That’s the title of an article by S. Ganguly for Reuters.

Practically two-thirds of strategists in a March 6-12 Reuters ballot of bond market consultants, 22 of 34, stated the yield curve’s predictive energy shouldn’t be what it as soon as was.

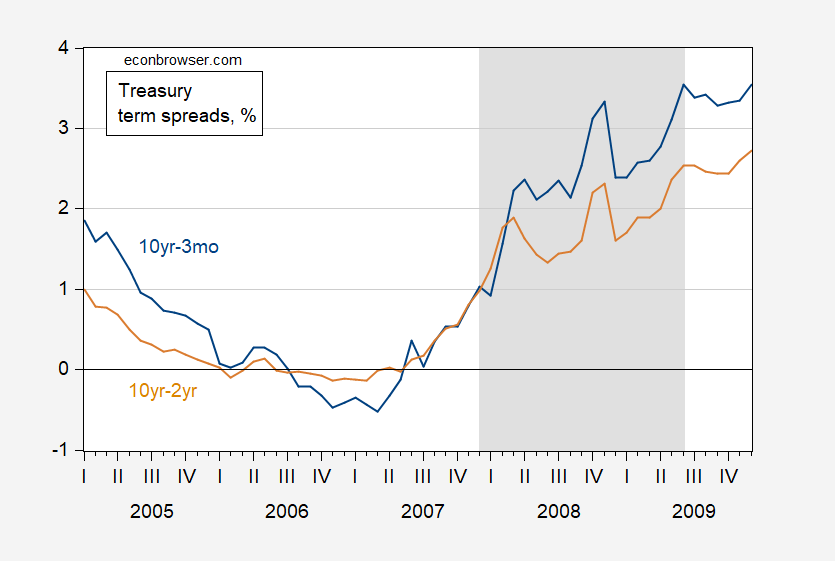

Right here’s an image of spreads, as much as March 14th.

Determine 1: 10 12 months minus 3 month Treasury unfold (blue), 10 12 months minus 2 12 months (tan), each in %. March for knowledge by way of 3/14. Supply: Treasury by way of FRED, and writer’s calculations.

For comparability’s sake, word that the Nice Recession was preceded by an inversion that began a 12 months and a half earlier than the NBER outlined peak.

Determine 2: 10 12 months minus 3 month Treasury unfold (blue), 10 12 months minus 2 12 months (tan), each in %. NBER outlined peak-to-trough recession dates shaded grey. Supply: Treasury by way of FRED, NBER, and writer’s calculations.

We’re at the moment a couple of 12 months and a half from when the 10yr-2yr unfold went adverse, So I might say it’s nonetheless too early to say we’re protected, regardless of the obvious energy of the financial system proper now (properly, as of February’s knowledge).

Why do some economists low cost the inversion’s predictive energy this time round?

“In case you have these two issues occurring collectively – insatiable demand for the long-end from actual cash like pension funds and the Fed protecting front-end charges increased due to the resilience of the financial system – the curve will keep inverted for some time.”

I interpret this which means the standard correlation between inversion and recession breaking down as a result of the time period premium on lengthy bonds is smaller than ordinary. Contemplate:

then the ten year- 3 month time period unfold is:

![]()

With the tp time period smaller than ordinary, then the pure EHTS charge is likely to be increased than for a typical inversion.

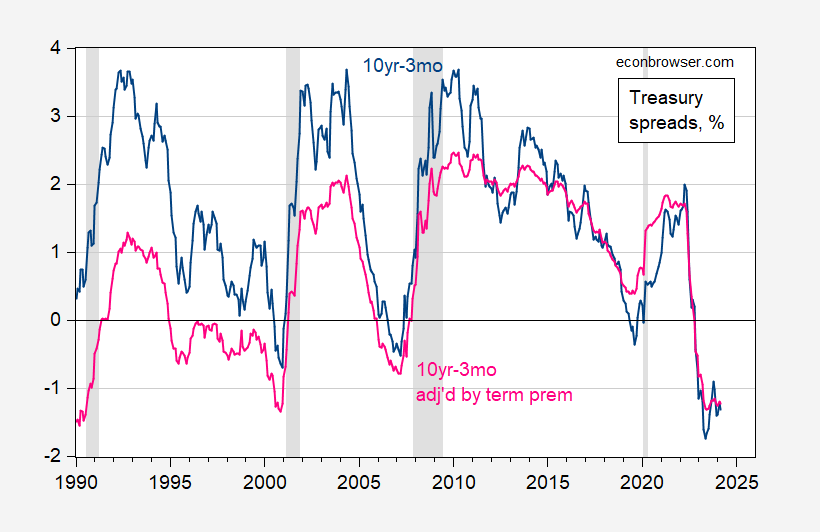

Whereas the low or adverse time period premium argument sounds believable, adjusting the unfold by an estimated time period premium (Kim-Wright 10 12 months from FRED, collection THREEFYTP10), doesn’t appear to alter our view of how inversions correlate with subsequent recessions.

Determine 3: 10 12 months minus 3 month Treasury unfold (blue), 10 12 months minus 3 month adjusted by estimated Kim-Wright time period premium (pink), each in %. NBER outlined peak-to-trough recession dates shaded grey. Supply: Treasury, Kim-Wright by way of FRED, NBER, and writer’s calculations.

Therefore, I be part of Cam Harvey (who dropped at prominence the yield curve as recession predictor) who says it’s too early to drop the recession name.