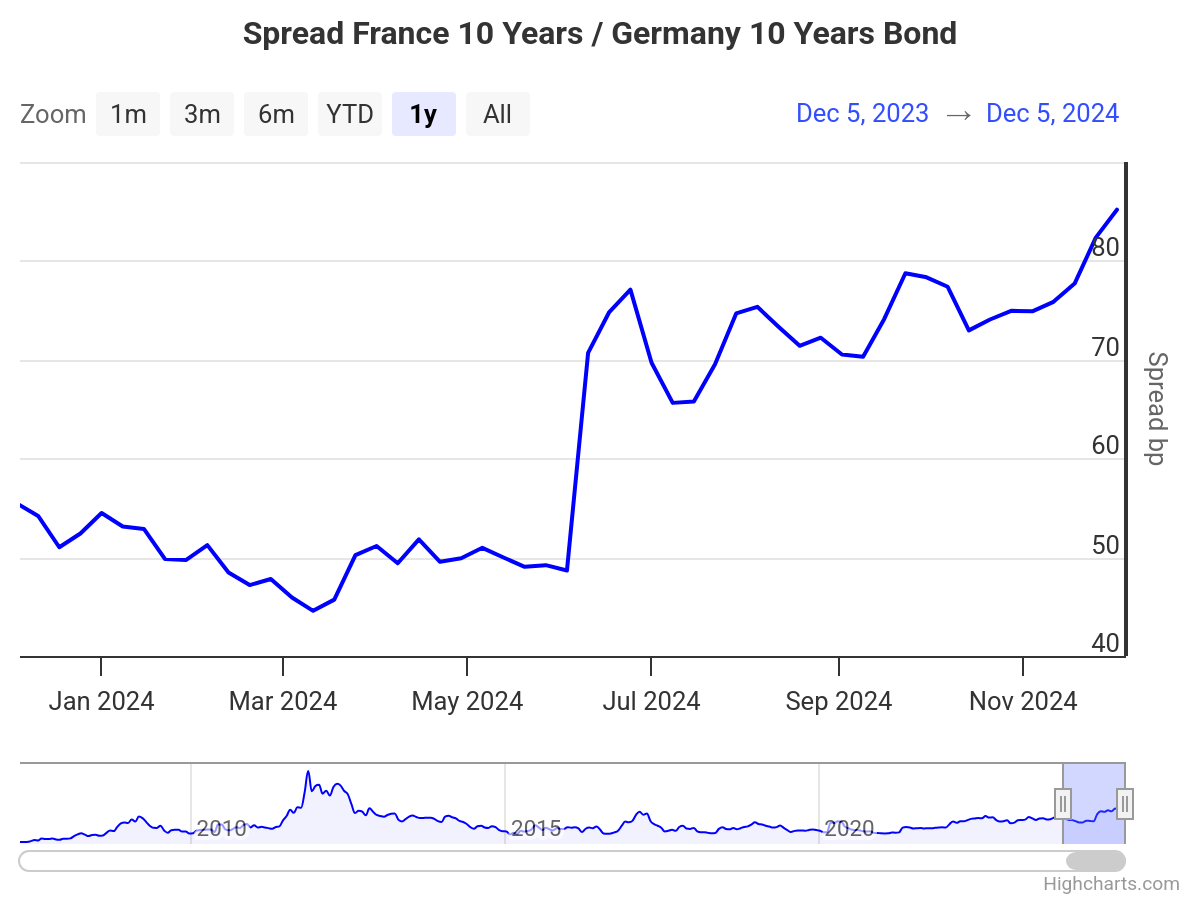

Right here’re CDS swaps and spreads vis a vis Germany over the previous 12 months:

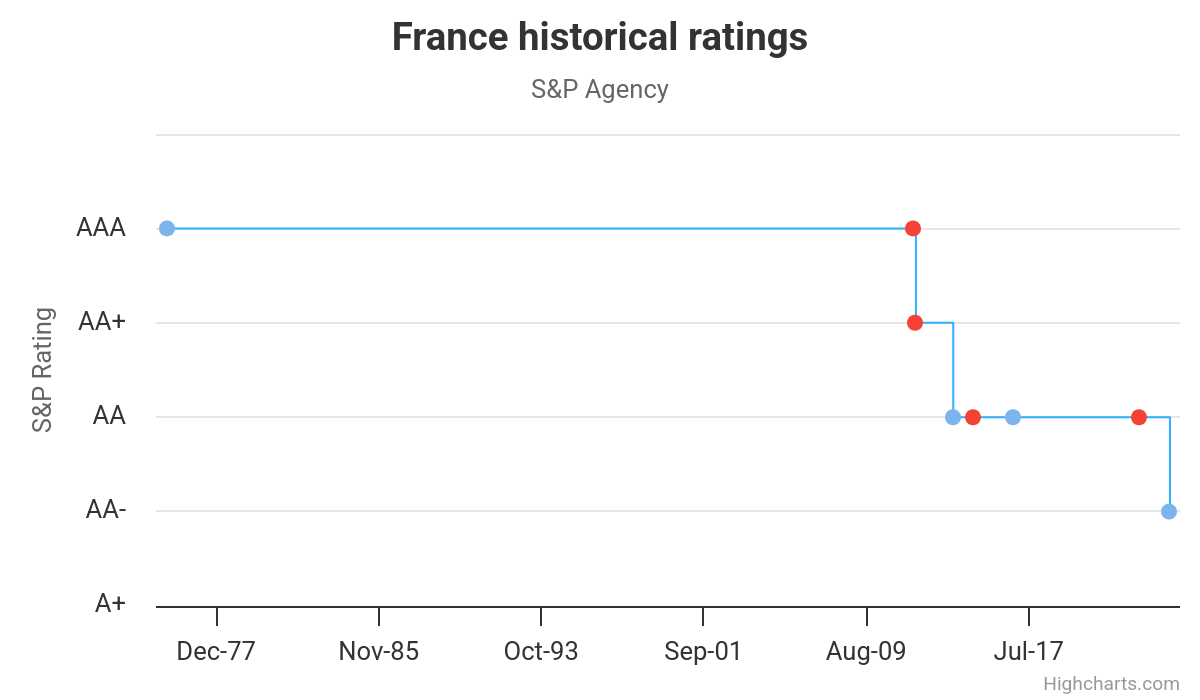

The credit score scores have been steady for years…till right now. Right here’s S&P’s:

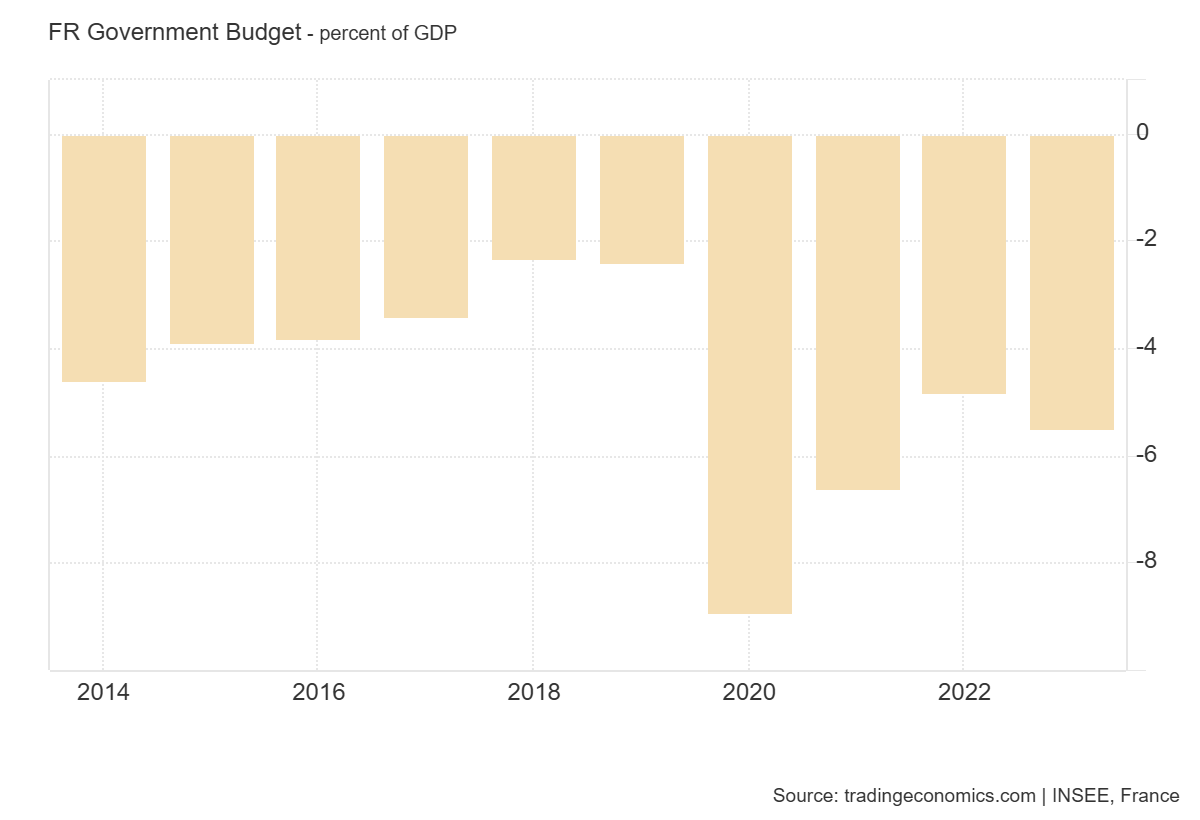

Right here’s the fiscal state of affairs, as summarized by the price range stability as share of GDP.

The six p.c of GDP deficit is smaller than in 2020, and is similar to that within the US. Nonetheless, the US points the world’s world forex, so is endowed with exorbitant privilege. Furthermore, the price range is the move, and doesn’t present the outlook for debt, given the pressures coming from pension spending over time. So whereas debt to GDP has fallen since 2020, it’s going to reverse course sooner or later (that is the place the significance of reviving pattern progress comes into play).