Charles Payne joins the recession camp.

Present indicators will not be very supportive of an imminent recession:

Determine 1: Nonfarm Payroll (NFP) employment from CES (blue), implied NFP from preliminary benchmark (daring blue), civilian employment (orange), civilian employment including variety of staff indicating unemployed as a result of climate (orange sq.), industrial manufacturing (crimson), private earnings excluding present transfers in Ch.2017$ (daring mild inexperienced), manufacturing and commerce gross sales in Ch.2017$ (black), consumption in Ch.2017$ (mild blue), and month-to-month GDP in Ch.2017$ (pink), GDP (blue bars), all log normalized to 2021M11=0. Supply: BLS through FRED, Federal Reserve, BEA 2024Q3 1st launch, S&P World Market Insights (nee Macroeconomic Advisers, IHS Markit) (11/1/2024 launch), and writer’s calculations.

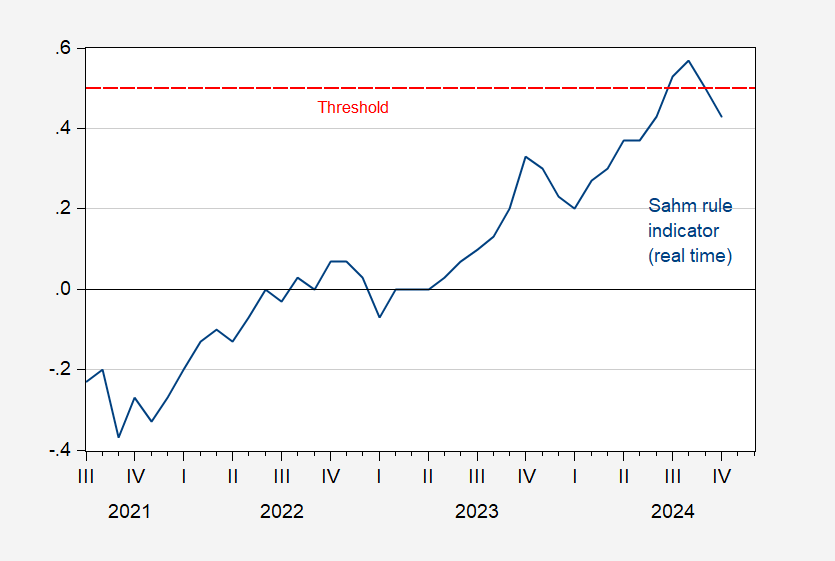

Different indicators present an identical story. And the Sahm rule (actual time) is now under the set off charge:

Determine 2: Sahm rule (actual time) indicator, % (blue). Set off at 0.5 ppts. Supply: FRED.

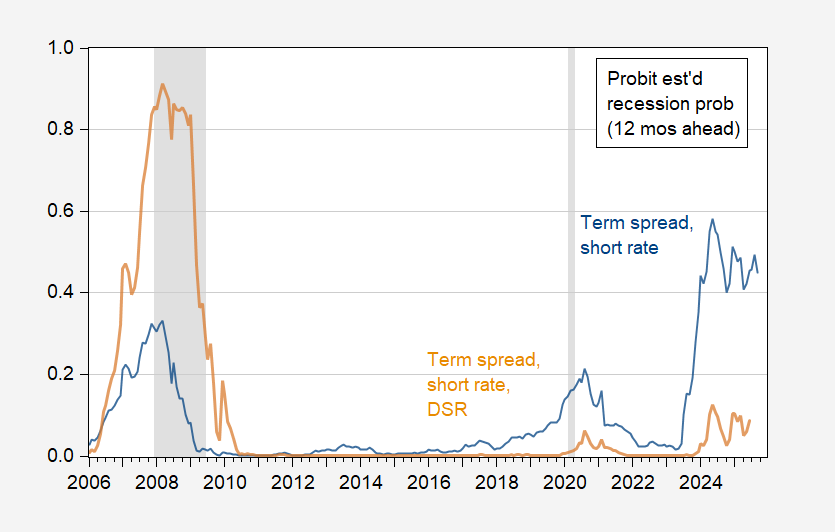

Neither is (my most popular – variation on Chinn-Ferrara (2024)) forecasting equation displaying a recession quickly, though a easy time period unfold mannequin nonetheless alerts warning (see dialogue right here).

Determine 3: Estimated 12 month forward chances of recession, from probit regression on time period unfold and brief charge, 1986-2024 (blue), on time period unfold, brief charge and debt-service ratio (tan). NBER outlined peak-to-trough recession dates shaded grey. Supply: Treasury through FRED, BIS, NBER, and writer’s calculations.