Since most of my lecture notes have migrated behind a gate (software program referred to as Canvas, used on many campuses), I assumed I’d share some instructing materials that some Econbrowser readers would possibly discover of curiosity.

First, recession vs. output hole (Econ 442 Lecture 9):

Determine 1: Quarter on Quarter progress price of actual GDP (blue), 12 months on 12 months (tan), each calculated as log variations. NBER outlined peak-to-trough recession dates shaded grey. Supply: BEA, NBER, and writer’s calculations.

Observe there isn’t any NBER-defined recession in 2022H1, regardless of two consecutive quarters of destructive GDP progress. In distinction, there’s a NBER outlined recession in 2001, regardless of the absence of two consecutive quarters of destructive progress within the newest classic of GDP (when was it that there have been? See right here.). Hamilton’s Markov Switching mannequin of recessions didn’t point out a recession then, nor did the real-time Sahm rule.

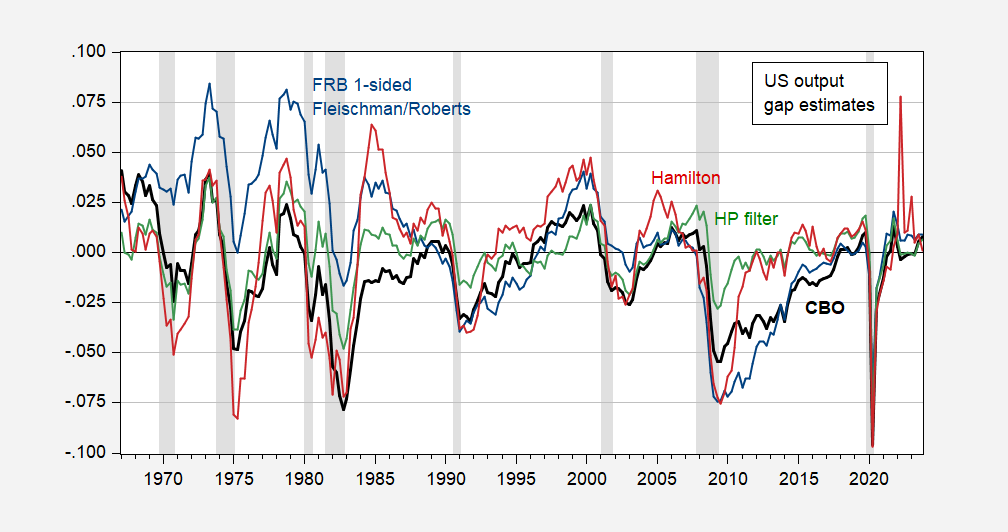

I distinguish between an output hole and recession by referring to this graph:

Determine 2: Output hole, from CBO (daring black), from Fleischman/Roberts-FRB (blue), from HP filter estimated over 1947-2023 (inexperienced), and from Hamilton filter estimated over 1967-2023 (pink). NBER outlined peak-to-trough recession dates shaded grey. Supply: BEA, CBO February 2024, Atlanta Fed Taylor rule utility February 2024, NBER, and writer’s calculations.

Observe that for the Euro space, CEPR’s BCDC famous two consecutive quarters of destructive progress in 2023 GDP, however has additionally not declared a recession, given will increase in employment and hours labored.

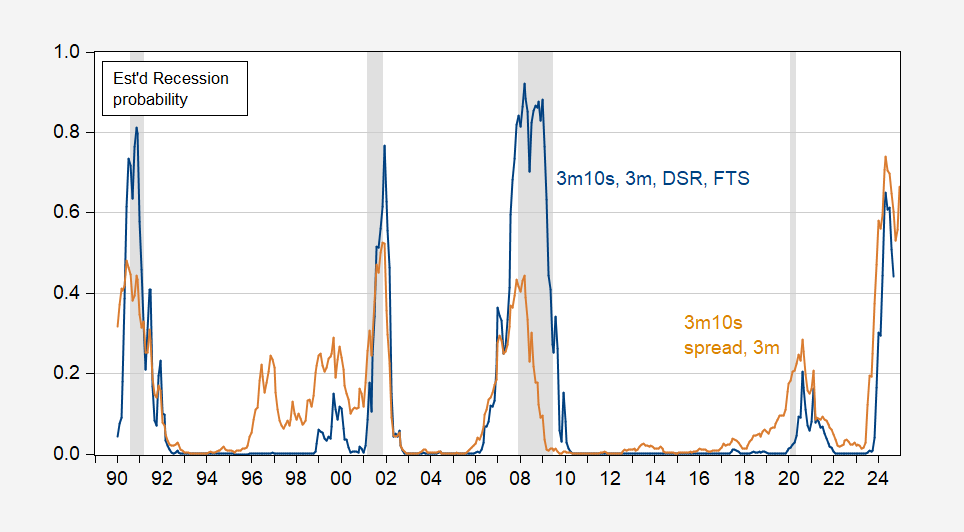

What about recession prediction? That’s mentioned on this handout (Recession Early Warning Methods). Given the continued yield curve inversions, it’s not stunning that estimated recession possibilities are excessive. Alternatively, my analysis with Ferrara, Ahmed, Kucko and Chatelais and Stalla-Bourdillon suggests different predictors. These present different estimates of recession possibilities. Beneath I study the affect of the overseas time period unfold in addition to the debt service ratio.

Determine 3: Likelihood of recession from time period unfold and brief price (tan), and time period unfold and brief price, debt-service ratio, overseas time period unfold (blue). NBER outlined peak-to-trough recession dates shaded grey. Supply: NBER, and writer’s calculations.

As I be aware within the handout:

…the estimated recession possibilities for February 2024 are 56% for the unfold plus brief price, and 29.5% for the total specification. This implies simply because there are not any apparent indications of the recession’s onset as of January doesn’t imply that we have now essentially dodged a recession. Could 2024 are maximal possibilities.

So, keep on guard for proof of a downturn.

As an apart, that is an instance of how analysis informs instructing.