Think about my shock after I see a press release “charges at the moment are barely constructive in line with all official inflation and fee information” in an article titled “Will the Fed Elect Biden?” and the accompanying graph:

Supply: ZeroHedge. Notes: (Information: Federal Reserve Financial Information (FRED), St. Louis Fed; Chart: Jeffrey A. Tucker)

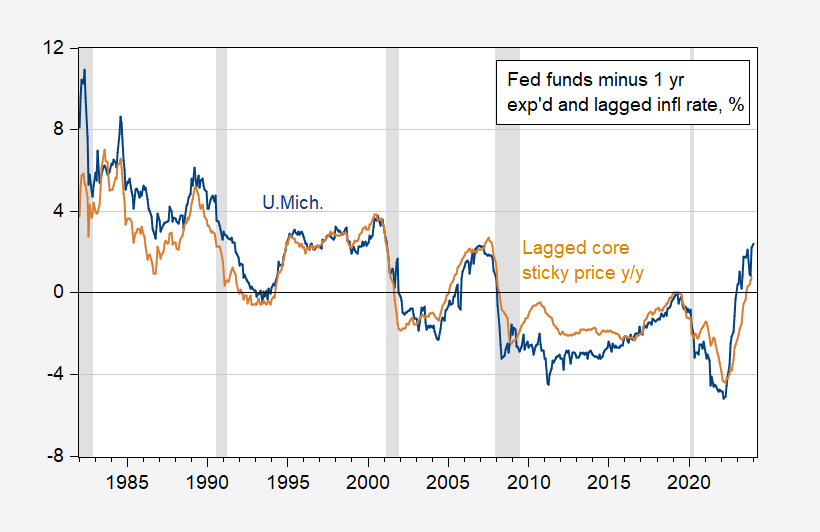

Nicely, the graph appears this fashion as a result of it makes use of lagged ex submit core sticky-price CPI inflation (y/y). To see how this graph would appear to be if one makes use of as a substitute the College of Michigan’s 1 yr forward CPI inflation expectations:

Determine 1: Fed funds fee adjusted by U.Michigan one yr forward anticipated CPI inflation, y/y (blue), and by lagged core sticky value CPI inflation, y/y (tan), each %. NBER outlined peak-to-trough recession dates shaded grey. Supply: Fed, U.Mich., Atlanta Fed by way of FRED, NBER, and creator’s calculations.

The ex ante actual Fed funds fee is significantly larger, for longer interval, than the oddly outlined actual fee supplied by ZeroHedge. In reality, the ex ante Fed funds fee is larger than peak simply previous to the 2007 recession, a lot larger than the actual fee underneath Donald Trump. In any case, concept means that financial choices are primarily based totally on ex ante actual charges, not present charges adjusted by lagged inflation. Except one makes use of adaptive expectations. All I can conclude is that both ZeroHedge or Jeffrey A. Tucker has gone totally adaptive expectations with unit coefficient. To cite: “Not that there’s something is incorrect with that.” In spite of everything, that is in line with the Friedman accelerationist speculation. It’s only a bit stunning. And I’m undecided why one would select the core sticky value measure.

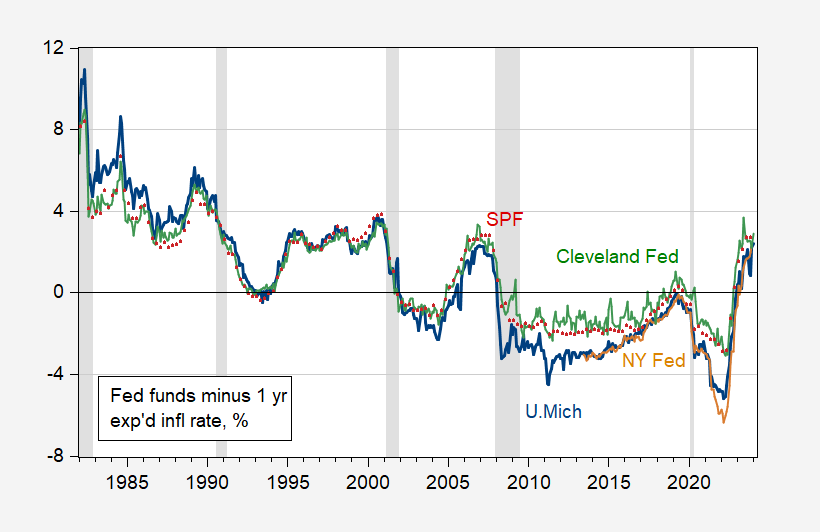

Right here’s an image of extra typical ex ante actual Fed funds charges:

Determine 2: Fed funds fee adjusted by U.Michigan one yr forward anticipated CPI inflation, y/y (blue), by NY Fed (orange), by Cleveland Fed (inexperienced), and by Survey of Skilled Forecasters (crimson), all %. NBER outlined peak-to-trough recession dates shaded grey. Supply: Fed, U.Mich by way of FRED,, NY Fed, Cleveland Fed, Philadelphia Fed SPF, NBER, and creator’s calculations.

So, the opposite inflation expectations measures verify that actual ex ante Fed funds charges are effectively into the constructive territory.