Industrial manufacturing surprises on upside (0.9% vs. 0.3% m/m), whereas nominal retail gross sales enhance modestly (0.1 precise vs. 0.3% consensus).

Determine 1: Nonfarm Payroll (NFP) employment from CES (daring blue), civilian employment (orange), industrial manufacturing (pink), private earnings excluding present transfers in Ch.2017$ (daring inexperienced), manufacturing and commerce gross sales in Ch.2017$ (black), consumption in Ch.2017$ (mild blue), and month-to-month GDP in Ch.2017$ (pink), GDP (blue bars), all log normalized to 2021M11=0. Supply: BLS by way of FRED, Federal Reserve, BEA 2024Q1 second launch, S&P World Market Insights (nee Macroeconomic Advisers, IHS Markit) (6/1/2024 launch), and writer’s calculations.

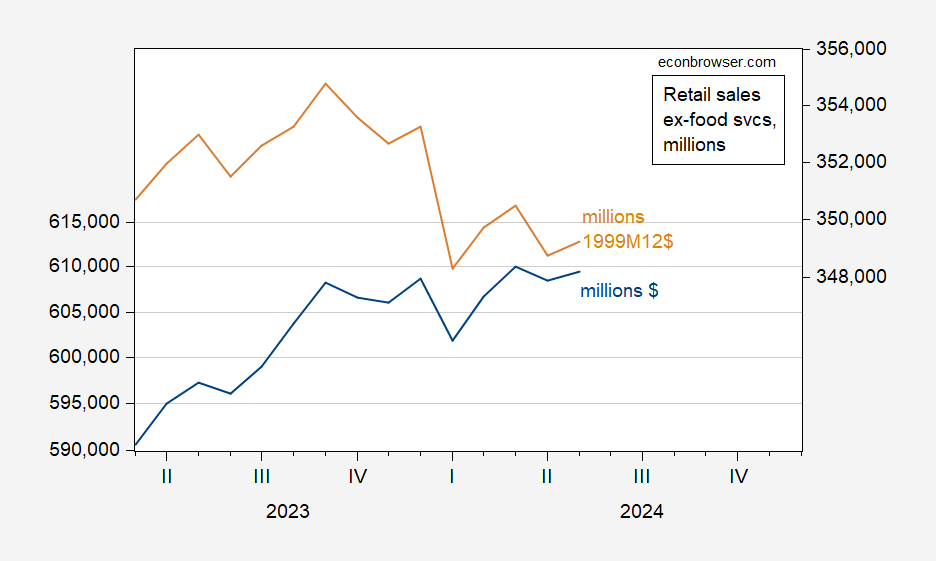

Retail gross sales:

Determine 2: Retail gross sales, mn $/month (blue, left scale), and in mn 1999M12$/month (tan, proper scale). Deflated utilizing chained CPI seasonally adjusted by writer utilizing X-13. Supply: Census, BLS, writer’s calculations.

Core retail gross sales have been down 0.1% vs. consensus +0.2%.

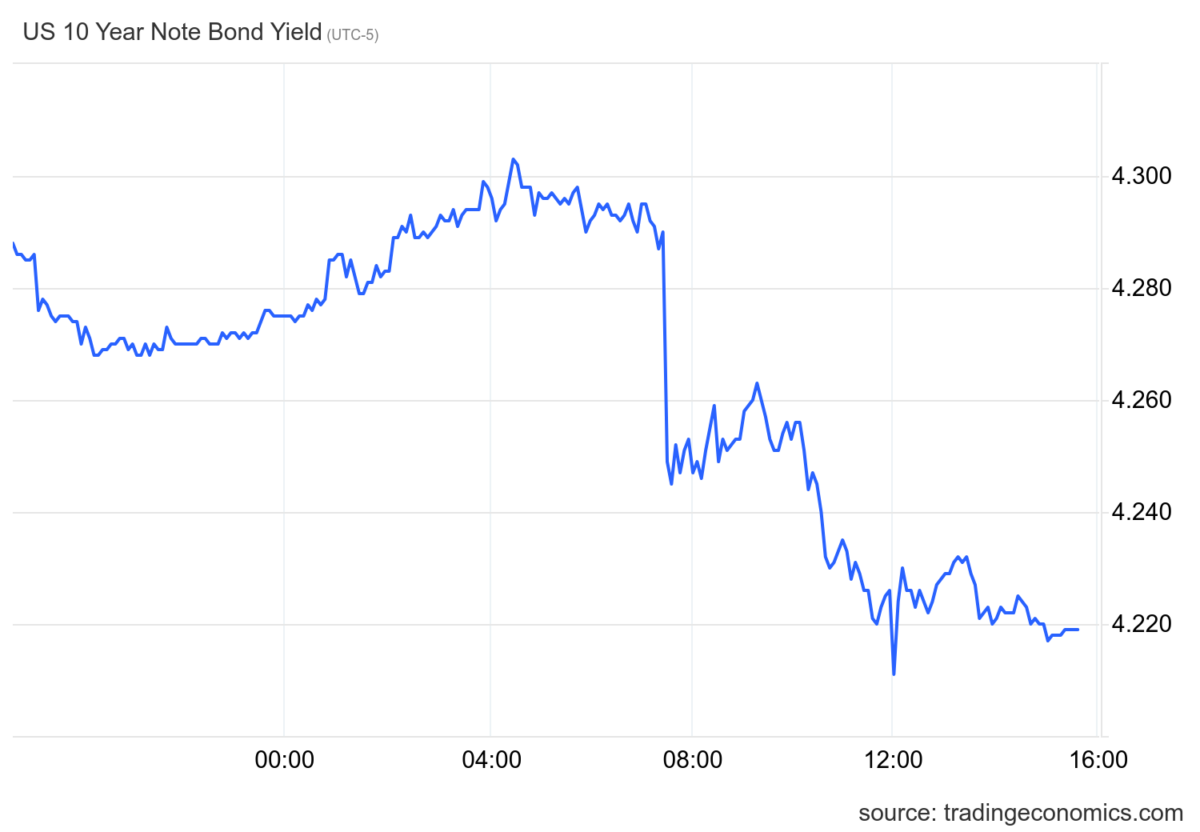

Treasury yields got here down noticeably, as a consequence of the cooler than anticipated retail quantity.