Industrial and manufacturing manufacturing (+0.9% m/m vs. +0.3% consensus; +0.6% m/m vs. +0.2% consensus), retail gross sales (management) shock on the upside. First, indicators adopted by the NBER BCDC:

Determine 1: Nonfarm Payroll (NFP) employment from CES (blue), implied NFP from preliminary benchmark (daring blue), civilian employment (orange), industrial manufacturing (crimson), private earnings excluding present transfers in Ch.2017$ (daring mild inexperienced), manufacturing and commerce gross sales in Ch.2017$ (black), consumption in Ch.2017$ (mild blue), and month-to-month GDP in Ch.2017$ (pink), GDP (blue bars), all log normalized to 2021M11=0. Supply: BLS by way of FRED, Federal Reserve, BEA 2024Q3 third launch, S&P World Market Insights (nee Macroeconomic Advisers, IHS Markit) (12/2/2024 launch), and writer’s calculations.

Second, different indicators, which paint the same story of continued progress, with adjusted for CBO estimated immigration employment greater. On the opposite facet, car miles traveled was down in October and November.

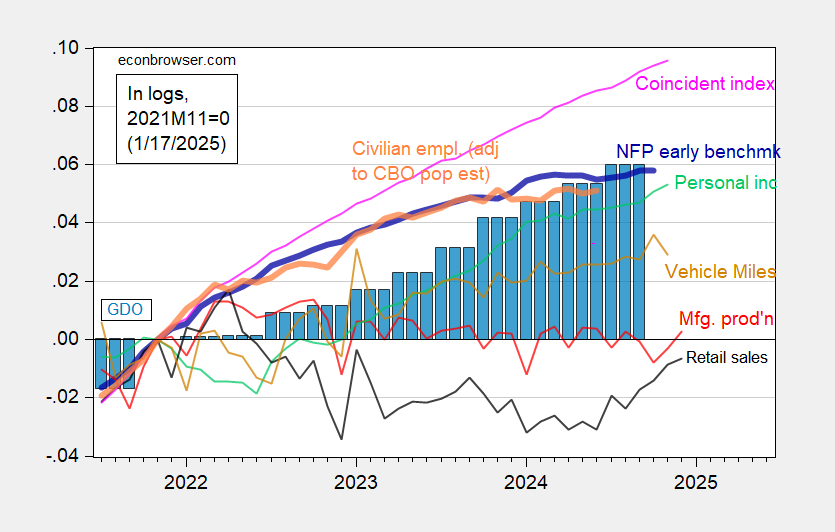

Determine 2: Implied nonfarm Payroll early benchmark (NFP) (daring blue), civilian employment adjusted utilizing CBO immigration estimates (orange), manufacturing manufacturing (crimson), private earnings excluding present transfers in Ch.2017$ (daring inexperienced), manufacturing and commerce gross sales in Ch.2017$ (black), consumption in Ch.2017$ (mild blue), and month-to-month GDP in Ch.2017$ (pink), GDO (blue bars), all log normalized to 2021M11=0. Supply: Philadelphia Fed [1], Philadelphia Fed [2], Federal Reserve by way of FRED, BEA 2024Q3 third launch, , and writer’s calculations.