The FT-Sales space Macroeconomist Survey was launched at this time. GDP is slated to develop 2.1% in 2024, this fall/this fall.

Determine 1: GDP (daring black), CBO projection (blue), Survey of Skilled Forecasters (pink), FT-Sales space median forecast (brown inverted triangle), GDPNow of three/14 (gentle blue sq.), all in bn.Ch.2017$. Supply: BEA 2024Q4 2nd launch, CBO Price range and Financial Outlook (February), Philadelphia Fed SPF, Sales space Faculty, Atlanta Fed (3/14), and creator’s calculations.

The median progress fee is 2.1%, with 10% decrease/higher bounds at 1.6% and a pair of.5%. This progress fee is quicker than the 1.7% median fee within the February SPF. (I’m apparently extra pessimistic than the median, with my level estimate at 1.7%.)

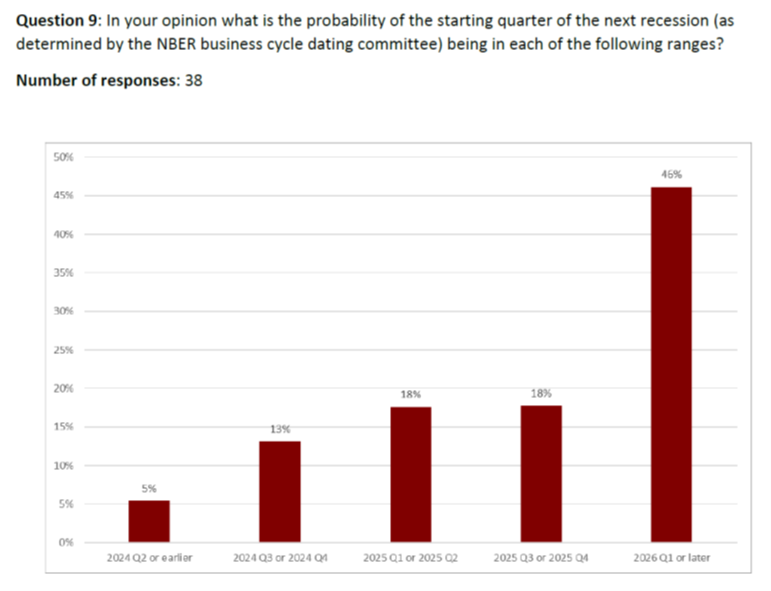

What about recession? The modal response is now pushed to 2026 or later.

Supply: Sales space Faculty.

The recession begin date has but once more been deferred, with modal response moved to 2026 or past. Within the December survey, 42% indicated a begin in 2025Q3 or past.

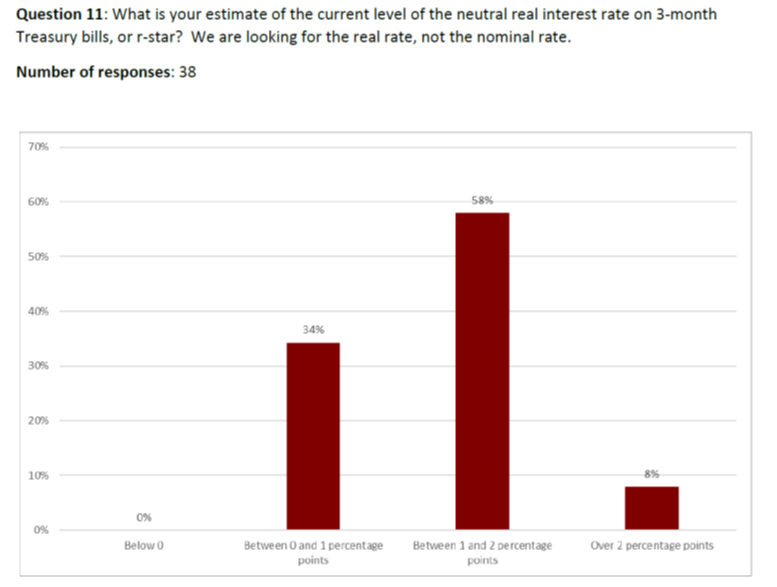

Lastly, the respondents weighted in on r*:

Supply: Sales space Faculty.

The modal response is for r* to between 1%-2%, which is per the estimates proven on this submit, and this submit. Solely 3 folks (out of 38) believed r* > 2% (which solely the Lubik-Matthes estimate matches).

“Fed should hold charges excessive for longer than markets anticipate, say economists,” in FT highlights different facets of the survey.