Immediately we’re happy to current a visitor contribution written by Christopher A. Hartwell (ZHAW College of Administration and Regulation, Switzerland), and Pierre Siklos (Professor Emeritus at Wilfrid Laurier College; and Balsillie College of Worldwide Affairs, Canada).

A paper by the 2 of us, forthcoming within the Worldwide Journal of Central Banking, makes the case that poorly performing central banks – particularly, ones that frequently miss their inflationary targets – not solely undermine their very own credibility, but in addition undermine a rustic’s institutional high quality. Due to this fact, when asking: What Harm Can a Poorly Performing Central Financial institution Do? The reply is: quite a bit, truly. Such a conclusion has far-reaching ramifications for institutional improvement, resulting in much less general financial resilience.

Ever because the coverage of central financial institution autonomy unfold across the globe, financial authorities have performed, some would say, an outsized function in figuring out the trail of a rustic’s financial system. Given this significance, we hypothesize that how a central financial institution performs can have a considerable affect on not solely the efficiency of the financial system however the power of its establishments. For instance, short-term declines in central financial institution credibility, a stream variable, suggest a parallel decline within the general belief positioned in central banks, with belief a slower-moving stock-like variable. If this belief begins to ebb away from the central financial institution, there may be the potential to degrade a rustic’s establishments extra broadly. Weaker establishments translate into much less institutional resilience in an financial system. We consider resilience as the power of a rustic to face up to shocks, probably of each the financial and political selection.

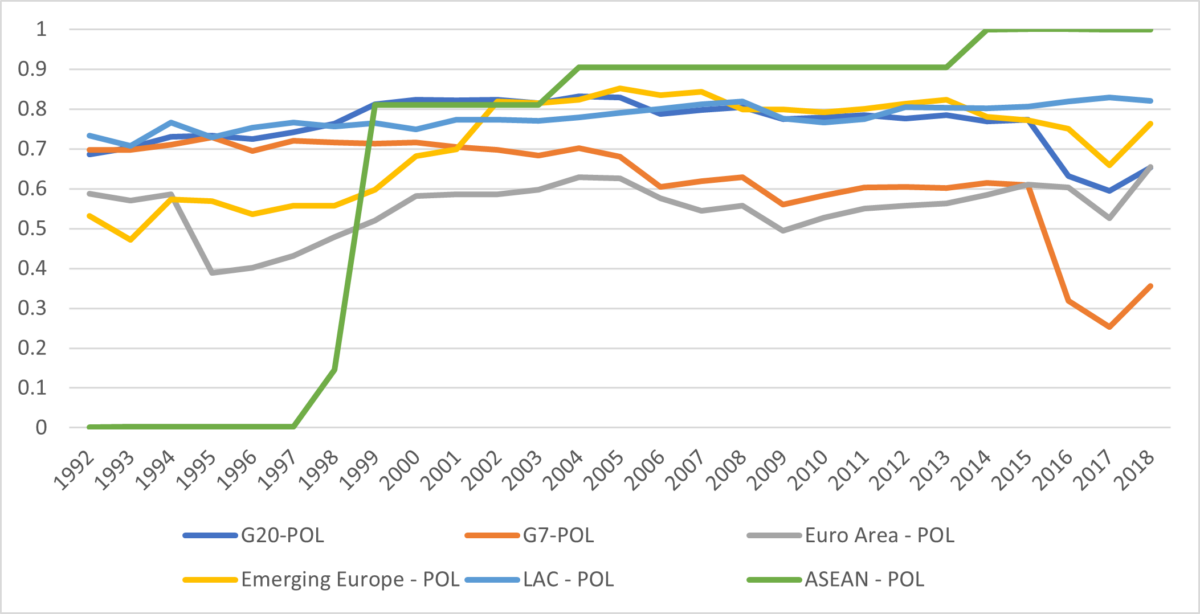

To quantify this relationship, we assemble an index of institutional resilience encompassing financial elements (e.g., extent of property rights, extent of openness to commerce and finance, and suppleness of change charges) and political ones (e.g., democracy, govt constraints, and the fiscal dimension of presidency). This index captures attributes that must be positively correlated with resilience, other than dimension of presidency, which must be negatively correlated (a big authorities has little room to maneuver within the face of shocks). The graphs beneath illustrate our findings for financial and political resilience (the index ranges from 0 to 1) for chosen nation teams, though we’ve generated these indices for every of the over 90 particular person international locations in our information set (representing over 80% of world GDP). Whereas our information return to the Sixties, it is just by the Nineteen Nineties that the widest array of variables thought-about are constantly accessible for international locations past the superior economies. As proven beneath, the Nineteen Nineties and 2000s have seen a world rise in central financial institution resilience though there may be appreciable variation over time and the gaps between the nation teams proven present fewer indicators of convergence by the top of the pattern that within the early Nineteen Nineties. Gaps in political resilience stay all through the pattern thought-about and there’s a marked drop for the G7 international locations starting in 2015 that predates the pandemic and up to date occasions. The G7 had been among the many most politically resilient within the early Nineteen Nineties.

Determine 1: Financial Resilience. Larger scores suggest larger resilience

Determine 2: Political Resilience. Larger scores suggest larger resilience

We array this index towards a measure of central financial institution effectiveness, which is linearly comprised of three separate parts. First, we evaluate a central financial institution’s inflation efficiency towards both said objectives – within the case of inflation focusing on – or towards an implicit purpose (a five-year shifting common of inflationary outcomes) – the place banks haven’t any pre-stated purpose. Second, we vogue a measure of financial coverage uncertainty, measuring divergence of inflation and output outcomes versus forecasts. Lastly, we measure how out of step a rustic’s inflation efficiency is with the world.

Utilizing generalized technique of moments (GMM), mannequin choice strategies, and an area projection estimation from a VAR, we discover that every % decline in a central financial institution’s credibility corresponds with a mean 3.6% drop in a rustic’s institutional resilience because the Nineteen Nineties. Plainly put, the extra {that a} central financial institution loses confidence by way of lacking inflation targets or veering from international traits, the extra hurt it does to general institutional resilience in a selected nation.

The ramifications from this analysis as soon as once more spotlight that central financial institution autonomy might result in higher inflation outcomes, however a central financial institution can nonetheless pursue poor insurance policies or be ineffective even when independence is managed for. A greater performing central financial institution, that’s, one which primarily focuses on worth stability, is best for an financial system; extra importantly, with central banks taking part in such an necessary institutional function in an financial system, a rustic’s general institutional high quality might also be depending on how nicely a central financial institution performs. Whereas our outcomes relaxation on imperfect indicators we’ve tried, throughout the constraints of information availability, to ascertain the sensitivity of our outcomes to modifications in definition, modifications in pattern durations, and sources of information. Our primary findings stay considerably strong throughout estimation strategies employed.

This put up written by Christopher Hartwell and Pierre Siklos.