Or, Why We Don’t Use GDP Alone to Decide Enterprise Cycle Dates. First, contemplate our varied measures of output.

Determine 1: GDP (blue), GDO (tan), and GDP+ (inexperienced), ultimate gross sales (crimson), all in bn.Ch.2017$ SAAR. GDP+ assumes 2019Q4 GDP+ equals GDP. Hypothesized 2022H1 recession shaded gentle blue. Supply: BEA 2023Q4 advance estimate, Philadelphia Fed, and writer’s calculations.

Whereas GDP and GDO decline in 2022H1, GDP+ which is aimed to hitting the eventual degree of GDP grows persistently over the 2022H1. Remaining gross sales (GDP ex-inventory accumulation) solely reveals one quarter of decline. I would notice that GDO in 2022Q2 is barely 0.26 share factors beneath 2021Q4 ranges…

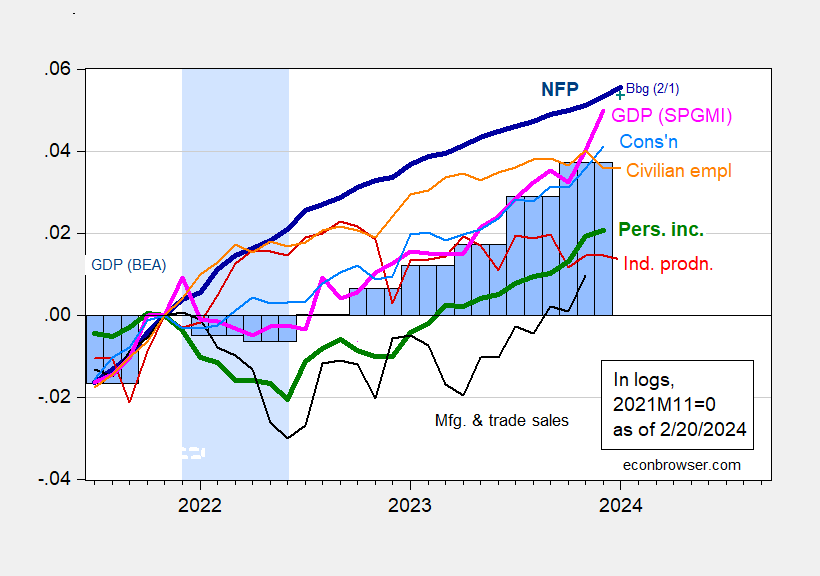

Second, contemplate different — extra well timed — measures of financial exercise. NBER’s Enterprise Cycle Courting Committee depends upon a sequence of variables, chief amongst them in current occasions nonfarm payroll employment and private earnings excluding present transfers. These are proven in Determine 2 beneath, with month-to-month GDP and official quarterly GDP added in.

Determine 2: Nonfarm Payroll employment (daring darkish blue), Bloomberg consensus of two/1 (blue +), civilian employment (orange), industrial manufacturing (crimson), private earnings excluding present transfers in Ch.2017$ (daring inexperienced), manufacturing and commerce gross sales in Ch.2017$ (black), consumption in Ch.2017$ (gentle blue), and month-to-month GDP in Ch.2017$ (pink), GDP, 2023Q4 advance launch (blue bars), all log normalized to 2021M11=0. Hypothesized 2022H1 recession shaded gentle blue. Supply: BEA, BLS through FRED, Federal Reserve, 2023Q4 advance launch,, S&P International Market Insights (nee Macroeconomic Advisers, IHS Markit) (2/1/2024 launch), and writer’s calculations.

It’s laborious to make out a constant story with totally different variables going totally different instructions. One solution to circumvent this drawback is to summarize the knowledge in these sequence in a single sequence. A principal element evaluation is one strategy, as recommended by Atkinson et al. on the Dallas Fed (2022). Determine 3 reveals the primary principal element of the above sequence (ex-monthly GDP, and official GDP).

Determine 3: First principal element of nonfarm payroll employment, industrial manufacturing, private earnings ex-current transfers, manufacturing and commerce business gross sales, consumption, civilian employment in logs, 2007M01-2023M11. Hypothesized 2022H1 recession shaded gentle blue. Supply: writer’s calculations.

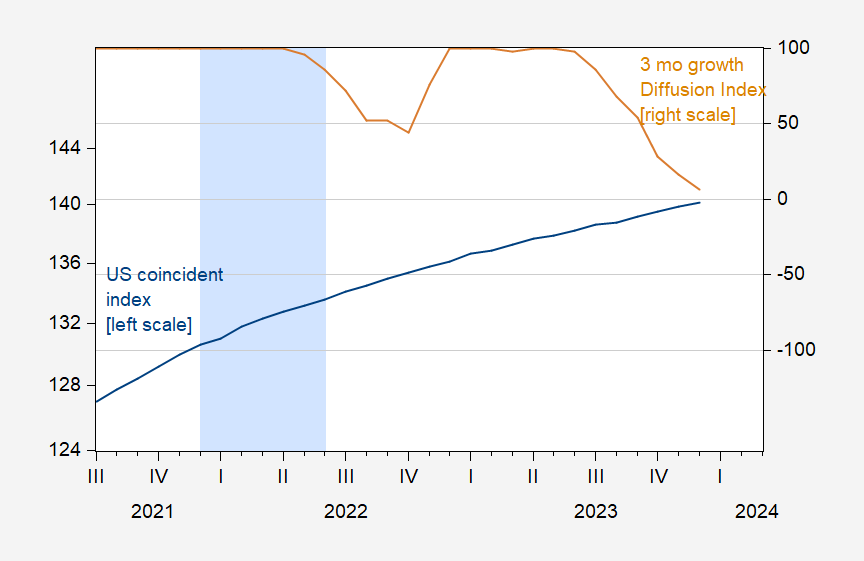

Philadelphia Fed calculates a coincident index for states and the USA general, which is predicated totally on labor market knowledge. This sequence is proven in Determine 4 beneath because the persistently rising sequence in blue. Relatedly, one risk is to look at a geographically-defined diffusion index, based mostly on the Philadelphia Fed’s coincident indexes, as recommended by Picerno (2024).

Determine 4: Coincident index for US (blue, left scale), and three month progress diffusion index (tan, proper scale). +100 diffusion index means all states rising; -100 means all states contracting. Hypothesized 2022H1 recession shaded gentle blue. Supply: Philadelphia Fed.

Word that the coincident index reveals no declines over the conjectured recession interval in 2022H1. In reality, a diffusion index based mostly on variety of states experiencing growth/contraction reveals somewhat dip in 2022H2, right down to 86. For comparability sake, the diffusion index was 16 in 2001M04 when the recession is dated to have begun (NBER peak at 2001M03).

Lastly, one can look to the labor market circumstances as summarized by the unemployment fee. The Sahm rule (actual time) indicator — the three month transferring common relative to the minimal unemployment fee within the earlier 12 months — is displayed in Determine 5. The brink for a recession onset is +0.5 ppts. The indicator was beneath zero for the 2022H1.

Determine 5: Sahm rule, in % (blue), and recession threshold (crimson dashed line). Supply: FRED.

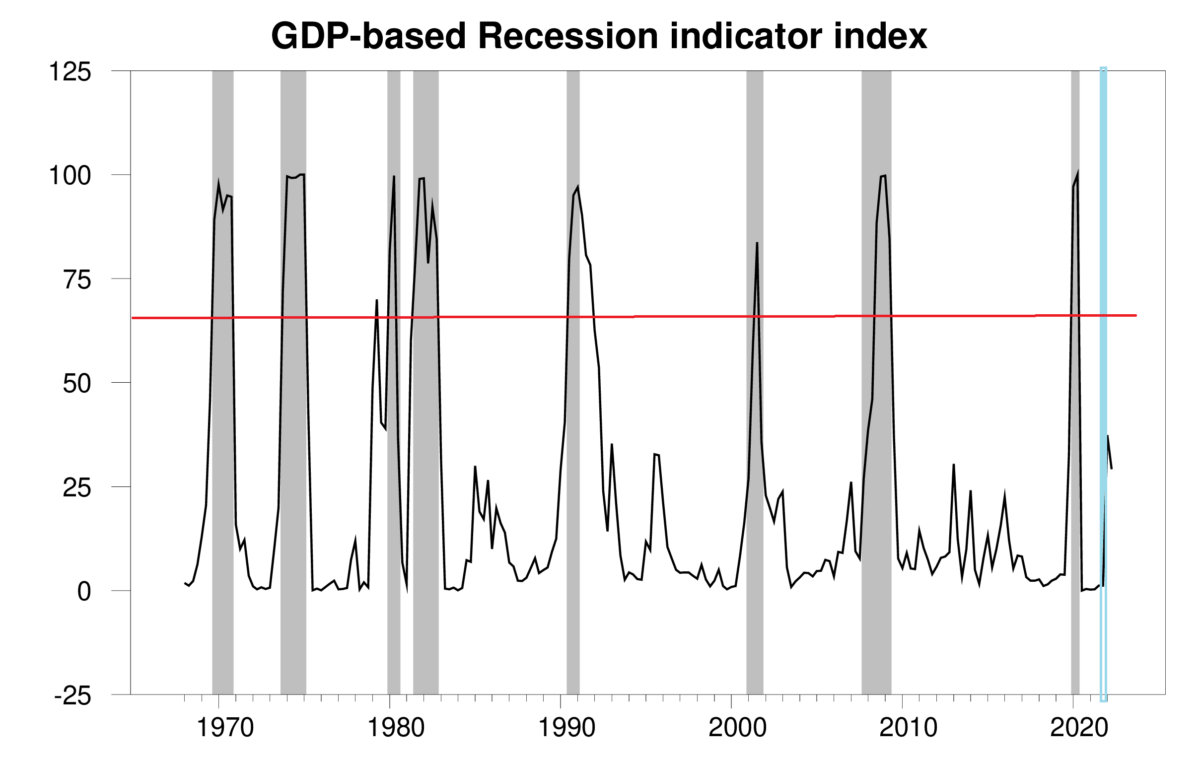

Now, suppose one needed to make use of GDP — particularly GDP progress — as a way of figuring out whether or not one was in a recession. Jim Hamilton has precisely that methodology (you possibly can entry the possibilities on FRED right here). Under, I put up his estimated chances via 2022Q1, utilizing the advance launch of GDP for 2022Q2 in July 2022, with the graph annotated to incorporate a posited recession in 2022H1, and the 65% threshold.

Supply: Hamilton (2022a). Notes: Hamilton recession chances (black) and NBER outlined recession dates shaded grey. Hypothesized 2022H1 recession shaded gentle blue. 65% threshold crimson line.

When the 2022Q3 advance launch got here out, Jim posted this graph (which I’ve annotated to incorporate the posited 2022H1 recession).

Supply: Hamilton (2022b). Notes: Hamilton recession chances (black) and NBER outlined recession dates shaded grey. Hypothesized 2022H1 recession shaded gentle blue. 65% threshold crimson line.

Extra description of NBER definition of recession in these slides.