Utilizing the Sahm rule:

Determine 1: Sahm rule index utilizing present classic of knowledge (blue), utilizing actual time information (tan), each in %. Threshold for recession is horizontal pink dashed line at 0.5%. Mild inexperienced shading denotes 2022H1. Supply: FRED.

The Sahm rule is a fairly good indicator of when a NBER outlined recession begins. Now, if you wish to outline a recession as when VMT goes down, gasoline consumption goes down, or the U.Michigan sentiment goes down, or when actual wages go down, or when GDP within the present classic is detrimental for 2 consecutive quarters, or the output hole i is detrimental, or when GDI is detrimental for 2 consecutive quarters, you then may discover a recession in 2022H1. Simply perceive that it won’t be a recession as different individuals outline it.

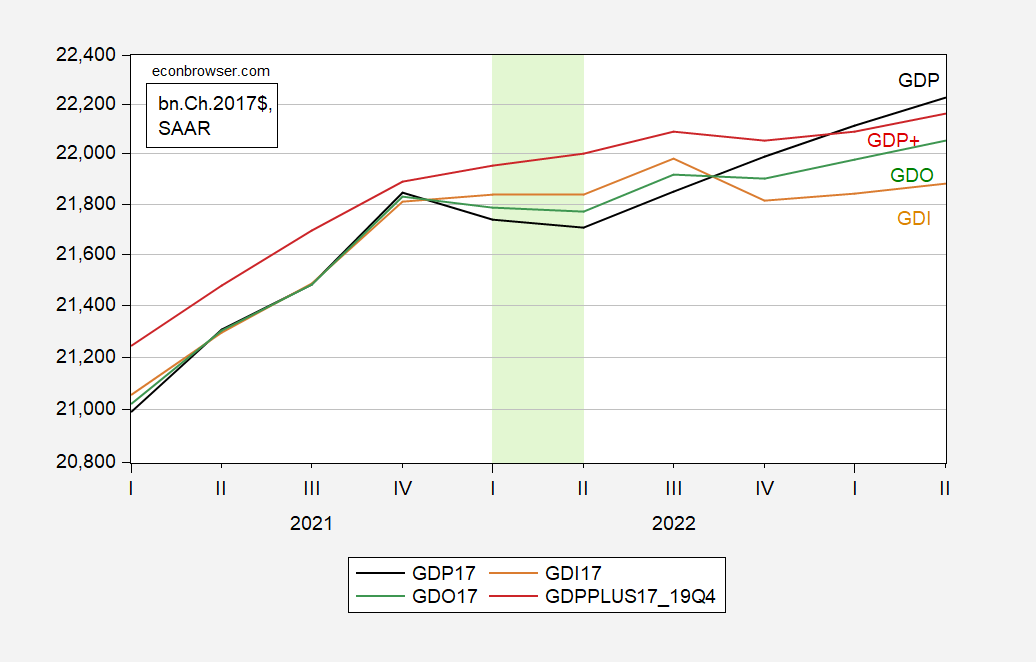

By the best way, right here’s an image of GDP, GDI, GDO, and GDP+. GDO is down, however GDP+ is up over 2022H1…

Determine 2: GDP (black), GDI (tan), GDO (inexperienced), GDP+ listed to 2019Q4 (pink), all in bn.Ch.2017$ SAAR. Mild inexperienced shading denotes 2022H1. Supply: BEA, Philadelphia Fed, and writer’s calculations.