Really, no — however maybe a quick meals nation in recession. In arguing that output is mismeasured, a lot so we’ve been in recession for the previous 4 years, Peter St. Onge (Heritage) and Jeffrey Tucker (Brownstone Institute) write:

Numerous research have proven that since 2019 quick meals costs — a gold commonplace in monetary markets for measuring true inflation — have outpaced official CPI by between 25% and 50%.

The “numerous research” cited are so far as I can inform a set of newspaper articles. What if we measure GDP utilizing quick meals costs? Right here’s the evolution of the quick meals (“restricted service eating places”) part of the CPI, as in comparison with the GDP deflator, the CPI, and the meals away from residence part of the CPI:

Determine 1: GDP deflator (black), CPI (blue), meals away from residence CPI (brown), meals away from residence – restricted service eating places CPI (tan), Massive Mac worth (inexperienced), all in logs 2017M01=0. Massive Mac costs primarily based on worth as near 12 months mid-point as attainable. NBER outlined peak-to-trough recession dates shaded grey. Supply: SPGMI (Macroeconomic Advisers/IHS-Markit) 8/1 launch, BLS through FRED, BLS, Economist, NBER, and writer’s calculations.

Some dialogue of quick meals retailer costs right here). My most popular measure is the Massive MacTM, which is utilized in many research of buying energy parity (together with one revealed in Financial Journal).

It’s true that utilizing the restricted providers restaurant worth index, costs have risen quicker than the CPI (though the identical just isn’t true for Massive MacTMs!).

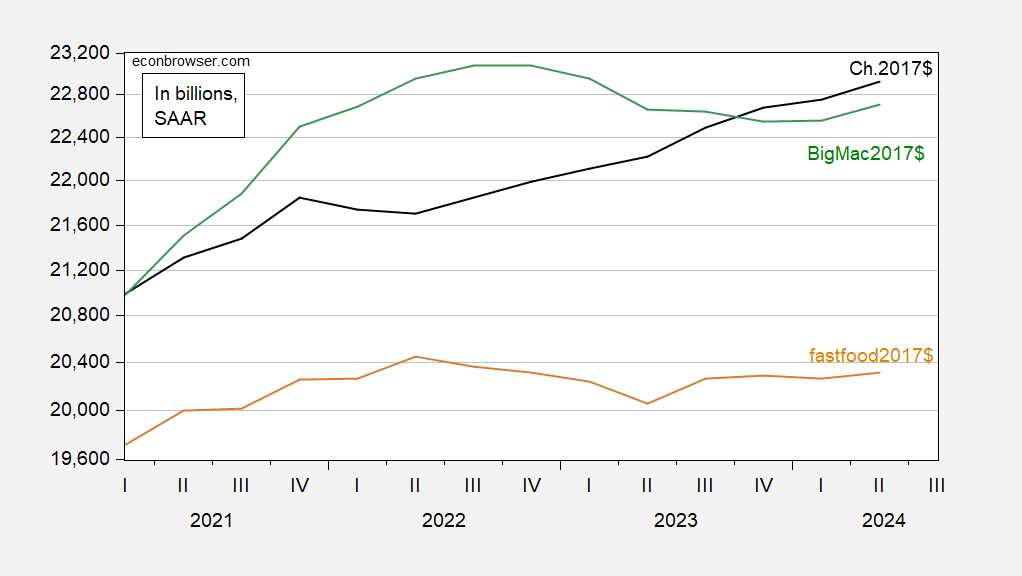

I plot the completely different measures of GDP over the identical interval plotted by St.Onge and Antoni.

Determine 2: GDP in bn.Ch.2017$ (black), in bn.BigMac2017$ (inexperienced), in bn. bundles of restaurant meals 2017$ (tan), all SAAR. Massive MacTM costs interpolated (cubic) from annual July observations. Supply: BEA 2024Q2 2nd launch, BLS, Economist, and writer’s calculations.

Utilizing Massive MacTM costs, actual GDP has been falling since end-2022, albeit from the next degree than GDP measured in Ch.2017$. Utilizing the food-away-from-home restricted providers part of the CPI, we’ve an image barely extra in step with the St. Onge-Tucker thesis.

So…if all we consumed, invested in, paid troopers and civil servants, and exported was burgers, sandwiches, fried hen and tacos, then certainly we’d have been in a recession for the previous 4 years. (Quick meals has a 2.5% weight within the CPI-U, so assuming consumption is 70% of GDP, then quick meals consumption accounts for about 1.8% of GDP.)