…to 1% y/y [1]. Their Main Financial Indicator edges up barely [2]. Justin Ho mentioned their brightening view on Friday’s Market.

Curiously, the Convention Board sees close to zero development in 2024Q2-Q3. That is according to the time period unfold primarily based predictions which present a excessive chance of recession in 2024Q2.

Determine 1: GDP (daring black), CBO projection (blue), Survey of Skilled Forecasters (crimson), FT-Sales space median forecast (brown inverted triangle), FOMC Abstract of Financial Projections March 20 (open mild inexperienced sq.), GDPNow of three/19 (mild blue sq.), Convention Board as of three/21 (chartreuse), all in bn.Ch.2017$. Supply: BEA 2024Q4 2nd launch, Philadelphia Fed SPF, Sales space Faculty, Federal Reserve Board, Atlanta Fed (3/19), Convention Board, and writer’s calculations.

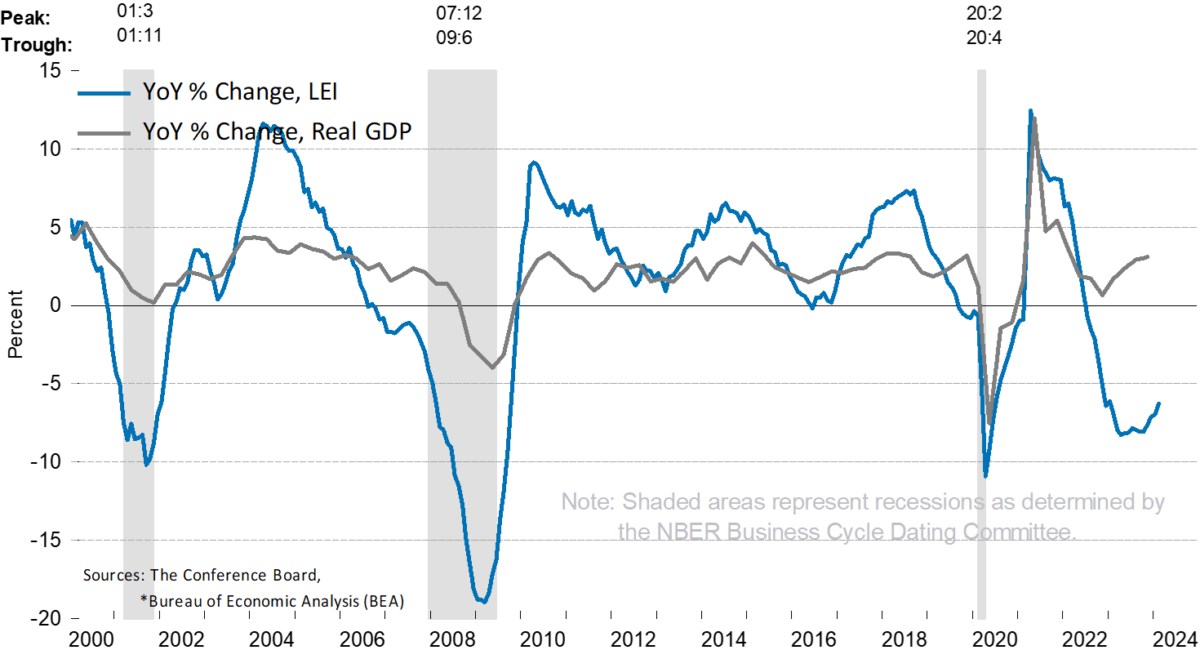

The decrease path for GDP vis a vis SPF or FT-IGM survey median is probably going due partially to the depressed stage of their Main Financial Indicator which solely turned barely optimistic in February.

Supply: Convention Board.

The literature from the Convention Board signifies that LEI turning factors lead GDP turning factors by 7 months, so September 2024.

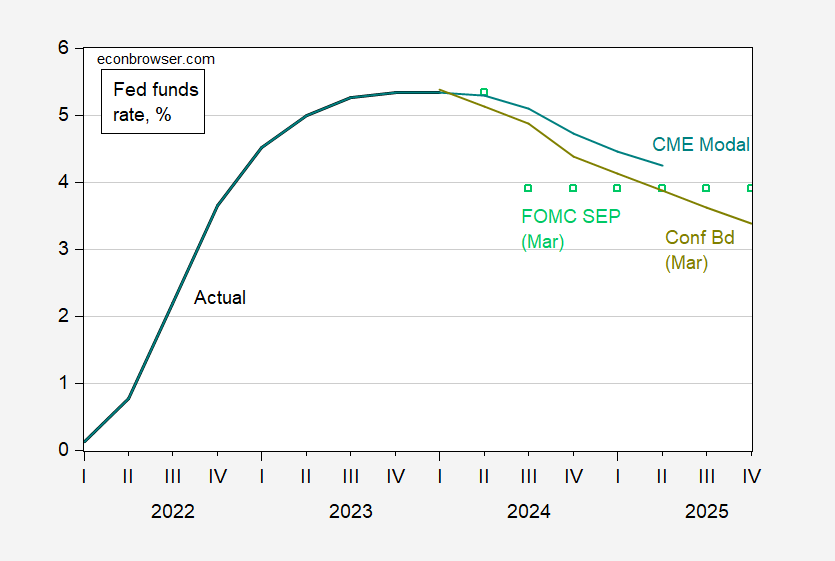

The Convention Board forecasts a decrease Fed funds in all probability as a consequence of the decrease projected development.

Determine 2: Fed funds price (black), FOMC March 2024 SEP (mild inexperienced squares), Convention Board forecast (chartreuse), CME modal forecast as of three/23 (sky blue). Supply: FRB through FRED, FRB, Convention Board, CME, and writer’s calculations.