The CBO launched an up to date Financial Outlook yesterday. Projected PCE inflation is increased, as are price range deficits. First drop in Fed funds charge in 2025Q1. For me, most attention-grabbing are the GDP projections, together with with respect to potential GDP.

Right here’s the GDP projection as of June, and as of February.

Determine 1: GDP as reported (daring black), February CBO (purple), June CBO (blue), FT-Sales space median (scarlet triangle), GDPNow as of 18 Jun (gentle blue sq.), all in bn.Ch.2017$ SAAR. Supply: BEA (2024Q1 2nd launch, CBO February Price range and Financial Outlook, CBO June Financial Outlook replace, June Sales space macroeconomist survey, Atlanta Fed.

The CBO projections are primarily based on information out there as of Could 2nd. The most recent CBO projection is considerably above the February projection (see dialogue right here), largely because of the intervening upside GDP surprises. It’s presently consistent with the FT-Sales space June median forecast, and the marginally under (for Q2) the Atlanta Fed nowcast. (It’s barely above the Could median Survey of Skilled Forecasters estimate).

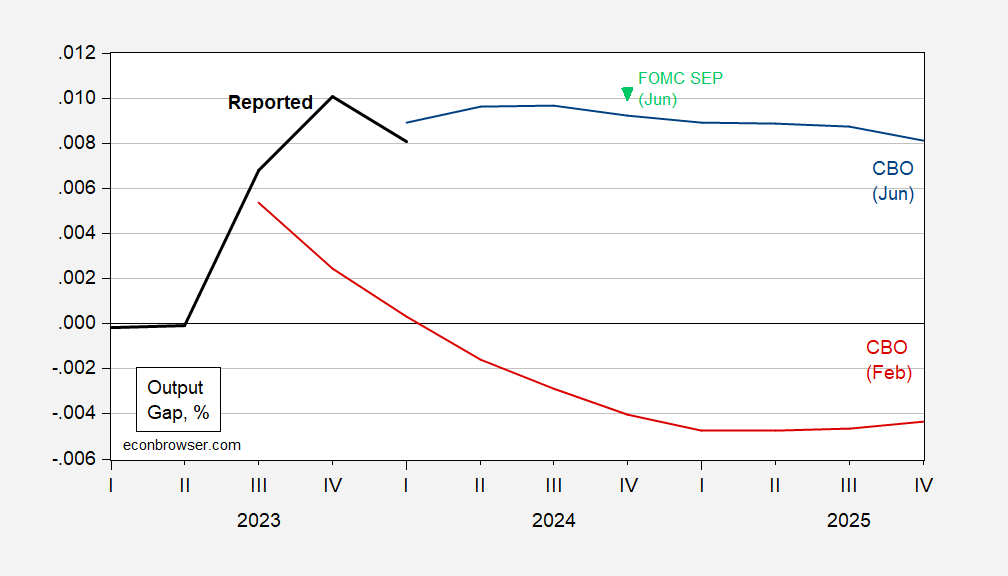

Whereas the revised q/q progress charge projections are increased within the quick time period, relative to February forecast (primarily based on information out there as of January 6), then decelerate to slower charges by finish 2025, implying reversion to potential. That being stated, the present implicit CBO projection of the output hole is dramatically completely different than reported within the February Financial Outlook. [Update: As suggested by Paweł Skrzypczyński, the implied output gap is even larger using SEP and CBO potential. However, we don’t know what the FOMC’s view on potential GDP is, although the Green Book must have an estimate.]

Determine 2 [updated 1pm CT]: Log output hole, in % (daring black), February CBO projection (purple), Jun CBO projection (blue), FOMC June Abstract of Financial Projections (inverted gentle inexperienced triangle). Reported relies on reported GDP and Jun CBO estimated potential GDP. Supply: BEA (2024Q1 2nd launch, CBO February Price range and Financial Outlook, CBO June Financial Outlook replace, Federal Reserve, and creator’s calculations.

This implies the CBO is projecting a optimistic output hole for the subsequent yr and half, below present regulation. For perspective, the pre-pandemic peak output hole was 0.9 ppts, whereas the best in current historical past is 2.4% in 2000Q2.

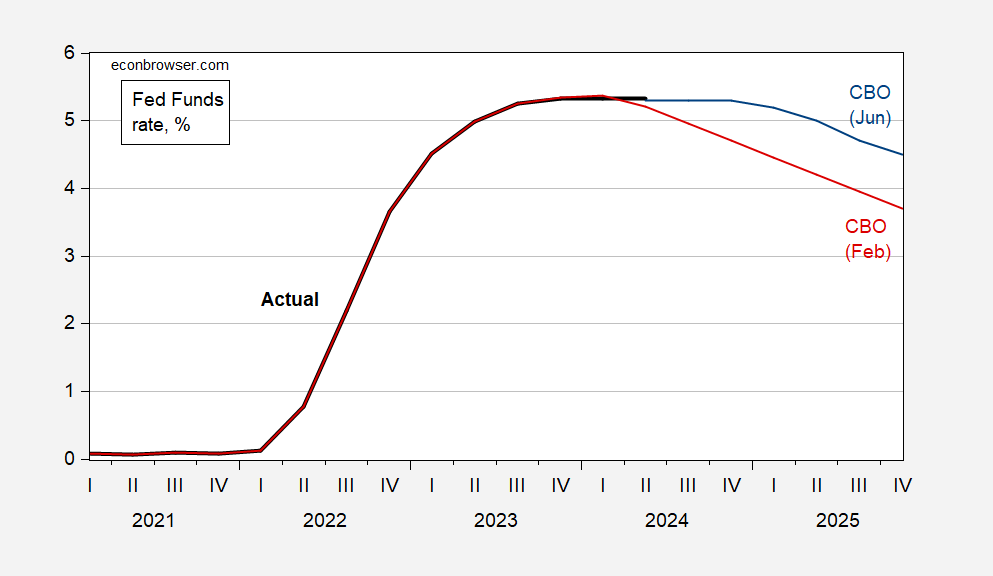

It’s attention-grabbing to notice that the CBO projection relies on an assumption the Fed first begins decreasing the Fed Funds charge in 2025Q1; this contrasts with projected charge discount by about 60 bps (on common) by finish of 2024 within the February projection.

Determine 3: Fed funds charge (daring black), February CBO projection (purple), June CBO projection (blue), all in %, interval common. Supply: Federal Reserve, CBO February Price range and Financial Outlook, CBO June Financial Outlook replace.