Joe Biden is dethroning King Greenback in actual time. The US greenback’s monetary dominance is beneath siege from a uniquely unhealthy mixture of international and home insurance policies, and Individuals ought to be deeply involved by the fallout if the greenback loses its 80-year reign because the world’s reserve forex.

That’s from an article by EJ Antoni and Peter St. Onge, again in March 2023. The usage of monetary sanctions is the set off for foreigners to flee US greenback property. The outcome?

If foreigners not need them for commerce, central financial institution reserves, personal wealth funds, and the official forex of a couple of dozen international locations, all these {dollars} have nowhere to go however again to us in a flood like our nation has by no means seen. This flood will compete for items and providers within the US towards the {dollars} already right here as many years of amassed commerce deficits come flooding again .

At that time, hyperinflation won’t be hyperbole

OK. Time for some information.

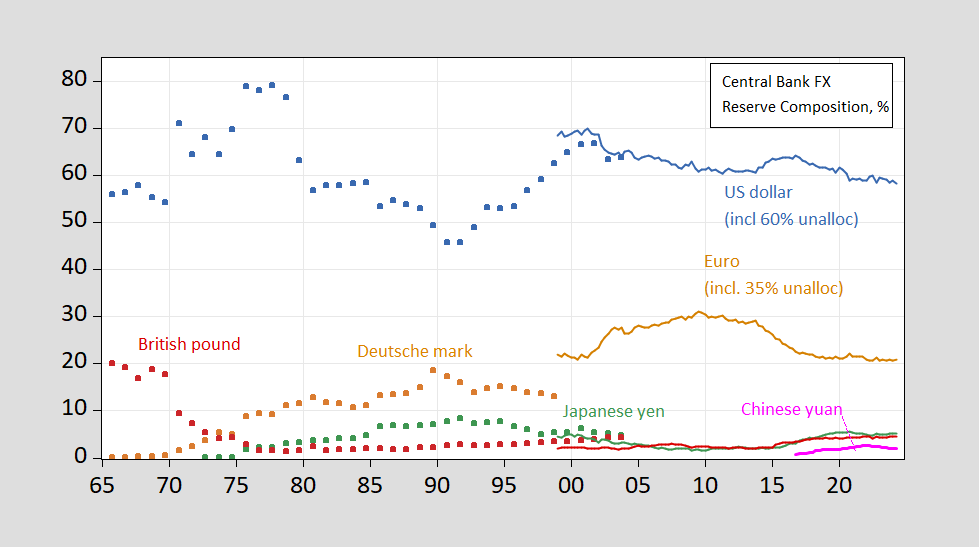

Determine 1: USD share of whole reserves as reported (gentle blue), and USD share plus 60% of unallocated share (daring blue). Supply: IMF, COFER, and creator’s calculations.

Whereas this discount in greenback share would possibly appears precipitous, it’s attention-grabbing to notice the quicker shift was through the Trump administration. In any case, some context is helpful.

Determine 2: Share of international change reserves held by central banks, in USD (blue), EUR (orange), DEM (tan squares), JPY (inexperienced), GBP (sky blue), Swiss francs (purple), CNY (crimson). For 1999 information onward, estimates based mostly on COFER information, and apportionment of unallocated reserves, described in textual content. Supply: Chinn and Frankel (2007), IMF COFER accessed 10/1/2024, and creator’s estimates.

The lower from 2022Q3 may be accounted for by the lower within the worth of the US greenback (bear in mind the shares are calculated utilizing forex values evaluated utilizing market change charges). So, a bit untimely to fret in regards to the finish of the greenback’s reserve forex hegemony.

Do we all know if sanctions spurred a decline in greenback holdings? Not likely. From Chinn, Frankel and Ito (2024), we all know by way of 2021, they didn’t. In fact, Antoni and St. Onge are referring to the 2022 sanctions in response to Russia’s expanded invasion of Ukraine. In ongoing work, we’ll asses whether or not there was an influence in 2022 (as soon as we’ve the info).

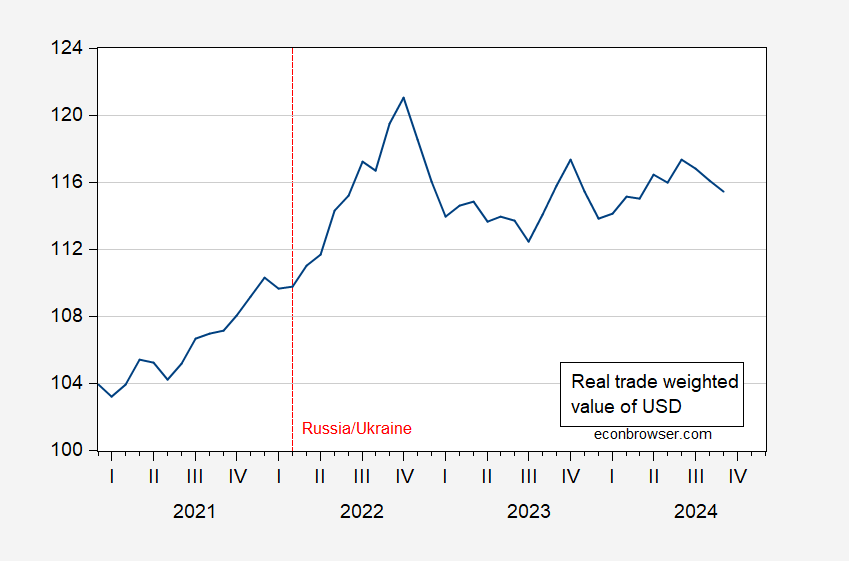

Oh, and the greenback’s appreciated (in actual phrases) for the reason that sanctions have been imposed.

Determine 3: Actual trade-weighted worth of the US greenback (blue). Up is appreciation. Supply: Federal Reserve by way of FRED.