Month-to-month GDP declines 7.1 ppts m/m annualized Right here’s an image of key indicators adopted by the NBER Enterprise Cycle Courting Committee plus month-to-month GDP.

Determine 1: Nonfarm Payroll employment (daring darkish blue), civilian employment (orange), industrial manufacturing (crimson), private revenue excluding present transfers in Ch.2017$ (daring inexperienced), manufacturing and commerce gross sales in Ch.2017$ (black), consumption in Ch.2017$ (mild blue), and month-to-month GDP in Ch.2017$ (pink), GDP, 2nd launch (blue bars), GDPNow for 2024Q1 as of two/29 (lilac field), all log normalized to 2021M11=0. Supply: BLS by way of FRED, Federal Reserve, BEA 2023Q4 2nd launch, Atlanta Fed (3/1), S&P World Market Insights (nee Macroeconomic Advisers, IHS Markit) (3/1/2024 launch), and writer’s calculations.

Whereas January month-to-month GDP was down, ultimate gross sales had been solely down by solely 4.1 ppts m/m annualized, whereas nonfarm payroll (NFP) employment and private revenue excluding present transfers had been each up that month. In response to the Bloomberg consensus, nonfarm payroll employment in February rose by 190K. Therefore, the economic system appears to have continued progress in January.

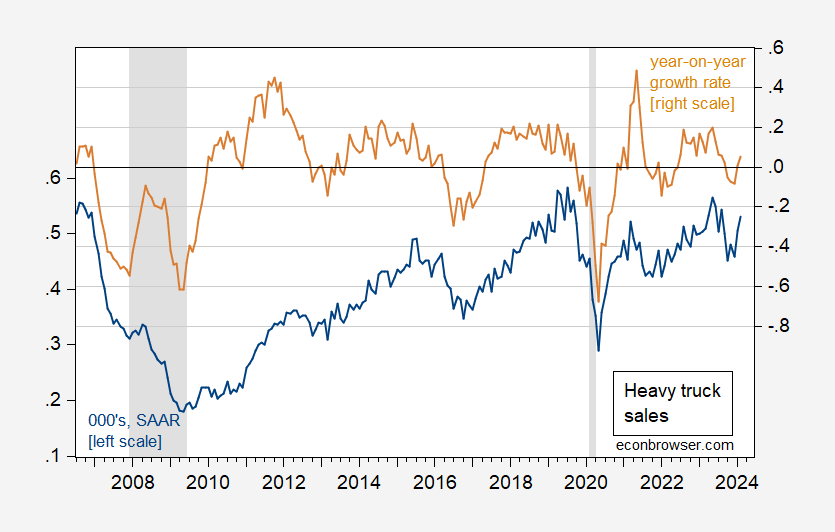

Calculated Danger factors out that heavy truck gross sales elevated in February. I’ve used this as a coincident indicator for recessions previously (higher than VMT, or gasoline consumption, for example). Right here’s the image as of in the present day.

Determine 2: Heavy truck gross sales, 000’s, s.a. (blue, left scale), and year-on-year progress price of heavy truck gross sales (tan, proper scale). NBER outlined peak-to-trough recession dates shaded grey. Supply: BEA by way of FRED, Calculated Danger for February, NBER, and writer’s calculations.

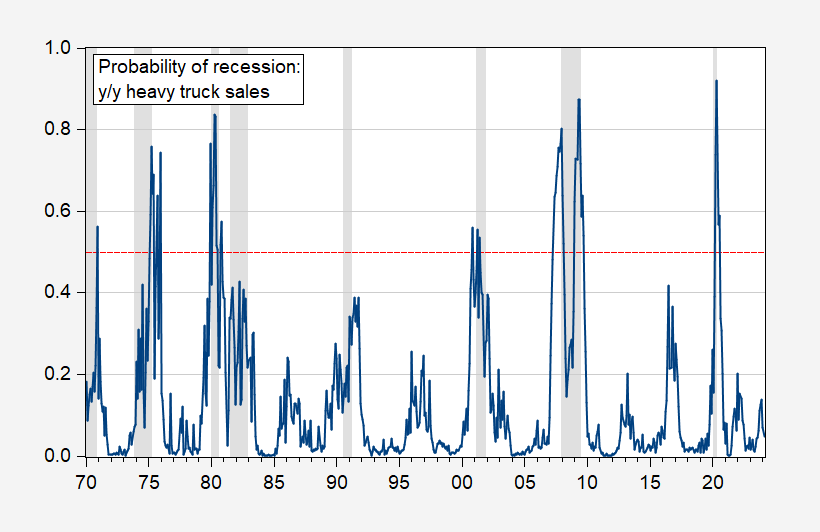

Over the 1970-2023 interval, a probit regression has a pseudo-R2 of about 0.29, and signifies recessions (bear in mind, that is as a coincident indicator) fairly nicely traditionally (aside from 1990-91).

Determine 3: Estimated recession chances from probit regression, 1970-2023 (blue), crimson dashed line at 50% likelihood threshold. NBER outlined peak-to-trough recession dates shaded grey. Supply: NBER and writer’s calculations.

As Calculated Danger notes:

Normally, heavy truck gross sales decline sharply previous to a recession. Heavy truck gross sales are strong.

Given the rise in heavy truck gross sales, I’m even much less inclined to contemplate February a begin date for recession.