With the employment scenario launch, we’ve a primary studying on April situations.

Determine 1: Nonfarm Payroll (NFP) employment from CES (daring blue), civilian employment (orange), industrial manufacturing (purple), private earnings excluding present transfers in Ch.2017$ (daring inexperienced), manufacturing and commerce gross sales in Ch.2017$ (black), consumption in Ch.2017$ (gentle blue), and month-to-month GDP in Ch.2017$ (pink), GDP, third launch (blue bars), all log normalized to 2021M11=0. Supply: BLS by way of FRED, Federal Reserve, BEA 2024Q1 advance launch, S&P International Market Insights (nee Macroeconomic Advisers, IHS Markit) (5/1/2024 launch), and writer’s calculations.

Common internet job progress is 242 thousand vs. 276 thousand as of March (pre-revision). Annualized m/m month-to-month GDP progress drops from pre-revision 11.5% in February to -1.9% in March.

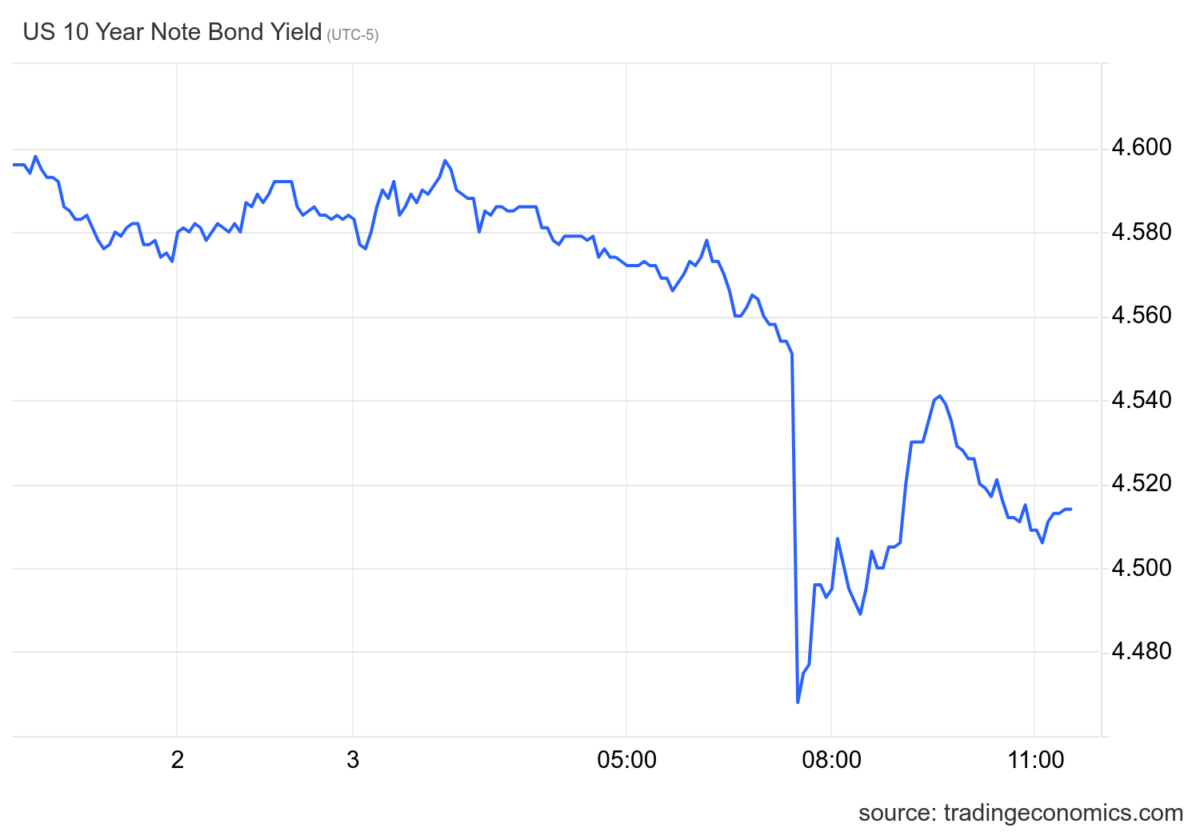

The bond market has taken the employment launch particulars as a complete as indicating a deceleration (relative to pre-release). Yields have dropped, whereas futures point out the next chance of drops in Fed funds come September FOMC assembly.

Supply: TradingEconomics, accessed 5/3/2024. Occasions are Central.