Initially of April. Wisconsinites’ views on the state’s economic system have been pretty downbeat, regardless of some optimistic indicators [0]. On potential clarification is the notion of the economic system’s state differs from respondent’s personal circumstances. One other risk is that we now have mismeasured the economic system’s circumstances.

Determine 1: GDP (Ch.2017$) (daring darkish blue), GDP (Ch.2012$) (mild blue), wages and salaries deflated by PCE worth index (tan), non-public sector hours (inexperienced), coincident index (crimson), all in logs 2021Q4=0. Hours calculated by multiplying non-public non-public employment by common weekly hours seasonally adjusted by creator utilizing X-13. Supply: BEA, Census, BLS, Philadelphia Fed, and creator’s calculations.

As an illustration, as of August of final 12 months, actual GDP development seemed respectable via 2023Q1. Nevertheless, with the excellent revision of NIPA knowledge incorporating extra and up to date knowledge, GDP development seemed fairly lackluster via 2023Q2. Development solely surged in 20243Q3-This fall. Why the big hole? Notes on the excellent revision usually are not illuminating on the precise supply of the distinction. What’s true is that, as an example, the California sequence don’t exhibit such a big change in contours, so I believe it’s one thing that has to do with how extra data impacts Wisconsin. Whole wages and salaries have been revised downward by about half a proportion level. One other points is that the nation-wide costs are utilized to Wisconsin sectoral values. Therefore, if Wisconsin costs are systematically increased than nationwide, then actual GDP will seem like decrease than the true values.

Actual wages and salaries solely picked up strongly in in Q2 (right here utilizing PCE deflator; utilizing chained CPI, the cumulative enhance by This fall is just 2%). Lastly, the Philadelphia Fed’s coincident index solely began rising once more, after plateauing via 2023, within the first quarter of this 12 months.

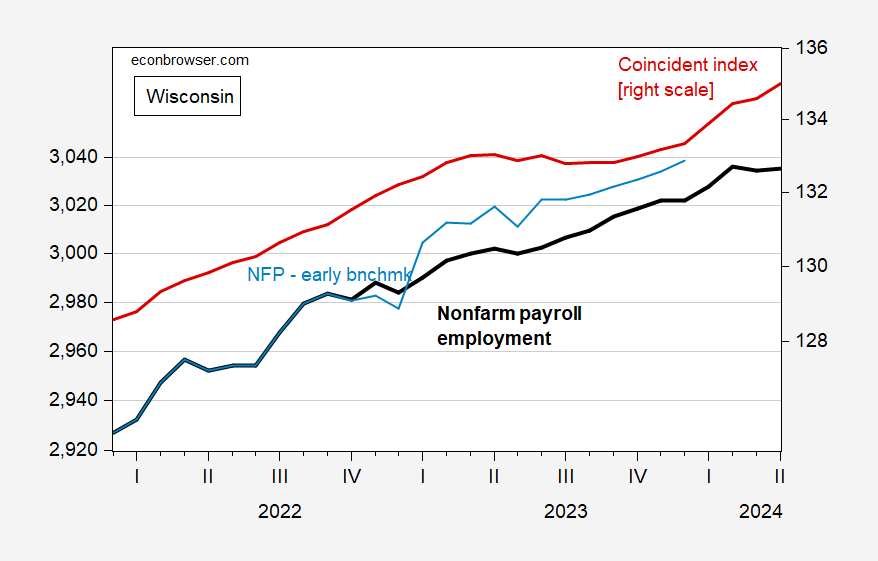

Whereas (preliminary) employment has leveled off in April, the coincident index — based mostly on a number of labor market indicators — has surged.

Determine 2: Nonfarm payroll employment (daring black, left scale), Philadelphia Fed early benchmark (mild blue, left scale), and coincident index (crimson, proper scale). Supply: BLS, Philadelphia Fed [1], [2].