Following up on the examination of what the time period unfold predicts, right here’s the slope coefficients for the time period unfold, in regressions augmented with brief charge, from 1946-2023Q3 (GDP development 1947-2024Q3).

Determine 1: Regression coefficient of GDP development lead 4 quarters on 10yr-3mo unfold for subsamples. + (***) signifies significance at 11% (1%) msl, utilizing Newey-West normal errors. Supply: Creator’s calculations.

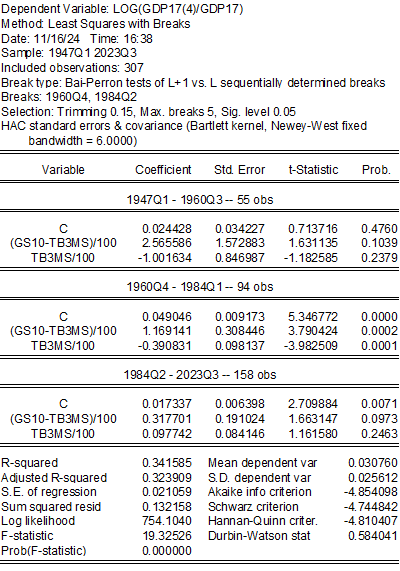

The general least-squares break regression end result (Bai-Perron) is:

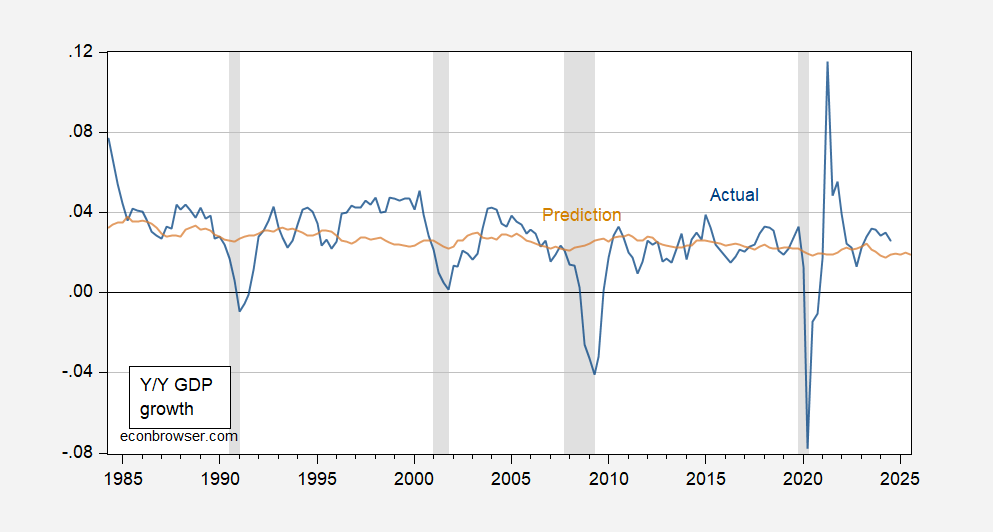

If one runs a easy OLS regression on the final subsample (1984Q2-2023Q3), the adjusted-R2 is just 0.04. The prediction appears to be like like the next:

Determine 2: 12 months-on-12 months GDP development charge (blue) and predicted (tan). NBER outlined peak-to-trough recession dates shaded grey.

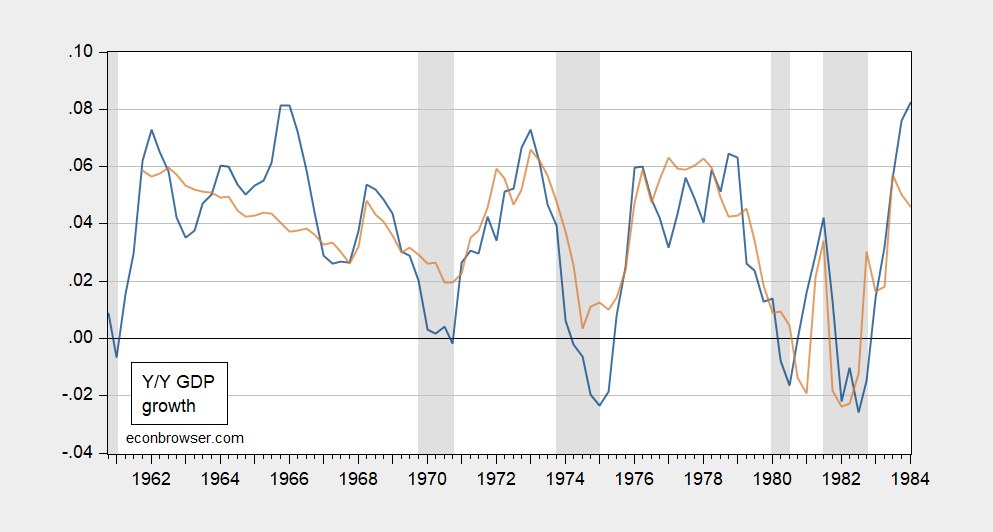

Clearly, the time period unfold Evaluate with the center interval recognized by the Bai-Perron methodology:

Determine 3: 12 months-on-12 months GDP development charge (blue) and predicted (tan). NBER outlined peak-to-trough recession dates shaded grey.

These outcomes counsel that the time period unfold will not be at present an important predictor of development (though it could develop into so once more sooner or later).