This Thursday 4:30 CT at UW:

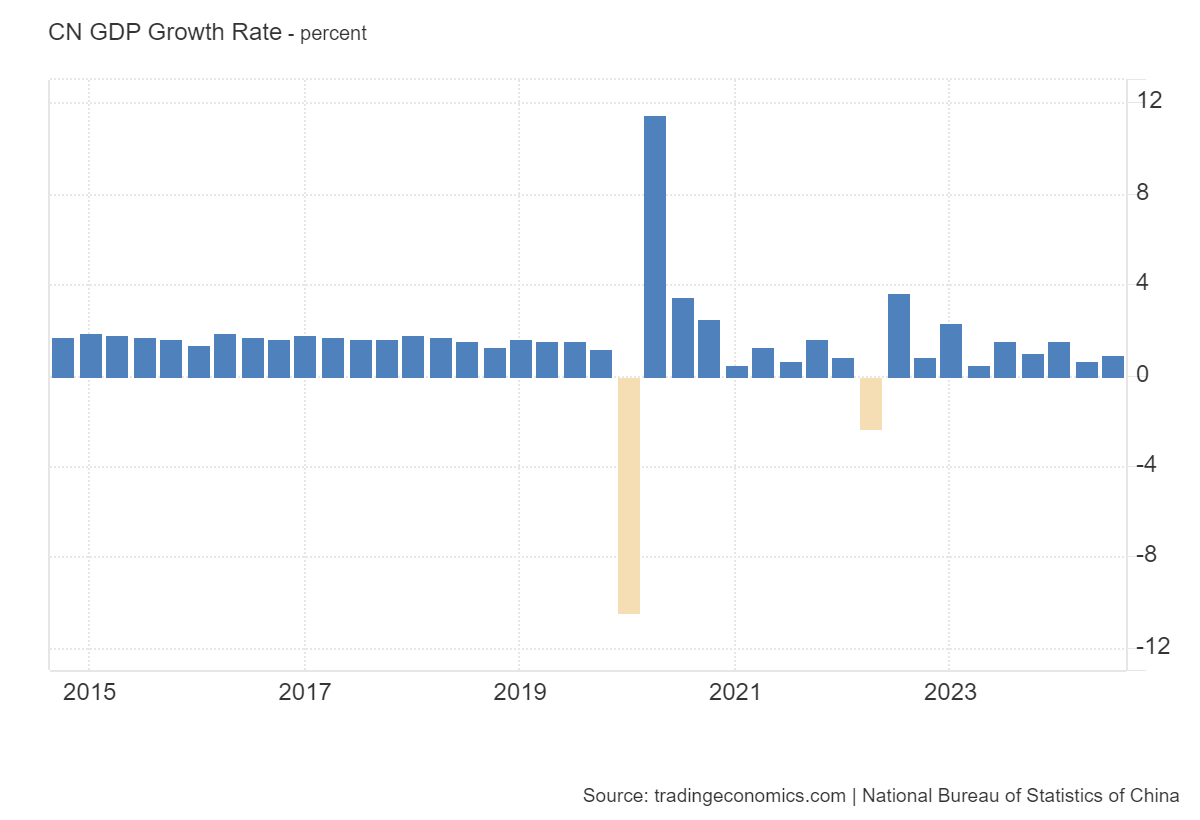

China GDP progress by means of Q3:

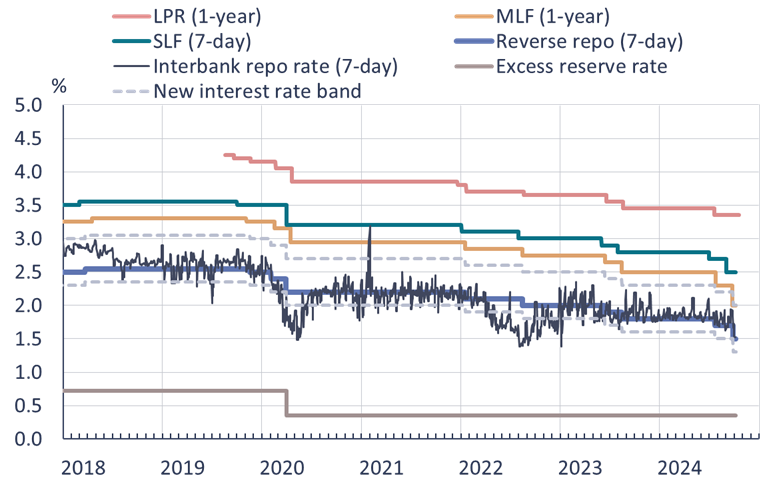

BOFIT evaluations the latest stimulus measures:

My impression is that the failure of the CCP to roll out higher fiscal stimulus signifies that one shouldn’t anticipate a giant cyclical rebound (and positively not one of the measures introduced and even contemplated the components affecting the secular development, together with more and more statist insurance policies in pursuit of different objectives). To wit, from Natixis at present:

• Two main developments have adopted the Third Plenum in July. First, a sequence of financial information releases indicated that the plenum had finished nothing to enhance the nation’s short-term outlook. Second, a sequence of stimulus measures have been introduced over a two-week interval, which have thus far didn’t reinvigorate the financial system.

• The federal government is unlikely to enact the reforms essential to help consumption because of excessive public debt and restricted fiscal capability, as doing so would require slicing subsidies central to the nation’s industrial coverage. This could contradict Xi Jinping’s deal with innovation.

• The Individuals’s Financial institution of China could have to proceed interventions in each the sovereign bond market and the inventory market, although this might cut back international investor curiosity in Chinese language monetary markets.

• The federal government’s stimulus measures thus far have largely been aimed toward stabilizing asset costs moderately than addressing the deeper problems with demand and overcapacity.

I don’t suppose Lardy essentially agrees with this viewpoint (nor the lagging consumption story typically), which is why it’s a good suggestion to hear!