Industrial manufacturing -0.9% vs. +0.1% consensus (m/m).Listed below are some key indicators adopted by the NBER’s BCDC, plus month-to-month GDP.

Determine 1: Nonfarm Payroll (NFP) employment from CES (blue), implied NFP from preliminary benchmark (daring blue), civilian employment (orange), industrial manufacturing (pink), private revenue excluding present transfers in Ch.2017$ (daring gentle inexperienced), manufacturing and commerce gross sales in Ch.2017$ (black), consumption in Ch.2017$ (gentle blue), and month-to-month GDP in Ch.2017$ (pink), GDP (blue bars), all log normalized to 2021M11=0. Supply: BLS through FRED, Federal Reserve, BEA 2024Q3 2nd launch, S&P World Market Insights (nee Macroeconomic Advisers, IHS Markit) (12/2/2024 launch), and creator’s calculations.

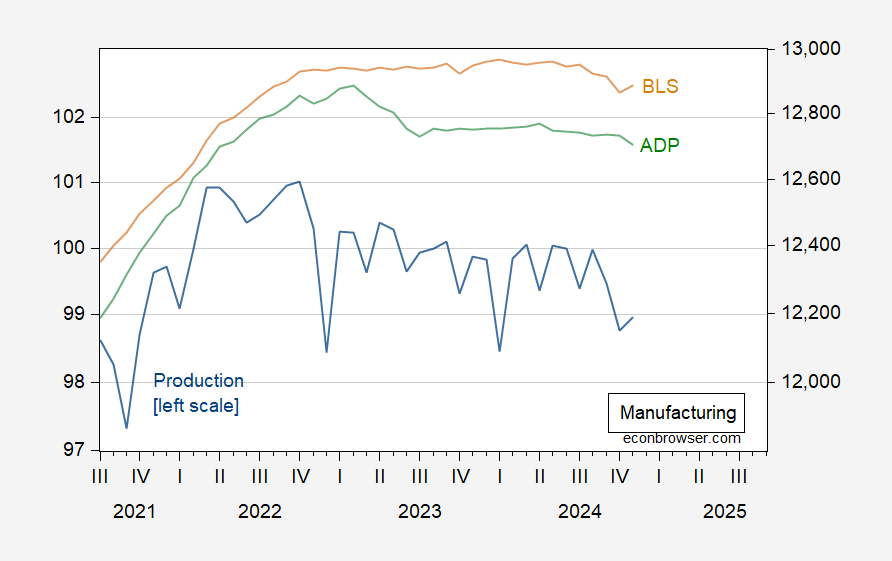

Manufacturing recovered considerably, however nonetheless beneath consensus (+0.2% vs. +0.5percentconsensus (m/m)).

Determine 2: Manufacturing manufacturing (blue, left log scale), manufacturing employment from BLS, 000’s (tan, proper log scale), manufacturing employment from ADP-Stanford Digital Financial system Lab, 000’s (inexperienced, proper log scale), all s.a. Supply: Federal Reserve, BLS, ADP all through FRED.

Core retail gross sales had been additionally beneath consensus (+0.2% vs. +0.4% m/m), whereas whole retail gross sales barely above (+0.7% vs. +0.6% m/m).

Hardly accelerating progress, however too early to declare recession, given will increase in employment and private revenue in November.