That’s a time period that’s invoked in a CNN article at present. I consider stagflation as weak progress mixed with excessive inflation. A little bit context:

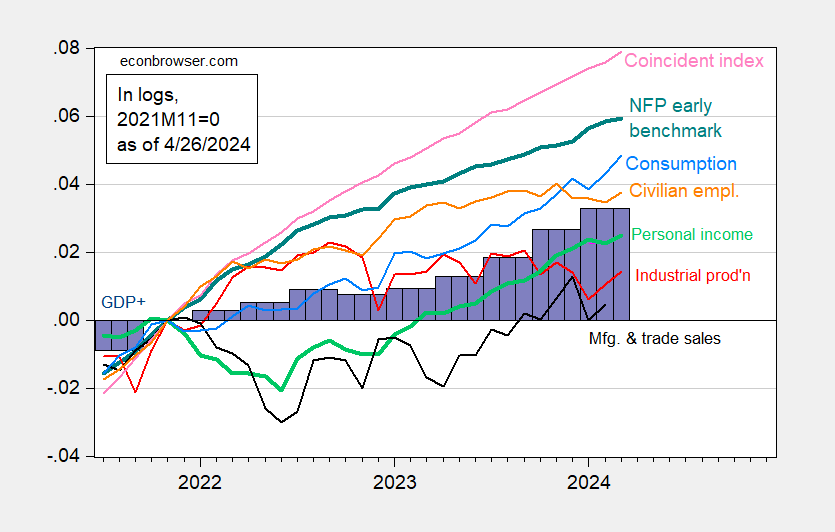

As famous right here, advance estimate for q/q GDP progress is 1.6%, under 3.4 consensus. However as mentioned right here, GDP+ is at 2.6%, and ultimate gross sales to personal home purchasers is working 3.0%. As well as we’ve the next key month-to-month indicators adopted by the NBER’s Enterprise Cycle Courting Committee.

Determine 1: Nonfarm Payroll (NFP) employment from CES (daring blue), civilian employment (orange), industrial manufacturing (crimson), private earnings excluding present transfers in Ch.2017$ (daring inexperienced), manufacturing and commerce gross sales in Ch.2017$ (black), consumption in Ch.2017$ (gentle blue), and month-to-month GDP in Ch.2017$ (pink), GDP, third launch (blue bars), all log normalized to 2021M11=0. Supply: BLS through FRED, Federal Reserve, BEA 2024Q1 advance launch, S&P International Market Insights (nee Macroeconomic Advisers, IHS Markit) (4/1/2024 launch), and creator’s calculations.

Be aware that NFP, civilian employment, private earnings, consumption, and industrial manufacturing all rose in March. One might use different proxies for GDP, month-to-month GDP, and NFP. I exploit respectively GDP+, Philadelphia Fed coincident index, and Philadelphia Fed early benchmark NFP.

Determine 1: Nonfarm Payroll (NFP) employment adjusted by ratio of early benchmark sum-of-states to post-benchmark sum-of-states (daring teal), civilian employment (orange), industrial manufacturing (crimson), private earnings excluding present transfers in Ch.2017$ (daring inexperienced), manufacturing and commerce gross sales in Ch.2017$ (black), consumption in Ch.2017$ (gentle blue), and coincident index (gentle pink), GDP+ launch (violet bars), all log normalized to 2021M11=0. Supply: BLS through FRED, Federal Reserve, BEA 2024Q1 advance launch, Philadelphia Fed [1], [2], [3]. and creator’s calculations.

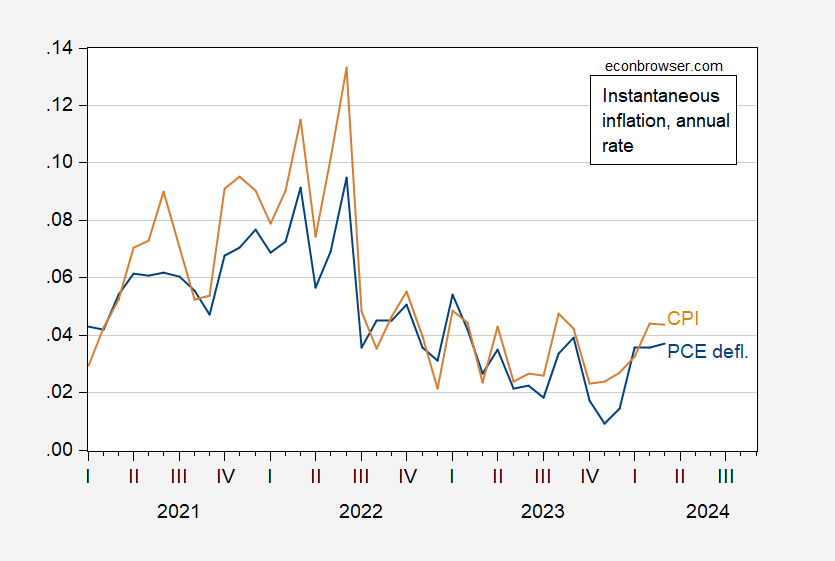

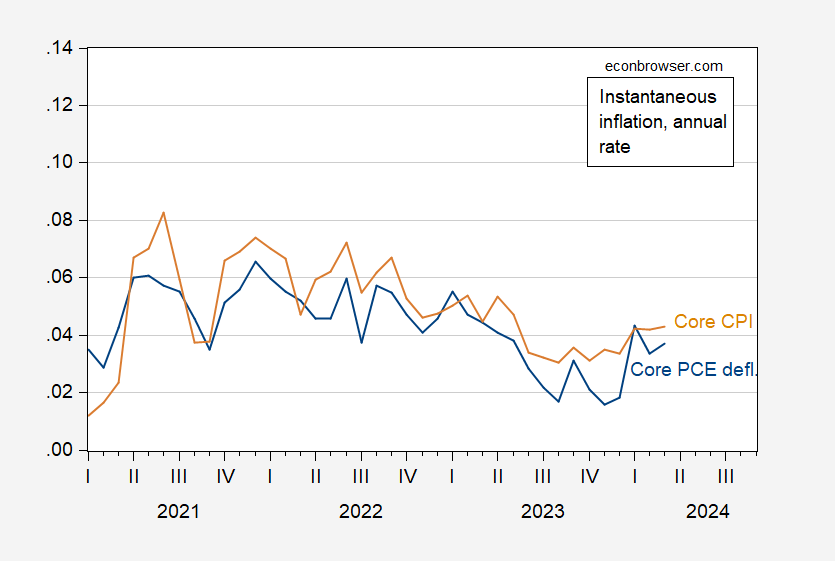

For fascinated about inflation traits, I present under instantaneous inflation (Eeckhout, 2023) for headline and for core PCE and CPI:

Determine 3: Instantaneous inflation for PCE deflator (blue), and CPI (tan), per Eeckhout (2023). Supply: BEA, BLS, through FRED and creator’s calculations.

Determine 4: Instantaneous inflation for core PCE deflator (blue), and core CPI (tan), per Eeckhout (2023). Supply: BEA, BLS, through FRED and creator’s calculations.

With financial exercise y/y progress starting from about 2.2-2.9 ppts when pattern is round 2 ppts, and pattern inflation round 4 ppts, I’m unsure “stagflation” is the fitting time period.