Right here’s an image of the important thing indicators adopted by the NBER Enterprise Cycle Relationship Committee used of their enterprise cycle chronology:

Determine 1: Nonfarm Payroll employment from CES (daring blue), from Philadelphia Fed early benchmark (teal), civilian employment (orange), industrial manufacturing (crimson), private revenue excluding present transfers in Ch.2017$ (daring inexperienced), manufacturing and commerce gross sales in Ch.2017$ (black), consumption in Ch.2017$ (gentle blue), and month-to-month GDP in Ch.2017$ (pink), GDP, third launch (blue bars), all log normalized to 2021M11=0. Supply: BLS through FRED, Federal Reserve, BEA 2023Q4 2nd launch, S&P International Market Insights (nee Macroeconomic Advisers, IHS Markit) (3/1/2024 launch), and creator’s calculations.

We will be pretty certain that employment progress is optimistic. See different indicators on this put up.

Listed here are some different indicators of financial exercise.

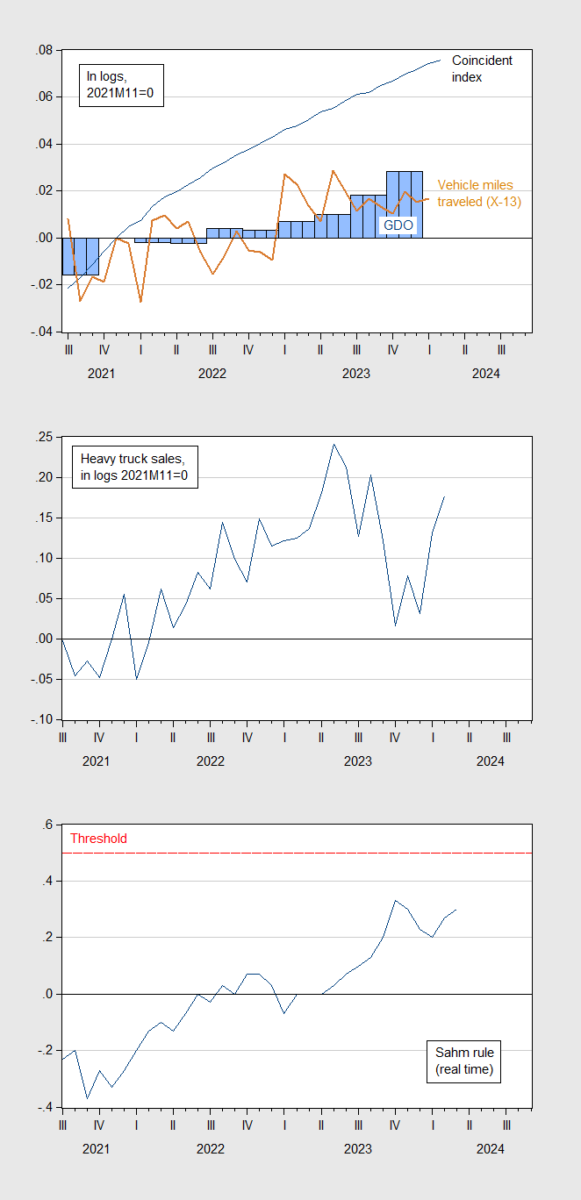

Determine 2: High panel: GDO (blue bar), coincident index (blue line), and automobile miles traveled seasonally adjusted by creator utilizing X-13 (tan line), all in logs, 2021M11=0; Center panel: Heavy truck gross sales, SAAR, (blue line), all in in logs, 2021M11=0; Backside panel: Actual time Sahm rule (blue), and recession threshold (crimson dashed line). Supply: BEA, Philadelphia Fed, NHTSA, Census, FRED, and creator’s calculations.

Not one of the indicators clearly sign the onset of a recession, though automobile miles traveled has flattened out, with y/y progress in January -0.8 %.