Opposite to expectations, nonfarm payroll employment surprises +256K vs. +164K Bloomberg consensus. The usual deviation of modifications is 85K, with imply +186 (over 2024), which implies the shock is about one customary deviation.

A number of observers have questioned the accuracy of the CES measure of nonfarm payroll employment. On the premise of the preliminary benchmark, Heritage’s EJ Antoni argued the recession began in July. Nonetheless, it’s obvious to me that there’s some debate over the extent of sequence.

Determine 1: Nonfarm payroll employment from CES (blue), implied from preliminary benchmark (pink), implied from Philadelphia Fed early benchmark (inexperienced), CPS adjusted to nonfarm payroll idea (blue), CPS adjusted to nonfarm payroll idea, adjusted to include CBO estimates of immigration (pink), QCEW complete coated employment seasonally adjusted by writer utilizing X-13 (chartreuse), all in 000’s. Supply: BLS by way of FRED, BLS, Philadelphia Fed, and writer’s calculations.

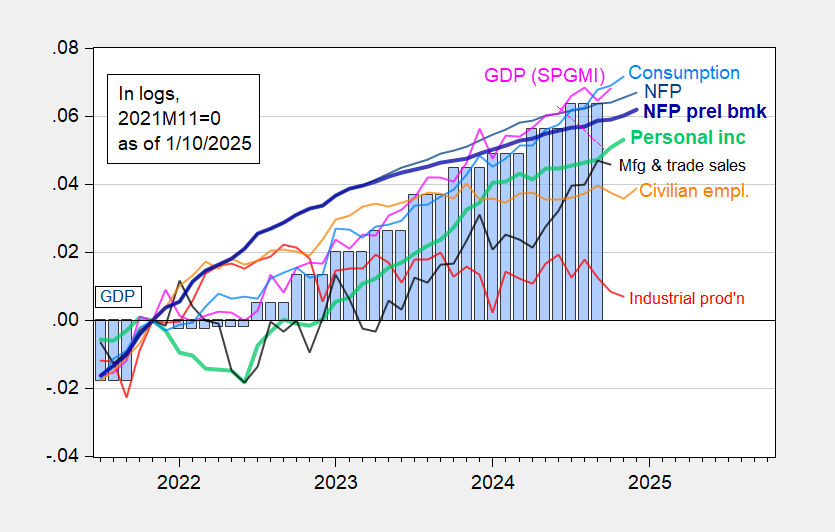

Right here’s the implication of the employment launch (and implied preliminary benchmark) for enterprise cycle indicators.

Determine 2: Nonfarm Payroll (NFP) employment from CES (blue), implied NFP from preliminary benchmark (daring blue), civilian employment (orange), industrial manufacturing (pink), private revenue excluding present transfers in Ch.2017$ (daring gentle inexperienced), manufacturing and commerce gross sales in Ch.2017$ (black), consumption in Ch.2017$ (gentle blue), and month-to-month GDP in Ch.2017$ (pink), GDP (blue bars), all log normalized to 2021M11=0. Supply: BLS by way of FRED, Federal Reserve, BEA 2024Q3 third launch, S&P International Market Insights (nee Macroeconomic Advisers, IHS Markit) (12/2/2024 launch), and writer’s calculations.

At the very least from the employment launch, financial exercise appears fairly sturdy on the finish of the Biden administration.