As we speak, we current a visitor submit written by David Papell and Ruxandra Prodan-Boul, Professor of Economics on the College of Houston and Economics Lecturer at Stanford College.

The Federal Open Market Committee (FOMC) maintained the goal vary for the federal funds price (FFR) at 5.25 – 5.5 % in its January 2024 assembly. With falling inflation, the December 2023 Abstract of Financial Projections (SEP) projected a spread for the FFR between 4.5 and 4.75 % by the tip of 2024. On the press convention following the January 2024 assembly, Fed Chair Jerome Powell mentioned that the FOMC was not prone to lower charges in March. In distinction, futures markets summarized by the CME FedWatch Device on the day following the assembly predicted a spread for the FFR between 3.75 – 4.00 % by the tip of 2024.

There may be widespread settlement that the Fed fell “behind the curve” by not elevating charges when inflation rose in 2021, forcing it to play “catch-up” in 2022. “Behind the curve,” nevertheless, is meaningless with out a measure of “on the curve.” Within the newest model of our paper, “Coverage Guidelines and Ahead Steerage Following the Covid-19 Recession,” we use information from the SEP’s from September 2020 to December 2023 to check coverage rule prescriptions with precise and FOMC projections of the FFR. This offers a exact definition of “behind the curve” because the distinction between the FFR prescribed by the coverage rule and the precise or projected FFR. We analyze 4 coverage guidelines which are related for the longer term path of the FFR within the submit:

The Taylor (1993) rule with an unemployment hole is as follows,

the place Rt is the extent of the short-term federal funds rate of interest prescribed by the rule, πt is the inflation price, πLR is the two % goal stage of inflation, ULRt is the 4 % price of unemployment within the longer run, Ut is the present unemployment price, and rLRt is the ½ % impartial actual rate of interest from the present SEP.

Yellen (2012) analyzed the balanced method rule the place the coefficient on the inflation hole is 0.5 however the coefficient on the unemployment hole is raised to 2.0.

The balanced method rule acquired appreciable consideration following the Nice Recession and have become the usual coverage rule utilized by the Fed.

These guidelines are non-inertial as a result of the FFR totally adjusts every time the goal FFR modifications. This isn’t in accord with FOMC apply to easy price will increase when inflation rises. We specify inertial variations of the principles primarily based on Clarida, Gali, and Gertler (1999),

the place p is the diploma of inertia and is the goal stage of the federal funds price prescribed by Equations (1) and (2). We set p as in Bernanke, Kiley, and Roberts (2019). Rt-1 equals the speed prescribed by the rule whether it is optimistic and nil if the prescribed price is adverse.

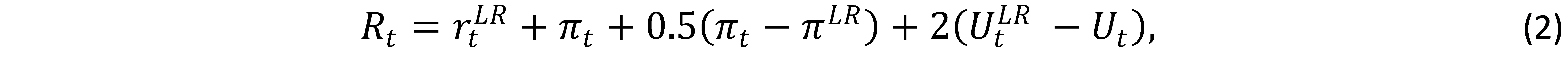

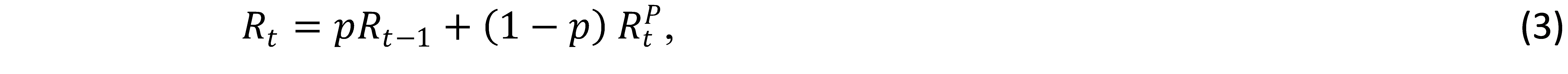

Determine 1 depicts the midpoint for the goal vary of the FFR for September 2020 to December 2023 and the projected FFR for March 2024 to December 2026 from the December 2023 SEP. Following the exit from the ELB to 0.375 in March 2022, the FFR rose to five.375 in September 2023 and is projected to fall to 4.625 in December 2024, 3.625 in December 2025, and a couple of.875 in December 2026. Based mostly on Jerome Powell’s reply to a query on the press convention following the January 2024 assembly that it’s unlikely that the FOMC will lower the FFR in March, we assume that there will likely be 25 foundation level price cuts in June, September, and December 2024. Determine 1 additionally depicts coverage rule prescriptions. Between September 2020 and September 2023, we use real-time inflation and unemployment information that was obtainable on the time of the FOMC conferences. Between December 2023 and December 2026, we use inflation and unemployment projections from the September 2023 SEP. The variations within the prescribed FFR’s between the inertial and non-inertial guidelines are a lot bigger than these between the Taylor and balanced method guidelines.

Determine 1. The Federal Funds Fee and Coverage Rule Prescriptions. Panel A. Non-Inertial Guidelines

Coverage rule prescriptions are reported in Panel A for the non-inertial Taylor and balanced method guidelines. They don’t seem to be in accord with the FOMC’s apply of smoothing price will increase when inflation rises. The prescriptions for the 2 guidelines are an identical on the ELB by way of March 2021. The FOMC fell behind the curve beginning in June 2021 when the prescribed FFR elevated from the ELB of 0.125 to 2.625 for the Taylor rule and to 0.375 for the balanced method rule whereas the precise FFR stayed on the ELB. The coverage rule prescriptions sharply elevated by way of 2021 and peaked in March 2022 at 7.875 for the Taylor rule and eight.125 for the balanced method rule when the FFR first rose above the ELB to 0.375. The hole additionally peaked in March 2022 at 750 foundation factors for the Taylor rule and 775 foundation factors for the balanced method rule. The hole narrowed significantly between March 2022 and September 2023 because the FFR rose from 0.375 to five.375 whereas the Taylor rule prescriptions fell to six.125 and the balanced method rule prescriptions fell to six.625. Trying ahead, the hole between the FFR projections and the coverage rule prescriptions reverses in December 2023 and the FFR projections are above the coverage rule prescriptions by way of December 2026.

Determine 1. The Federal Funds Fee and Coverage Rule Prescriptions. Panel B. Inertial Guidelines

Panel B studies the outcomes for the inertial Taylor and balanced method guidelines. They’re much extra in accord with the FOMC’s apply of elevating the FFR slowly when inflation rises. The prescriptions for the 2 guidelines are an identical on the ELB by way of March 2021. The FOMC fell behind the curve beginning in September 2021 when the prescribed FFR elevated to 0.875 for the Taylor rule and 0.625 for the balanced method rule whereas the precise FFR stayed on the ELB. The hole between the coverage rule prescriptions and the FFR peaked in March 2022 at 200 foundation factors when the prescribed FFR was 2.325 for each guidelines whereas the FFR first rose above the ELB to 0.375.

The inertial guidelines prescribe a a lot smoother path of price will increase from September 2021 by way of September 2023 than that adopted by the FOMC. If the Fed had adopted the inertial Taylor or balanced method rule as an alternative of the FOMC’s ahead steering, it might have prevented the sample of falling behind the curve, pivot, and getting again on observe that characterised Fed coverage throughout 2021 and 2022. Trying ahead, the FFR projections from the December 2023 SEP are very near the coverage rule prescriptions by way of December 2026. The present and projected FFR is in accord with prescriptions from inertial coverage guidelines.

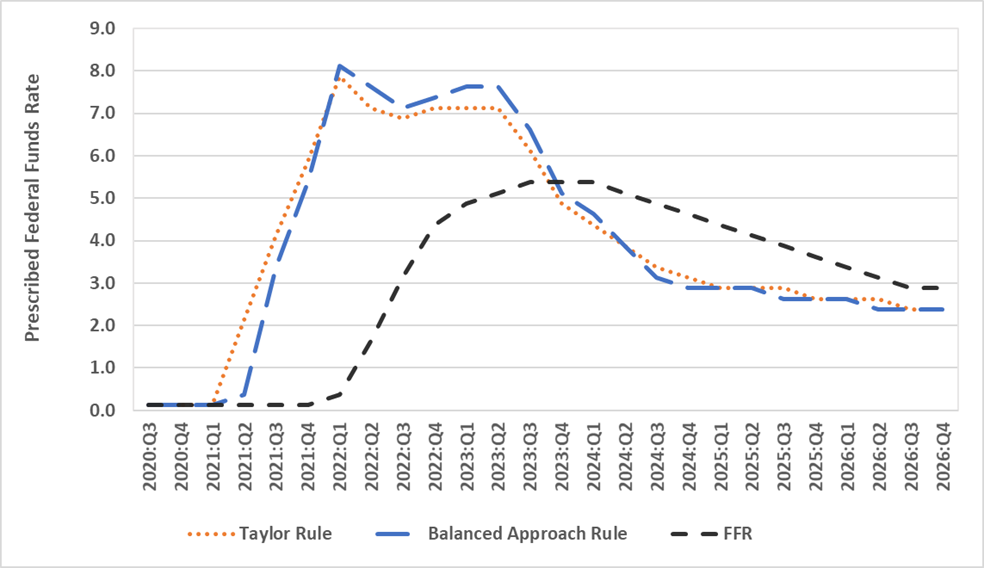

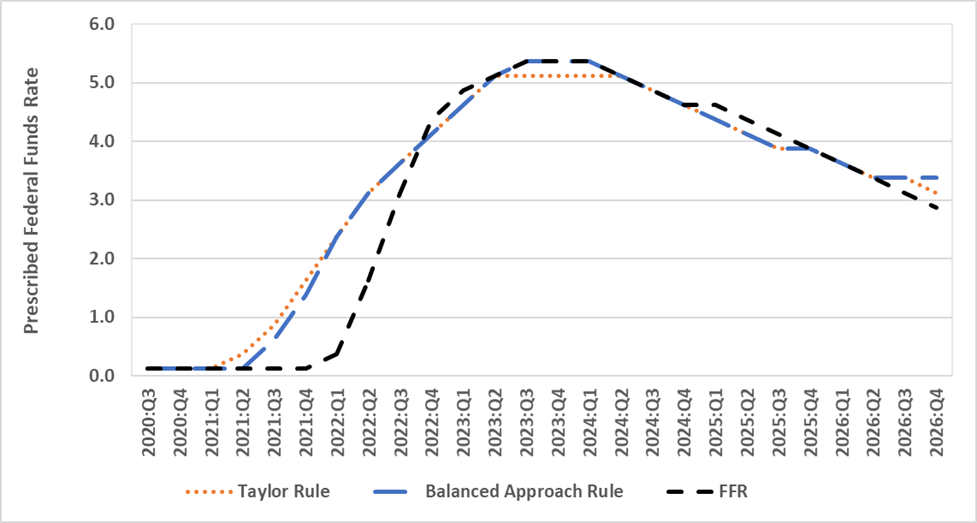

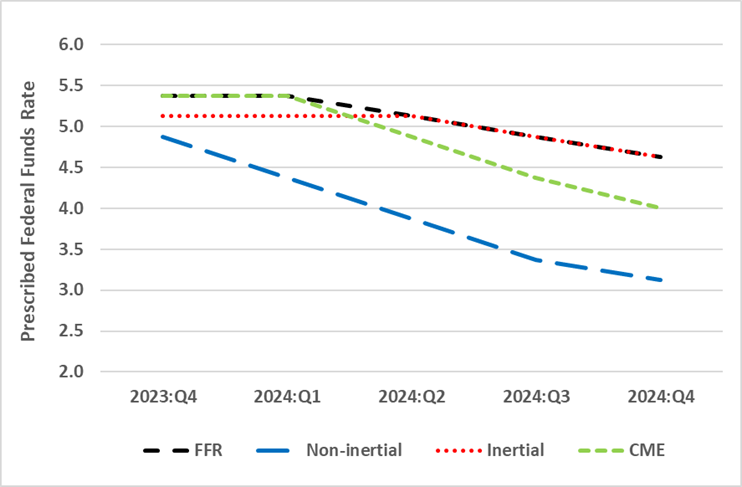

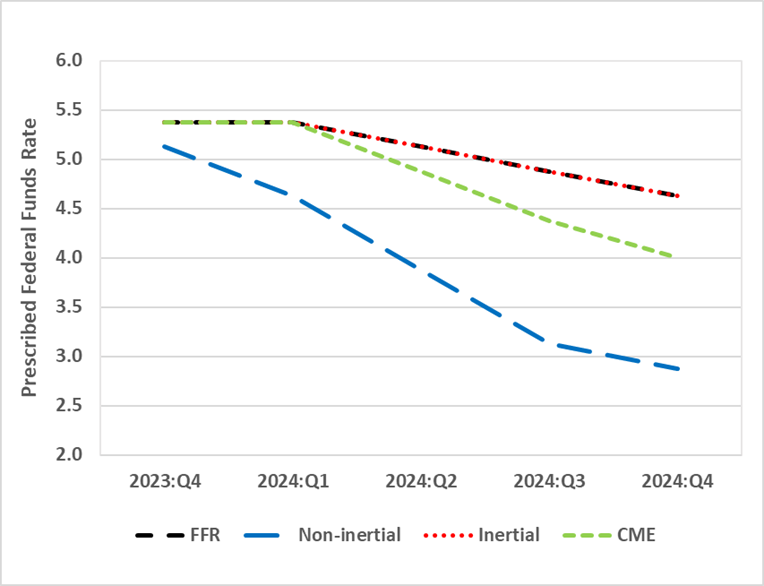

It has been broadly reported that market individuals have been predicting a steeper downward path for the FFR than the SEP. Determine 2 depicts the median predictions from futures markets described within the CME FedWatch Device on February 1, 2024, the day following the January 2024 FOMC Assembly, by way of the tip of the prediction horizon in December 2024. The FFR is predicted to fall from 5.375 in March 2024 to 4.875 in June 2024, 4.375 in September 2024, and three.875 in December 2024. The futures market predictions are equal to the FFR projections from the December 2023 SEP for March 2024 and fall under the projected FFR from June 2024 by way of December 2024.

Determine 2: The Federal Funds Fee, CME FedWatch Device, and Coverage Rule Prescriptions. Panel A. Taylor Guidelines

Determine 2: The Federal Funds Fee, CME FedWatch Device, and Coverage Rule Prescriptions. Panel B. Balanced Method Guidelines

We add to this dialogue by together with prescriptions from coverage guidelines. For each the Taylor and balanced method guidelines, the futures market predictions equal the FFR and are under the prescriptions from the inertial coverage guidelines for June 2024 by way of December 2024. In distinction, the futures market predictions are above the prescriptions from each non-inertial coverage guidelines from December 2023 by way of December 2024. Comparability between futures market predictions and coverage rule prescriptions is determined by the selection between inertial and non-inertial guidelines however not on the selection between Taylor and balanced method guidelines.

<

This submit written by David Papell and Ruxandra Prodan-Boul.