Buyers are pushing again their expectations of rate of interest cuts around the globe, because the US Federal Reserve’s battle with worth pressures complicates different central banks’ loosening plans.

Because the US reported the newest in a string of poor inflation figures, markets reined of their forecasts for charge cuts by the European Central Financial institution and the Financial institution of England, in addition to by the Fed itself.

“The Fed’s inflation issues have a world dimension and different central banks can’t ignore them,” stated James Knightley, chief worldwide economist at ING in New York. “Particularly, if the Fed can’t minimize charges quickly it might stoke up greenback energy, which causes stress for the European economic system and constrains different central banks’ capacity to chop charges.”

He added: “Plus there’s a fear that what is occurring on inflation within the US might floor in Europe as effectively.”

Senior officers on the ECB and BoE argue they aren’t confronting the identical inflation issues because the US, implying they’ve extra scope to chop charges earlier.

However shifts within the futures market point out the worldwide influence of the persistent US inflation downside.

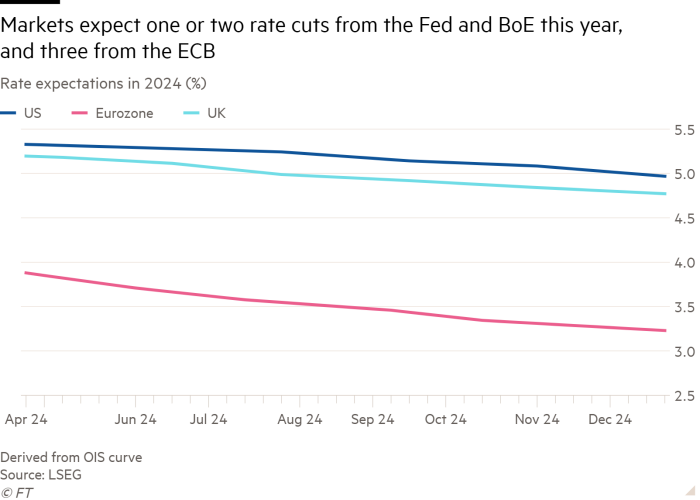

Merchants now anticipate the ECB to chop charges by a mean of about 0.7 share factors this yr beginning at its subsequent coverage assembly on June 6, whereas two weeks in the past they anticipated cumulative cuts of 0.88 factors.

Initially of the yr, when US inflation appeared on a firmer downward path, they anticipated cuts of 1.63 factors.

Markets now anticipate BoE cuts of 0.44 share factors this yr in contrast with 0.56 factors two weeks in the past and 1.72 factors firstly of the yr.

The backdrop for the shift has been the market’s decreased expectations for the Fed, which is ready to maintain charges at their 23-year-high at its assembly subsequent week. Whereas firstly of the yr buyers had anticipated as many as six quarter-point cuts, this yr, they now anticipate one or two.

The US and its European counterparts have diverged previously. But when different areas minimize charges extra aggressively than the Fed, they threat harming their very own economies due to the influence on alternate charges, import prices and inflation.

“There’s an excellent macro case for divergence, however finally there’s a restrict on how far it may possibly go,” stated Nathan Sheets, chief economist at US lender Citi. He added that it was “more difficult” for the ECB to “minimize aggressively in an setting the place the Fed is ready”.

Fed chair Jay Powell conceded this month that US inflation was “taking longer than anticipated” to hit its goal, signalling that borrowing prices would wish to remain excessive for longer than beforehand thought.

In figures on Friday, the Fed’s most well-liked inflation metric got here in larger than anticipated at 2.7 per cent for the yr to March, and a minority of merchants at the moment are even betting on Fed charge rises within the subsequent 12 months.

Marcelo Carvalho, world head of economics at BNP Paribas, stated the ECB was neither “Fed-dependent” nor “Fed-insensitive”.

Regardless of the market’s expectations that top US borrowing prices will restrict their freedom of manoeuvre, high European central bankers insist their much less critical inflation downside requires a special response.

“It’s a completely different type of animal we are attempting to tame,” ECB president Christine Lagarde stated this month in Washington.

She stated the “roots and drivers” of the 2 areas’ worth surges have been completely different — with Europe affected extra by vitality prices and the US by massive fiscal deficits.

BoE governor Andrew Bailey has additionally argued that European inflation dynamics have been “considerably completely different” from the US.

High officers from the ECB and BoE have signalled charges will nonetheless be minimize this summer time, regardless of the inflation knowledge that has led buyers to cost within the first Fed charge discount in November.

The shift is a marked distinction to earlier this yr when the Fed was seen as main the way in which down.

“The ECB and BoE are working in a a lot weaker progress setting, so I believe they may don’t have any compunctions about chopping charges earlier,” stated Mahmood Pradhan, head of worldwide macroeconomics at Amundi Asset Administration.

However ECB policymakers have given divergent indications on how massive a charge hole with the Fed they’ll tolerate.

Banque de France governor François Villeroy de Galhau instructed Les Echos that he expects continued chopping “at a realistic tempo” after June. Nonetheless, Austria’s central financial institution head Robert Holzmann warned: “I might discover it tough if we transfer too distant from the Fed.”

The euro has fallen 3 per cent in opposition to the greenback because the begin of the yr to simply above $1.07, however buyers have elevated bets it might drop to parity with the US foreign money.

Such a fall would add about 0.3 share factors to eurozone inflation over the following yr, in accordance with current ECB analysis. The financial institution’s vice-president, Luis de Guindos, stated this week it will “must take the influence of alternate charge actions under consideration”.

The far-reaching influence of US coverage is already extremely seen in Japan, the place buyers are growing bets that the Financial institution of Japan might want to preserve elevating borrowing prices as a weaker yen fuels inflation. The yen has dropped to 34-year lows in opposition to the greenback, pushing up the worth of imported items.

However some EU policymakers argue that if a extra hawkish Fed results in tighter world monetary situations, it might bolster the case for relieving within the eurozone and elsewhere.

“A tightening within the US has a destructive influence on inflation and output within the eurozone,” Italy’s central financial institution boss Fabio Panetta stated on Thursday, including that this was “prone to reinforce the case for a charge minimize reasonably than weakening it”.

Tighter US coverage additionally impacts world bond markets, with Germany’s 10-year Bunds typically mirroring actions by the 10-year US Treasury.

BNP Paribas estimates that if European bond yields have been pushed half a share level larger by the fallout from US markets, it will require an additional 0.2 share factors of charge cuts by the ECB to offset the influence of tighter monetary situations. Equally, it will require 0.13 factors of additional cuts by the BoE.

Tomasz Wieladek at T Rowe Value in London argued that the ECB and BoE “must actively lean in opposition to this tightening in world monetary situations to carry their home monetary situations extra in step with the basics in their very own economies”.

Further reporting by George Steer in London