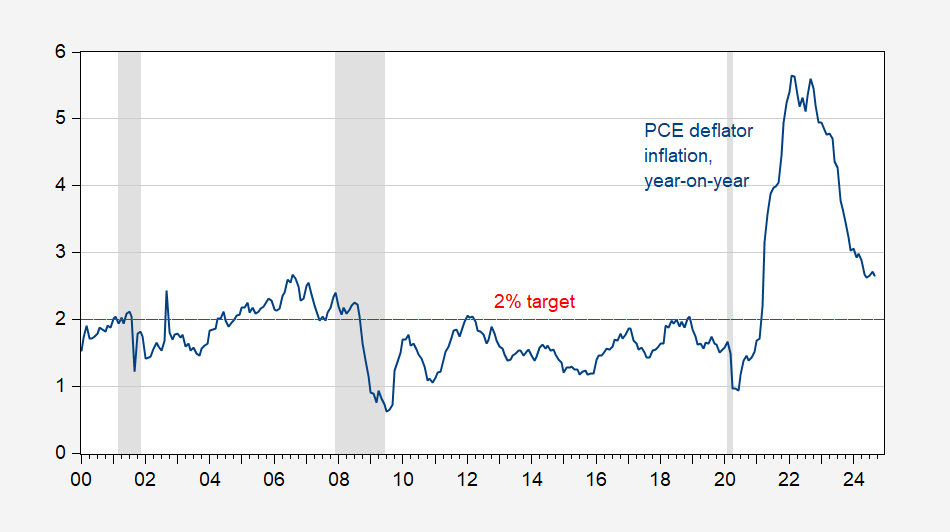

As well as, the inflation shock is mainly now over. Within the newest August rely, inflation was 2.6%. If that sounds too excessive, by comparability, within the final month earlier than the pandemic struck (January 2020), inflation was 2.5%. The Federal reserve targets 2% inflation. We at the moment are nearer to that concentrate on than we have been for a lot of the final 20 years, after we systematically undershot the mark by a large margin.

Immediately’s low and near-target inflation defies most of the predictions made in the course of the peak of the pandemic. In 2022, distinguished specialists, similar to Larry Summers, made grim forecasts predicting stubbornly excessive inflation that might have to be crushed down by way of years excessive unemployment. We have now averted this consequence, and the Fed has seemingly achieved the a lot desired “tender touchdown.” Furthermore, whereas value ranges have elevated about 20% because the begin of the pandemic in 2020, actual (inflation-adjusted) earnings per capita has elevated by practically 9% and is now again on pre-pandemic pattern.

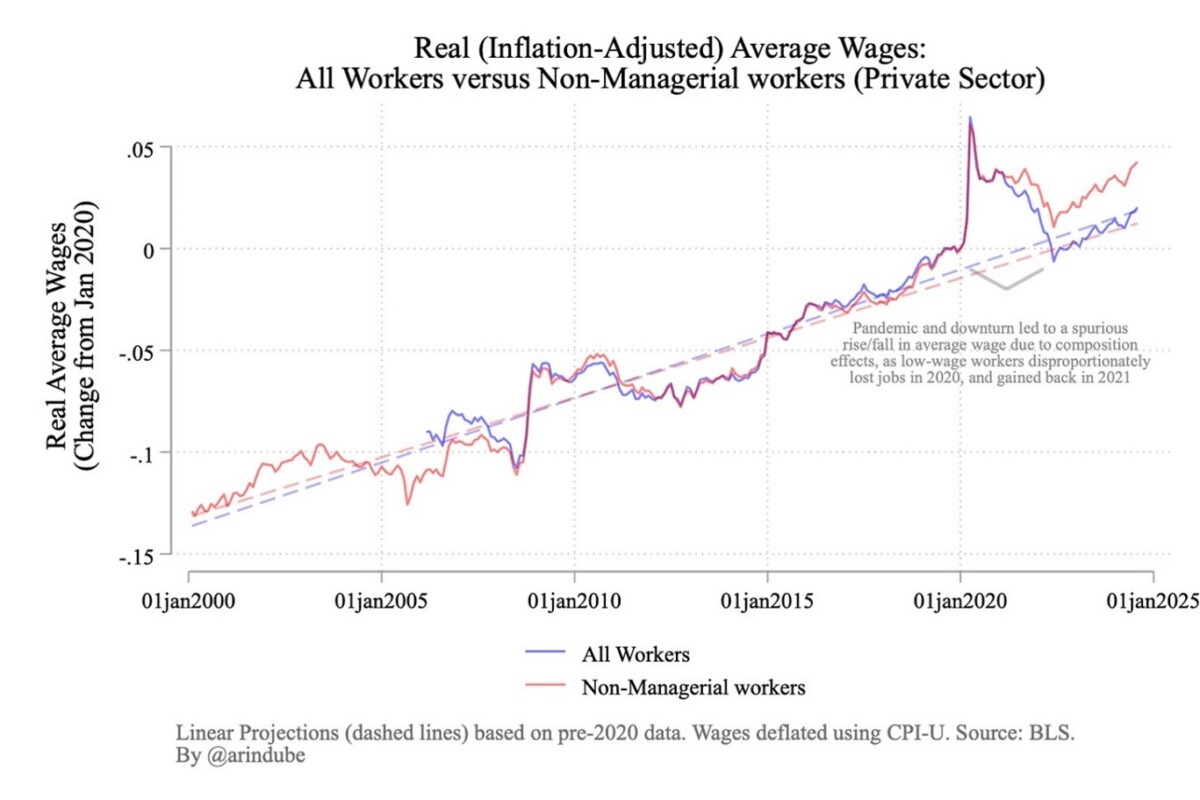

To make certain, inflation has distributional prices and this progress has not been equally shared. Nevertheless, these on the lowest rungs have truly gained, slightly than misplaced, in comparison with these higher off. This may be seen by wanting on the weekly earnings of these within the backside quarter of the earnings distribution, adjusted for inflation, in comparison with the median. Likewise, we will see this when have a look at actual wages, which have grown considerably quicker for “common” (non-managerial) staff than for all staff, which incorporates executives and different extra highly-paid professionals.

Put merely, regardless of the worldwide shocks and the inflation since 2020, the economic system is in glorious form, the typical American voter is doing considerably higher now than 4 years in the past, and inequality is declining in America as wage and earnings development on the backside of the earnings distribution are growing quicker than on the prime. This actuality runs counter to the doom-and-gloom narrative many people accepted over the previous few years.

Wanting ahead over the following two months and into 2025, barring sudden occasions just like the outbreak of a significant navy battle, few economists see a recession. With rates of interest falling, borrowing will grow to be simpler, significantly for these hopeful homebuyers.

All these constructive developments are in danger, relying upon the alternatives we make in November.

Trump and Harris campaigns current divergent financial plans

The financial proposals of the 2 presidential candidates, to the extent that we all know them, differ considerably. The financial insurance policies that Republican nominee Donald Trump has provided usually have a lot much less element than the corresponding plans from Vice President Kamala Harris, the Democratic candidate.

For Trump, now we have full extension of the tax fee reductions within the Tax Cuts and Jobs Act of 2017, an extra company tax discount, and the elimination of taxes on suggestions. Extra specifics have been supplied for mass deportations of undocumented (and apparently documented) immigrants, in addition to an across-the-board 10% (or 20%) tariff fee, with 60% tariffs on Chinese language merchandise and 200% on John Deere tools produced in Mexico.

In distinction, Harris has proposed a set of tax breaks that embody elements of the TCJA, enlargement of the Baby Tax Credit score, a tax credit score for first-time homebuyers together with incentives to extend reasonably priced housing.

We perceive that it’s typically simpler mentioned than performed in at the moment’s extremely polarized political local weather, however we nonetheless consider within the worth of utilizing evidence-based evaluation to information views on what’s greatest for our nation when it comes to financial coverage. To guage these measures proposed by the candidates, one has to have in mind each the prices, and the advantages.

Trump’s financial plans will price considerably greater than Harris’

We will rely the candidates’ proposed tax measures’ prices for the taxpayers pretty simply. For Trump’s plans, economists have calculated a value of about $3 trillion over 10 years. For Harris, the quantity is about $1.4 trillion. A more moderen tabulation of the price of Trump’s guarantees is $11 trillion over 10 years, as he has expanded the variety of tax breaks he has promised

There are additionally non-budgetary prices. Within the case of Trump’s tariff plans, the near-unanimous opinion of economists is that his proposed across-the-board tariffs would result in a catastrophe. Right here the proof isn’t so fuzzy. The tariffs of 2018-19 led to elevated prices — not just for American companies that used metal, aluminum and different imported items — but additionally for American shoppers. Furthermore, as prices elevated, the tariffs didn’t even assist manufacturing, costing the sector 175,000 jobs, on internet. With each imported good topic to at the very least a ten% tariff, the economic system would probably shed development, maybe going into recession (significantly if our buying and selling companions retaliate).

Moreover, America’s farm exports dropped precipitously on account of retaliation by our buying and selling companions. Solely by advantage of a authorities bailout with authorities funds, to the tune of over $12 billion, have been farmers’ fortunes saved. A key factor to remember with respect to this promise to begin a brand new commerce conflict is that for most of the proposed commerce measures, Trump doesn’t want Congress’s approval.

Equally detrimental assessments have additionally been reported for Trump’s said plans to pursue mass deportation insurance policies concentrating on each authorized and undocumented immigrations. One latest estimate from the American Immigration Council notes that such insurance policies might price over $300 billion and scale back U.S. GDP by 4.2% to six.8%, a shock to the economic system much like that of the Nice Recession.

Even when solely restricted to post-2020 arrivals, these mass deportations would undoubtedly depress financial exercise considerably. After all, this doesn’t even start to the touch on the human price of such a draconian strategy to immigration that might probably tear on the material of communities throughout the nation.

Harris plan would proceed development, Trump’s would spur larger costs

In distinction, the insurance policies proposed by Harris would virtually definitely assure a extra steady and affluent economic system. In avoiding a extra escalated commerce conflict, the U.S. and world economic system would probably proceed to develop. Furthermore, her tax proposals are geared toward lowering financial inequality (as within the enlargement of the Earned Earnings Tax Credit score), and towards investing in human capital by means of the expanded Baby Tax Credit score. The earlier Baby Tax Credit score enlargement, which was enacted in the course of the pandemic, lower baby poverty practically in half. Therefore, now we have stable empirical proof that each of those tax measures will assist scale back poverty and earnings inequality.

On the similar time, Harris has proposed retaining a majority of tax cuts from the 2017 Tax Cuts and Job Acts, particularly these geared toward decrease and center earnings teams. These are the large ticket price range gadgets, which might largely be offset by tax will increase on larger earnings households and firms.

Extra focused, however nonetheless vital, measures would barely make a noticeable affect on the price range. As an example, the housing credit score for first time homebuyers, coupled with measures to develop the housing provide, might make a big affect on housing affordability. Proposals to forestall value gouging by suppliers of groceries, by means of anti-trust actions, would have primarily no fiscal affect, however nonetheless assist to maintain dwelling prices down.

Analyses by unbiased analysis teams, similar to Goldman Sachs, Moody’s, Peterson Institute for Worldwide Economics, point out that implementation of the majority of the Trump financial agenda, even when excluding full-fledged mass deportations of immigrants, would result in slower financial development throughout the 12 months.

Nevertheless, the Goldman Sachs and Moody’s analyses estimate a constructive affect for the Harris agenda. Furthermore, as a result of development can be slower, and deficits bigger, the federal debt would rise quicker underneath Trump than underneath Harris. Moreover, inflation, spurred by tariffs, would additionally rise quicker underneath Trump.

On the premise of economics, the selection is evident, at the very least for these not within the prime 10% in earnings and wealth. The price of dwelling, unemployment, and authorities debt would all be larger underneath a Trump administration. Even those that may acquire from tariffs may very effectively lose out in the long run, ought to Trump’s tariffs spur retaliation and set off a broader commerce conflict with China and different main buying and selling companions.

Then again, a Harris administration would pursue financial insurance policies that might largely profit large swaths of the American inhabitants. And whereas the longer term is unsure, a Harris administration is way much less more likely to disrupt the continuing and unprecedented American financial restoration of the final three years with stark coverage reversals that create new uncertainty about our nationwide financial insurance policies and our financial ties to our closest allies and main buying and selling companions.

Menzie Chinn is a professor of public affairs and economics in UW-Madison’s La Follette Faculty of Public Affairs and Division of Economics. Mark Copelovitch is a professor in UW-Madison’s La Follette Faculty of Public Affairs and Division of Political Science.