As I’ve noticed earlier than, the reason for why now we have not but seen a recession’s onset within the knowledge but might be one of many following: (1) the mannequin based mostly on historic correlations is not relevant (DGP has modified), (2) we had been utilizing the mistaken mannequin, (3) the recession is but to return, however has not but proven up within the knowledge. As well as, it might be the mannequin was proper, and in a probabilistic world, there’s by no means a certain factor.

Only a recap on what a easy time period unfold mannequin predicts, vs. one that features the debt-service ratio and the overseas time period unfold:

Determine 1: Probit 12 month forward recession likelihood prediction from easy time period unfold mannequin estimated 1986-2023M06 (blue), from mannequin estimated 1986-2018 (inexperienced), and from mannequin with time period unfold, debt-service ratio, overseas time period unfold estimated 1986-2023M06 (tan). Assumes no recession as of November 2024. NBER outlined peak-to-trough recession dates shaded grey. Pink dashed line at 50% threshold. Supply: NBER and writer’s calculations.

It’s attention-grabbing that the time period unfold mannequin estimated over the complete pattern — together with the pandemic interval — signifies a higher than 50% likelihood this month (December) in addition to just a few occasions in 2025.

It might be the recession is right here in December 2024. Sadly, we don’t have any knowledge for December, and don’t even have employment knowledge for November but. Nonetheless, as documented right here, the indications of recession will not be sturdy for October, conserving in thoughts all now we have is preliminary knowledge. (That being stated, I don’t suppose a recession began in July 2024).

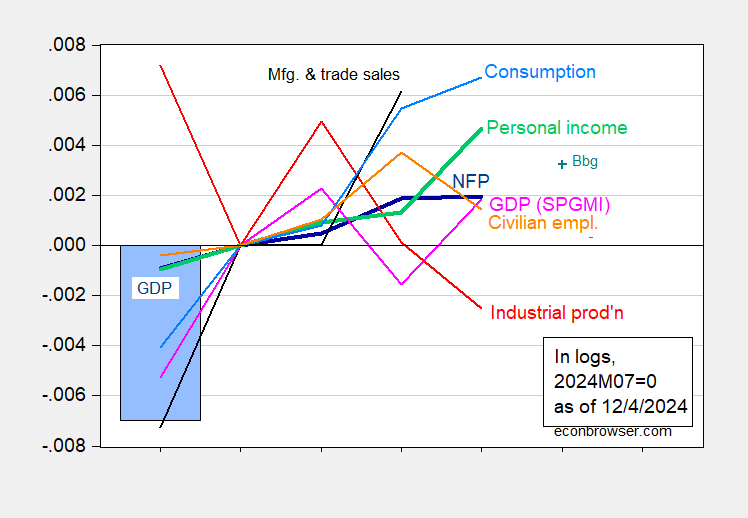

Determine 1: Nonfarm Payroll (NFP) employment from CES (blue), Bloomberg consensus as of 12/4 (blue +), civilian employment (orange), industrial manufacturing (crimson), private earnings excluding present transfers in Ch.2017$ (daring mild inexperienced), manufacturing and commerce gross sales in Ch.2017$ (black), consumption in Ch.2017$ (mild blue), and month-to-month GDP in Ch.2017$ (pink), GDP (blue bars), all log normalized to 2021M11=0. Supply: BLS by way of FRED, Federal Reserve, BEA 2024Q3 2nd launch, S&P International Market Insights (nee Macroeconomic Advisers, IHS Markit) (12/2/2024 launch), and writer’s calculations.

Then again, it might be a mannequin like that in Chinn and Ferrara (2024), utilizing a overseas time period unfold as in Ahmed and Chinn (JMCB, 2024) might be the suitable mannequin. Then there’s little to fret about…