Typical and Instantaneous

The unweighted common of unemployment price and inflation price is advert hoc. Right here’s the traditional utilizing y/y CPI:

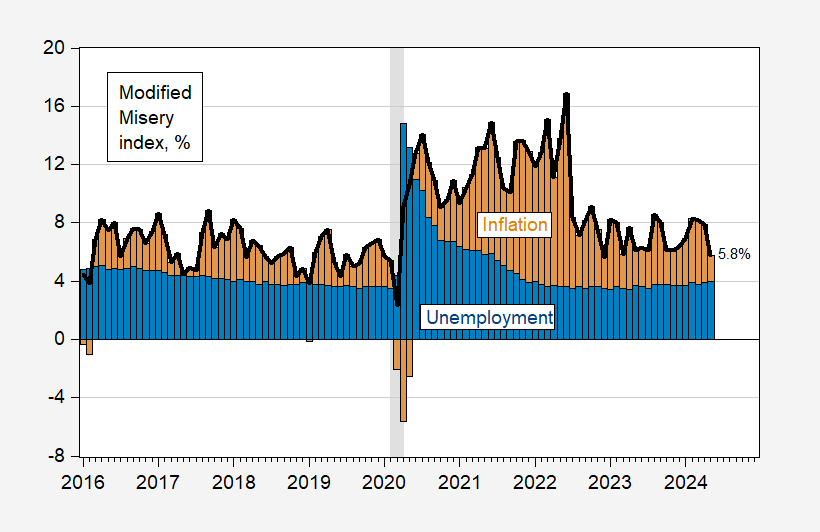

Determine 1: Unemployment price (blue bar) and y/y CPI inflation (tan bar), in %. NBER outlined peak-to-trough recession dates shaded grey. Supply: BLS, NBER, and writer’s calculations.

Using y/y inflation is unfair. Right here’s a measure utilizing instantaneous (per Eeckhout, 2023) inflation (T=12, a=4). (Equal weights on inflation and unemployment can also be arbitrary; see right here).

Determine 2: Unemployment price (blue bar) and instantaneous (T=12,a=4) CPI inflation (tan bar), in %. NBER outlined peak-to-trough recession dates shaded grey. Supply: BLS, NBER, and writer’s calculations.

Observe that the modified Distress Index in Could is just 5.8% vs. 7.3% typical. 5.8% compares favorably in opposition to the January 2021 worth of 9.4%. (the comparability is in opposition to 7.8% utilizing the traditional measure displayed in Determine 1).

Which one higher measures individuals’s perceptions? Utilizing the Michigan sentiment measure, one finds that the traditional measure is barely higher than the modified at predicting (Adj. R2 is 0.38 vs. 0.26), however reveals higher serial correlation.

Furthermore, the modified Distress measure peaks in 2022M06 whereas the traditional peaks at 2020M04. The Michigan sentiment sequence troughs at 2022M06, whereas the Gallup confidence index troughs at July 1st, 2022, roughly the identical time (Convention Board confidence troughs at 2020M08).