Reader Steven Kopits writes in response to Are you higher off than you have been 4 years in the past?:

I donʻt suppose individuals are going to check something to the pandemic. Trump didn’t trigger the pandemic, and albeit, most nations around the globe suffered some type of financial shock. I donʻt suppose thatʻs how voters are going to make comparisons.

They may make comparisons with 2019. The numbers are a combined bag.

I’m not so positive… Let’s really take a look at the information.

Determine 1: GDP per capita now (blue), and 5 years in the past (tan), each in bn.Ch.2017$ SAAR. Supply: BEA.

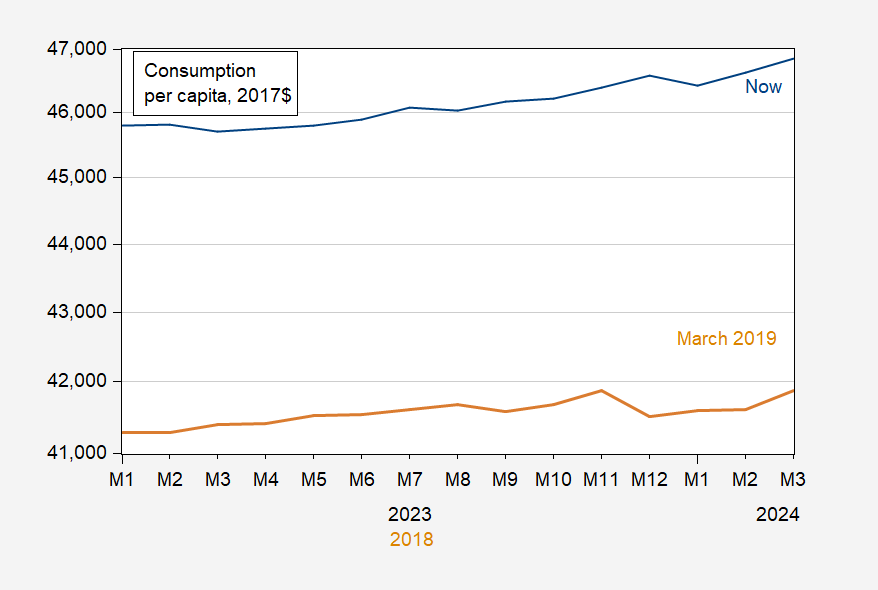

Determine 2: Consumption per capita now (blue), 5 years in the past (tan), in 2017$ SAAR. Supply: BEA.

Determine 3: Disposable private earnings per capita now (blue), 5 years in the past (tan), in 2017$ SAAR. Supply: BEA.

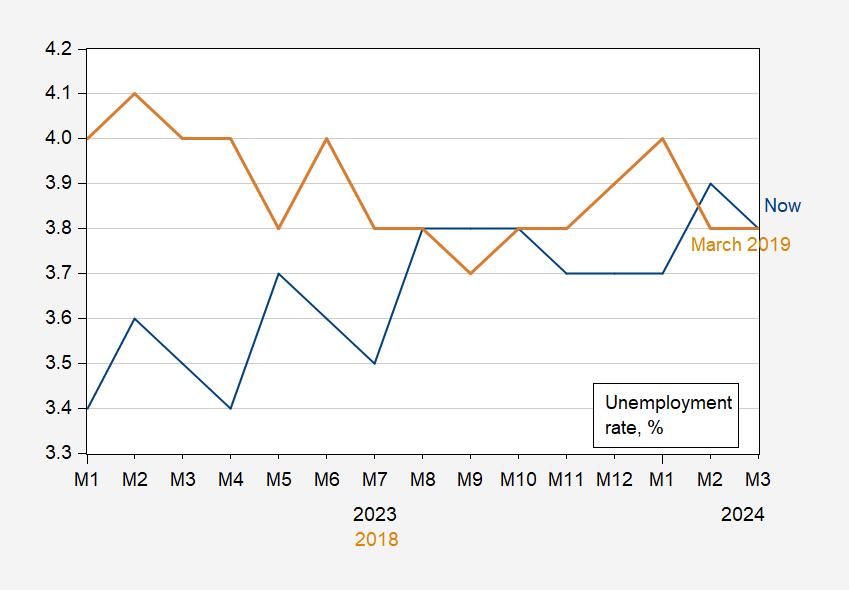

Determine 4: Unemployment price now (blue), 4 years in the past (tan), in %. April statement is Bloomberg consensus. Supply: BLS.

Determine 5: VIX now (blue), 5 years in the past (tan). Supply: CBOE by way of FRED.

Determine 6: Financial Coverage Uncertainty index (blue), 4 years in the past (tan). Supply: Policyuncertainty.com by way of FRED.

Determine 7: Distress index now (blue), 4 years in the past (tan), in %. April statement of unemployment is Bloomberg consensus, inflation is from Cleveland Fed nowcast as of 4/30/2024. Supply: BLS, Cleveland Fed, and writer’s calculations.

Mr. Kopits additionally writes:

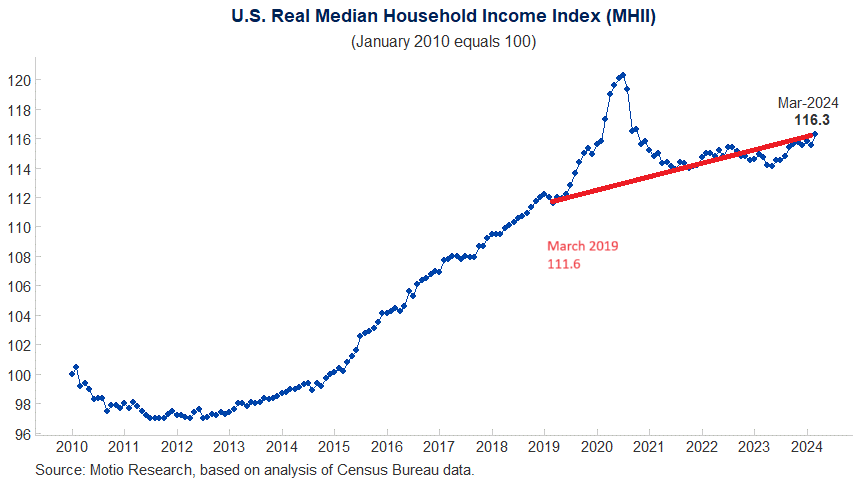

…it appears just like the median family isn’t materially higher off than it was in 2019. A misplaced 5 years.

I consider that Mr. Kopits is visually challenged. Under I present the evolution of actual median family earnings, with the purple line now drawn from March 2019, when the index stood at 111.6.

Supply: Motio Analysis.

So, to sum up: per capita GDP, consumption, disposable earnings and median family earnings are larger than they have been 5 years in the past. The unemployment price is similar. The VIX and Financial Coverage Uncertainty (dangerous issues, I’d say) have been larger 5 years in the past than at present. The detrimental is the “distress index” is 1.7 ppts larger than it was 5 years in the past (however for sure it’s now decrease than it was 4 years in the past).

Lastly, Mr. Kopits reveals a exceptional ignorance of phrases. He writes:

Btw, property taxes and residential insurance coverage have gone up so much since then, with none corresponding improve in tangible advantages that I can see, at the very least for most householders. On my present houses, my property taxes are up 37% since 2019. What are the presumptions on that from a ʻrealʻ perspective? Is there a presumption that providers have gone up accordingly, thus “consumption” has elevated? Or is it handled purely as value inflation?

Actual consumption is non-public consumption on items and providers undertaken, in inflation adjusted phrases (Determine 2). Disposable earnings takes under consideration federal, state and native taxes (Determine 3).