Justin Ho of Market mentioned the implications of the import/export worth launch Thursday. My view was that go via into import costs was low within the quick run, and even in the long term was not very giant, whereas go via into the broader worth index was unlikely to be giant. Unsure I used to be alone on this view, however right here’re my ideas.

Determine 1: Import worth ex-fuel (blue), nominal commerce weighted US greenback alternate price (up is depreciation) (tan), each in logs, 2020M02=0. NBER outlined peak-to-trough recession dates shaded grey. Supply: BLS, Federal Reserve Board by way of FRED, NBER, and writer’s calculations.

The variables are outlined in order that one anticipates the 2 variables to comove positively. The truth is, there’s not a lot of a correlation obvious in (log) ranges. Since each collection are nonstationary, it is sensible to estimate in log first variations. Sampling the information as end-of-quarter, and estimating the regression from 2002Q1-2023Q4 (with 4 lags of alternate price), one will get the long term go via coefficient at about 0.3 (ignoring every other components like home slack and measures for exporting nation prices). The adjusted R2 is 0.41. Notice that, as in earlier research, the estimated go via is far lower than unity, which is sensible given that the majority imports are invoiced in US {dollars}.

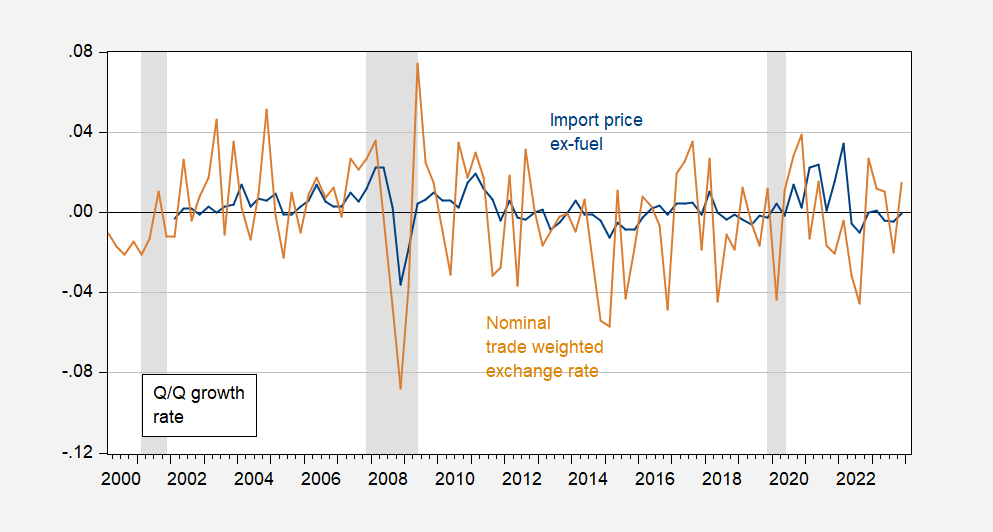

Determine 2: First log distinction in Import worth ex-fuel (blue), nominal commerce weighted US greenback alternate price (up is depreciation) (tan). NBER outlined peak-to-trough recession dates shaded grey. Supply: BLS, Federal Reserve Board by way of FRED, NBER, and writer’s calculations.

For comparability, Bussiere, della Chiaie and Peltuonen (2014) estimate the long term go via at about 0.35 for america, over the 1990-2011 interval. Outcomes from the sooner 2006 Fed survey, mentioned right here.

What about for broader indices? For the PPI for tradable industries, the estimate is about 0.3 for 2013-20 in Amiti et al. (2022), however 0.7 for 2021, suggesting the pandemic period displays totally different conduct.

What in regards to the affect on the broader indices? Mattschke and Sattiraju (2022) argue greenback appreciation/depreciation have little or no affect on PCE inflation. Declaring that solely about 10% of a core client basket includes imported items. (Oil costs denominated {dollars}, once they rise, are one other matter.)

A caveat is so as. Within the above literature, the alternate price is taken as largely exogenous, not utterly implausible given the big unpredictable element of nominal alternate charges. That being mentioned, as Forbes, Hjortsoe and Nenova (2018) and Ha, Stocker and Yilmazkuday (2020) notes, the sorts of shocks (demand, financial, provide) matter as nicely. For superior economies, Ha et al. discover the common alternate price go via into the CPI to be about 0.10.