Reader Bruce Corridor notes the correlation between Fed funds charge peaks and recessions, as a counterpoint to my use of unfold inversions.

Let’s examine peaks to inversions:

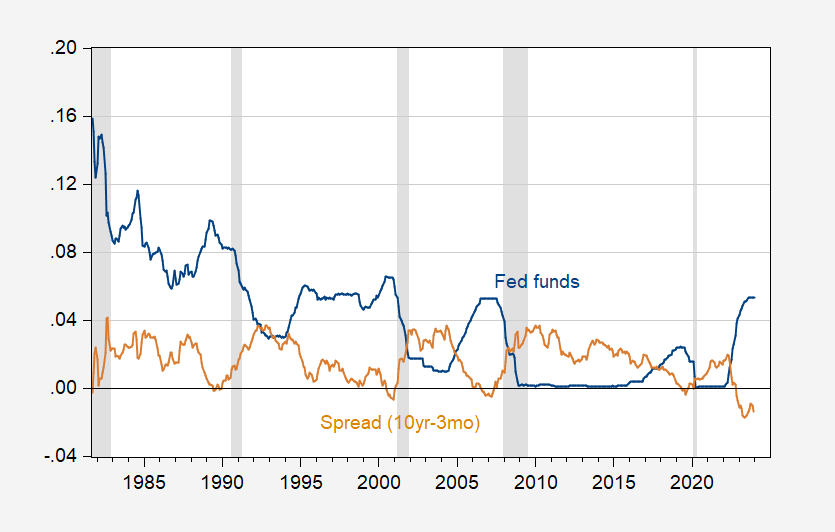

Determine 1: Fed funds (blue), and 10yr-3mo Treasury unfold (tan). NBER outlined peak-to-trough recession dates shaded grey. Supply: Treasury, Fed through FRED, NBER.

Inversions and peaks precede recessions. Which one does higher as a single predictor? I assess utilizing a typical probit regression.

Determine 2: Probit regression on recession lead by 12 months on Fed funds (blue), and on 10yr-3mo Treasury unfold (tan). NBER outlined peak-to-trough recession dates shaded grey. Supply: NBER, and creator’s calculations.

The probit regression on the Fed funds has a pseudo-R2 of 0.07, whereas that on the unfold has a pseudo-R2 of 0.27.

In my view, I’ll follow the unfold.